| |

Does anyone remember the “Laffer Curve”? It was originated by Dr. Arthur

Laffer. Dr. Laffer has written an article concerning the persistent efforts of those antediluvian progressive Democrats who

keep trying to foist the “blessings” of socialism and Marxism on America. For those unfamiliar with the Laffer Curve or with

Dr. Laffer, let me provide a short biography.

Dr. Arthur Betz Laffer was born on 14 August 1940. He is an American economist and author who first

gained prominence during the Ronald Reagan administration as a member of Reagan's Economic Policy Advisory Board (1981–89).

Laffer is best known for the Laffer curve, an illustration of the concept that there exists some tax rate between 0% and

100% that will result in maximum tax revenue for government. In certain circumstances, this would allow governments to cut

taxes, and simultaneously increase revenue and economic growth.

Laffer was the first to hold the title of Chief Economist at the Office of Management and Budget

(OMB) under George Shultz from October 1970 to July 1972. During the years 1972 to 1977, Laffer was a consultant to Secretary

of the Treasury William Simon, Secretary of Defense Donald Rumsfeld and Secretary of the Treasury George Shultz.

Laffer was an economic advisor to Donald Trump's 2016 presidential campaign. On 19 June 19 2019,

President Donald Trump awarded Laffer the Presidential Medal of Freedom for his contributions in the field of

economics. [1]

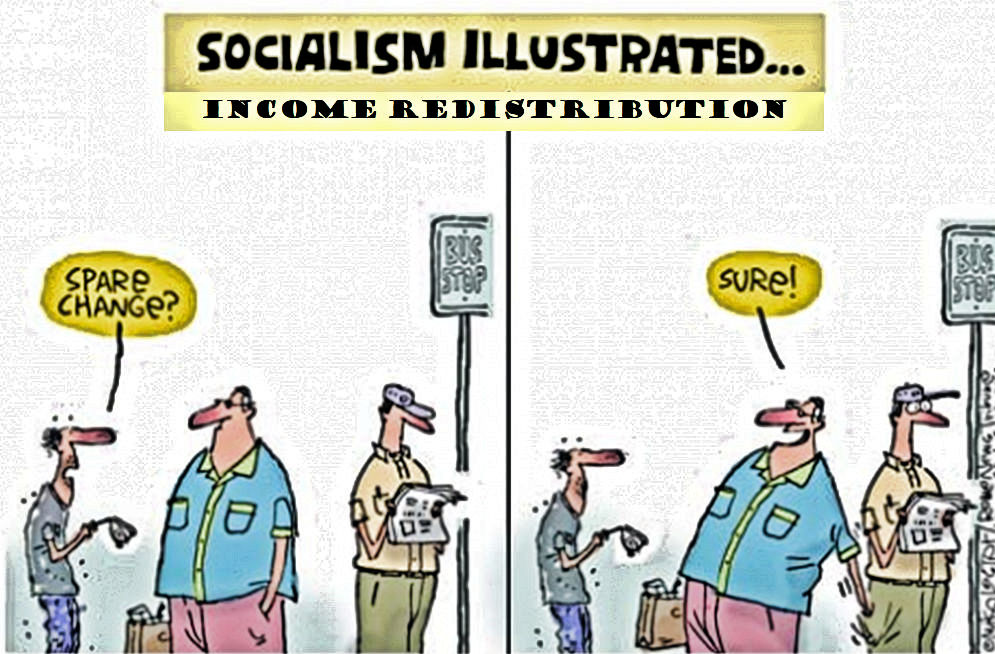

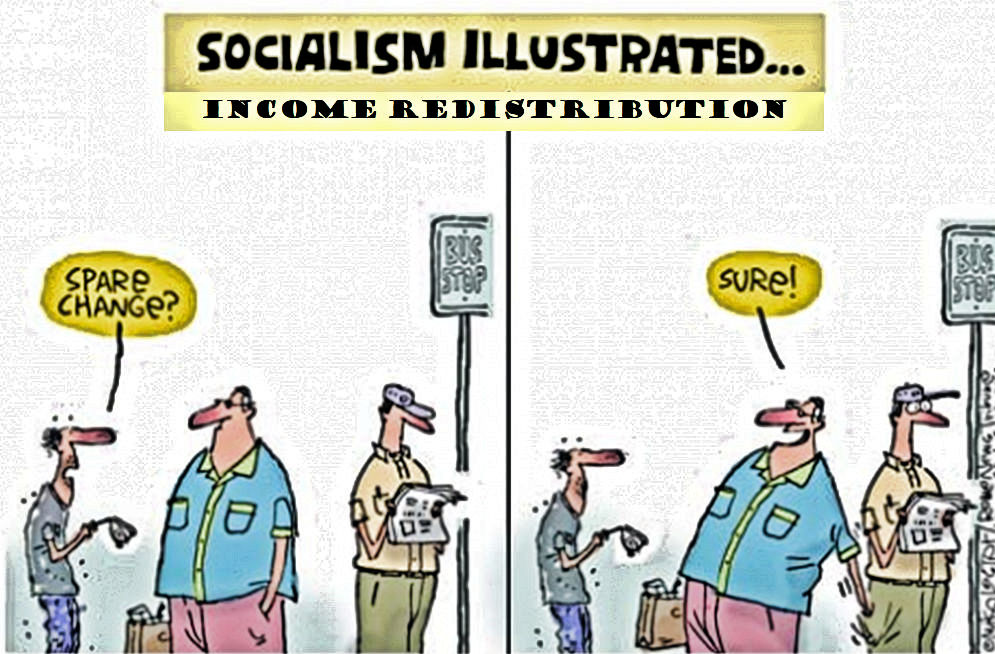

Now, allow me to present a recent article by Dr. Laffer concerning wealth redistribution as advocated

by our Marxist- and socialist-leaning progressives and Democrats.

“U.S. debt rising from 79% of GDP to 123% of GDP, as it has since just before the beginning of the

pandemic, from the end of 2019 to the present counting the now $3.5 trillion all but certain new spending bill plus unspent

funds from previous bills, is a first for America. This debt increase represents a massive redistribution of U.S. income pure

and simple. People who don’t work get paid, companies who borrow get their debts forgiven tax-free, and government

beneficence distributed to one and all are all part of the so-called stimulus funds.

“The taking of income from someone who earns a little bit more and then giving those proceeds to

someone who earns a little bit less — which is the essence of income redistribution — has significant and permanent impact

on U.S. prosperity. And those consequences aren’t dependent on whether you’re a rich or poor American, or on your race, age,

gender or whether you’re a Ph.D. economist or an average Joe. It’s math, not opinion. Economics is all about incentives.

“Taking income from people who earn more reduces their incentives to earn income and they will produce

and earn less. Likewise, giving the proceeds to people who earn less also reduces those peoples’ incentives to earn, given that

they now have an alternative source of income other than working. In both cases — higher or lower incomes — transfers reduce

total production, period! Quite simply, if you tax people who work and pay people who don’t work, you shouldn’t be surprised if

fewer people work! In the extreme, if a country decided that everyone, in the name of fairness, should end up with the same

amount of spending power i.e., everyone earns the exact same after all taxes and subsidies, then there will be no income.

“To guarantee perfect income equality, people who earn above the average income would have to be

taxed 100% of their excess earnings while people who earn less than the average income would have to be subsidized 100% up

to the average income. In other words, no matter what your earnings are before tax, your take-home pay won’t change. You

wouldn’t work, nor would anyone else. GDP would fall to zero. This is the precise reason why the economy, following the “W”

stimulus spending and Obama’s stimulus spending, never had even one year’s growth above 3% for 10 years. Ouch!

“We are in for one helluva bad future with what we’ve already done. My guess is that the U.S. role in

the world economy is in for one heckuva diminution.

“Lastly, don’t believe for a moment that taking from the rich and giving to the poor helps the poor.

It doesn’t. Under periods of economic stress and hardships the rich can get along a lot better than the poor, and in times of

prosperity, the poor are major beneficiaries. The rich have the resources, the focus and the political connections to cushion

their decline. The poor on the other hand need jobs and opportunities only provided by a vibrant economy to do well. The only

way the disadvantaged can remain employed and earning income is if there are so many open jobs that they must be hired.

“The lure of redistribution by taking from the rich and giving to the poor is an illusion. With

redistribution, it’s true that the rich also get poorer but so do the poor. Revolutions have always been fought to alter the

distribution of income and have invariably failed in that endeavor. Where they have been successful is that they have

invariably been accompanied by much lower incomes for all by reducing incentives to produce income. Redistribution, like

smoking, is virtually impossible to reverse once you’re addicted.” (Ref. 2)

So who are those stupid enough to keep trying to foist the “blessings” of socialism and Marxism on

America? One source claims that these advocates of Socialism and Marxism come in four general flavors:

“1. The Envious. They want what achievers have, less the effort. They see the lifestyles they want to live, but do not want

to put the time, effort, or personal investment necessary to create those lifestyles. They want assets (houses or apartments,

cars, phones, computers, etc.) that others saved for—right now. They see what their parents took decades to achieve, with

step-by-step incremental improvement, today. No waiting. It’s their right. Or something.

“2. The Underemployed. This includes those with student loan debt that far exceeds what their career field pays to support.

If you got a degree at (borrowed) $50K/year to work a job that pays $25K/year, that is a tough economic reality for the next

10 years or so. These folks want student loans forgiven (taxpayer paid), even though the taxpayer did not take out the loans,

choose the major, choose the school, or benefit from the education. This also includes those that were convinced they could be

artists, poets, song writers, singers, dancers, whatever, but they found out there is little market for their brand of art.

(If their art was in demand, they leave this group, because they can afford the student loan payments). These are also the

folks that want others to pay for their health care insurance, because it is expensive.

“3. The Underachievers. These are the folks that coast. Hard work, dedication to a job or company over time, and

self-improvement are for others, not them. Unlike The Envious, who are materialistic but lazy, this group doesn’t need much,

but still want others to provide it. They are more than happy to subsist on whatever Welfare programs are available, so long

as ‘work’ isn’t involved. This group is also the most likely to bitch that their unearned income is just too low,

man.

“4. The Power Brokers. This group assumes that in the Socialistic world, they will be the upper crust, the policy-makers,

not the downtrodden, overworked, drones necessary to keep their economy afloat. They understand that for some to receive

a service without paying, others need to pay and not receive that service. They just see themselves on the receiving end. Why

they see themselves in this envious role is unclear, as they are generally underperformers in any economic arrangement, so why

would they be promoted and rewarded under Socialism?” (Ref. 3)

Our Liberal and Progressive Democrats either lie or have no comprehension of basic economics

when they continue to claim that they can pay for all their socialistic giveaways by taxing the rich. As the year

2022 began, they continued to kick around various spending proposals that could end up costing taxpayers as much as $5.4

trillion over the next decade, even without which the country is set to run a budget deficit right around $3 trillion for

the second consecutive year. To justify this extraordinary fiscal expansion, they have continued to point fingers at a

familiar scapegoat - the wealthy - claiming America’s budget woes would evaporate should they simply pay their “fair share.”

But the latest data on federal revenues clearly puts the lie to this claim.

The most recent budget data from the nonpartisan Congressional Budget Office estimates federal

revenues for the 2021 fiscal year will exceed $4 trillion, an 18% increase relative to the previous year. Though total

federal revenues decreased somewhat last year due to the pandemic, dropping from $3.46 trillion in FY 2019 to $3.42 trillion

in FY 2020, this year’s increase more than makes up for that decline.

Fact: the revenue increase is driven largely by taxes paid overwhelmingly by the

wealthy. Fact: 97.4% of the 2021 revenue increase comes from corporate taxes and individual income

taxes. Fact: Individual income taxes, in particular, are skewed overwhelmingly toward the wealthy, with

the top 1% shouldering just over 40% of the income tax burden. Meanwhile, the major federal revenue source that

is structured less progressively, the payroll tax, actually saw a $2 billion decline in receipts compared to FY 2020.

Those figures contradict the Democrats’ progressive claim that the only thing standing in the way

of their agenda is a tax code that doesn’t adequately tax the wealthy. For years, Democrats have blamed the 2017 Tax Cuts

and Jobs Act (TCJA) for cutting individual income tax and corporate tax rates. But even fresh off a recovery from a global

pandemic-induced recession, this latest data shows that revenues from those areas of the tax code remain sizable indeed.

Corporate income tax revenues are right around the level the CBO was forecasting for this year prior to the passage of the

TCJA, and individual income tax revenues are even higher.

These facts should make taxpayers highly skeptical of Democratic proposals to track down a supposedly

enormous amount of tax revenue currently going unpaid, known as the “tax gap.” President Joe Biden has claimed that the tax

gap is many times larger than the IRS says it is, going on to say that his agenda can be paid for if only the tax cheats

could be hunted down. Biden’s and the Progressive Democrats’ unsupported claims of an enormous tax gap were always

suspect, and now they are even more so.

This obfuscation is all meant to cover a simple truth - Progressives can’t come close to

funding their expensive, expansive agenda off the backs of the rich. Though estimates of the wealth held by

America’s richest denizens can appear staggering, it represents little more than grocery money to the enormous money churn

that is the federal government.

It’s good to see tax revenues increasing. But Americans should take care to note the lesson being

presented here: Taxing the rich won’t help you dig out of the fiscal hole Progressives want to put you in.

This is one of the primary facts which the advocates of socialism will never admit has historically been the case and which,

today, continues to hold true.[4]

Joe Biden can certainly be accused of being all sizzle and no steak, as his undercooked reassurances

about COVID, Afghanistan and inflation have proven. Like another famous Joe - Joe Stalin - President Biden thinks he can manage

the American Economy better than the free-market system that led to America being the world’s premier economic system.

But let’s remember how Stalin and his Communist cohorts made out. Communism in the former Soviet Union

collapsed of its own weight. Soviet socialism caused the deaths of millions of citizens. The Soviet economy was famous for its

horrendous shortages, its defective products, innumerable and ineffective 5-year plans, starvations, products nobody wanted,

accompanied by rampant corruption and incompetence. Why does America’s 21st century Joe think he can do better at managing an

enormous economy than the 20th century Joe? Why does Joe Biden think he is smarter than America’s tried and tested free

market?

But our “Money is No Object” president is determined to heat up his poll numbers. His

administration, at the start of 2022, announced a $1 billion plan to address increased meat prices. The White House and many

Democrats, most notably Democratic Senator Elizabeth Warren of Massachusetts, is of the belief that meat and poultry cost more

because a small number of conglomerates are driving up prices.

“When dominant middlemen control so much of the supply chain, they can increase their own profits at

the expense of both farmers - who make less - and consumers - who pay more,” the White House said in a supposed fact

sheet.

The Biden administration is proposing to dedicate $1 billion from the American Rescue Plan

specifically for the purpose of expanding independent meat processing capacity.

Does a culinary cabal also exist for cereal, bread, non-alcoholic beverages, produce and used cars

and trucks? Because the prices of those items have also increased by a sizable margin.

The White House maintains that four companies dominate the meat market. But these companies have had

a huge market share for over the past 25 years. Why are they suddenly a monopoly threat in 2022?

So what’s different now is the Covid-19 pandemic, which Democrats are loathe to blame when they can

point the finger at good old fashion American corporations.

One thing the COVID pandemic has done is to provide a crash course in Economy 101.Take beef. When

COVID took hold in 2020, many production plants shut down, which left farmers with nowhere to send their beef, which led them

to have to cull cattle and other livestock. That and uncertainty about the future, caused farmers to scale back their

production, which “can affect production more than a year, year and a half down the road.”

Then came the labor shortage - affecting not just meat processing, but agriculture and the general

food ecosystem around the world. “You have this huge imbalance of supply and demand, which is causing the prices to

skyrocket . . . The demand side got even stronger as the months progressed in 2021, whereas the supply side of things got

worse.”

Tack on supply chain problems - especially a dearth of truck drivers - and it’s little wonder that

a steak dinner is becoming a memory for many families. Though Biden’s billion dollars may get more cattle to market, it can’t

make meat plant workers magically appear, nor truck drivers sign up to drive the meat to stores.

And even if it does make the smallest of dents in the beef biz, what about the bread and cereal

industries, agriculture, dairy and other items whose prices are causing sticker shock across the country? Why single out

meat?

Big corporations are Democrats’ go-to villains, and it’s much more expedient to assign blame

to meat moguls than admit that profligate spending in D.C. has stoked inflation like so much kindling.

But with poll numbers in the sub-basement, it’s all about winning the moment. And pledging a billion

bucks in the name of cheaper burgers sounds like something the White House thinks will score with the folks at home. It was

either that or another pet dog for the Bidens to improving the polling numbers.[5]

There once was an America when nearly everyone believed that, if able, people should work for what

one received. There once was an America, where nearly everyone was expected to repay what one borrowed or what one owed. There

once was an America where these principles constituted an ethic that made America great. It was called the American Ethic:

Americans worked hard and paid their obligations.

There were other countries around the world that marched down a different path. In those countries,

many held out their hands and accepted the dole. These pople took money without earning it and even borrowed money that they

could never repay and didn’t expect to repay. These countries sank into mediocrity and failed to experience the joy of

achievement and success that became characteristic of America. America became the envy of the world with what it achieved and

accomplished during the nearly two-and-a-half centuries since its founding.

But today, America is rapidly slipping into mediocrity! and the American Ethic is becoming

nothing but a faded memory. Americans are being told that

hard work is no longer an ideal or even a basic requirement. Americans are being told that they are under no obligation to earn

what they receive – ‘the government’ will give Americans everything they need without its citizens having to work for this

largesse. Americans are bombarded with advertisements on radio and television telling then that they can charge up bills on

their credit card without the need to repay their obligations in full. Americans are told by the government and by commercial

companies that they do not have to believe the IRS when it tells them to pay their income tax obligations. Americans are told

to hold their hands out to receive whatever they want from their Santa Clause government. At the same time, we Americans are

told not to ask where our government is getting all this money that it is so freely giving away. Apparently, ‘heaven will

provide’.

How often have you seen or heard the commercials that are telling Americans:

“Does The IRS Say You Owe Them Money? . . . Did You Know The IRS Writes Off Millions Each Year In Tax Debt? . . . Get

Relief Here. . . . The result is an elimination of your tax debt problems quickly and simply.”

(Ref. 6)

Or

“If the IRS is harassing you because you owe back taxes, you don’t have to pay what you owe! Contact us and we’ll reduce

or eliminate what you owe!”

Or

“Don’t let the credit card companies fool you when they tell you have to pay them what you owe!” The credit card companies

are lying to you! Contact us and we’ll eliminate or reduce your credit card debt!”

There was a time – not so long ago – when Democrats used to be the party of working people. They

applauded and praised those Americans who worked hard. Now, the Democrats sneer at people who work

hard.

Under President Joe Biden, Democrats spent most of 2021 pushing to pass the ‘Build Back Better’ bill

which would have had a single parent with two kids take home well over $31,000 in cash and noncash federal benefits a year,

tax-free, without having to work. The handouts would have been even higher in states that offer generous benefits.

QUESTION: So why get a job?

Nonworking adults were already eligible for food stamps, housing vouchers and health care. On top of

that, those Democrats wanted to send them monthly checks if they had kids — up to $300 per kid. The checks, nicknamed “Biden

Bucks,” originated in 2021 to help tide over families who lost their jobs because of COVID. President Joe Biden’s team wanted

to convert them into a permanent entitlement. House Republicans mocked it as “cash-for-kids.”

While everyone wants to help kids, thinking Republicans and one lone Democratic senator, Joe Manchin

(D-W.Va.) quite rightly opposed handing out cash to able-bodied parents without requiring them to work or train for a job.

Democrats and their media allies complained that this opposition was an example of cruelty. One Washington newspaper columnist

attacked work requirements as a “time tax and ritual humiliation” on poor people. Really? The rest of us have to work, and

there’s nothing humiliating about it.

The political battle over “Biden Bucks” is one key element of where we as a nation are now

headed.

Back in 1996, President Bill Clinton and a bipartisan majority in Congress passed welfare reform,

eliminating cash welfare without work or job preparation. It worked. Child poverty dropped from 13% to less than 4%,

and teen pregnancies and welfare dependence plummeted. But some 25 years later, the Democrats wanted to undo these

reforms.

In 1996, Biden himself supported the work requirement., But in 2021, he said he was adamantly against

it. What had changed? What happened to common sense? So much for Biden’s blue-collar credentials. The president had apparently

overcome his “fear that poor people might take advantage of government aid by choosing not to work.” A fear borne out by social

science and common sense. University of Chicago economists calculated that the monthly cash payments would encourage 1.5

million parents to quit working.

Don’t be misled by proposals to sunset the monthly checks after one year, or five, instead of making

them permanent. Once created, entitlements are almost never allowed to sunset. History teaches us that the funding would be

renewed in succeeding years.

America will fast become starkly divided between the hardworking people who foot the bills and the

millions on welfare, cheering on politicians to increase the dole. The burden on working people will become intolerable.

When fewer people work, fewer goods are produced, and they cost more. It's called

inflation. In 2021, Americans

were shellshocked by rising food and fuel prices. They had to recalculate how much they could afford and how it would impact

their life plans. Yet the Biden team was telling them they had to support able-bodied adults who didn’t want to work. The

reaction should be pure rage.[7]

For an extremely detailed and thoroughly researched report on the impact of the Biden Build Back

Better Act, the reader is urged to go to Largest Welfare Increase in U.S. History Will Boost Government Support to

$76,400 per Poor Family by Robert Rector and Jamie Hall.[8] A much abbreviated summary

of this study is presented below.

The U.S. has an extensive and heavily funded support system for poor and lower-income families with

children. This total government support system consists of government spending on cash, food, housing, medical care, direct

social services, and public education for those families. In 2018, before the COVID pandemic, taxpayers spent $695.7

billion on this system. The government resources received by the average family defined as poor by the government (a family

that typically has two children) came to approximately $65,200 per year.

The combined total resources of poor and lower-income families with children may be defined as their

benefits and subsidies from the government support system plus any earnings and other private income obtained by the family.

In 2018, the total combined resources of the average family defined as poor by the government came to $83,300 per year.

Earnings plus cash aid, food and housing benefits, and medical care alone came to more than $55,900 - more than twice the

official poverty level for that family, thus indicating that claims of widespread hunger, undernutrition, and inadequate

housing are misleading

Be aware that conventional reports on government spending, economic resources, and poverty are both

incomplete and inaccurate. For example, each year, the Census Bureau releases an official poverty report. That report begins

by ignoring all taxpayer spending on education and medical care for the poor. It also excludes nearly all government welfare

programs such as food stamps, the Earned Income Tax Credit, Section 8 housing vouchers, and public housing. In 2018, out of

the $378 billion that taxpayers spent on cash, food, housing, and medical benefits for poor and lower-income families, only

$34.3 billion (9 percent) appeared in the Census report on official poverty. Even private earnings were substantially

underreported.

Since the beginning of the War on Poverty, the U.S. has spent $34 trillion on means-tested welfare,

but the Census has counted only $2.6 trillion of this $34 trillion for purposes of measuring poverty and income. From the

perspective of the Census, the missing $31.4 trillion is simply “off the books.” As far as government poverty statistics go,

the War on Poverty never actually happened. Because the official Census poverty report is the basis of most public discourse

about poverty in the United States, it should therefore be no surprise that the extensive taxpayer support system for poor

families remains largely invisible and unknown.

Massive underreporting of government support leads to the widespread misperception that the U.S. has

a meager welfare program. The Biden Administration has capitalized on this misperception to demand the largest expansion

of means-tested welfare in U.S. history - the Build Back Better Act. The revised bill would increase spending on

low-income families with children by at least $650 billion over the next five years.

Under the President’s proposal, government benefits for the average poor family with children will be

increased by nearly $11,300 per year. This would include an annual increase of $9,300 in cash, food, and housing benefits

combined with $700 in new medical benefits and $1,300 in child care and education spending for low-income children. Cash, food,

and housing benefits plus earnings and other private cash income for the average poor family already totaled $37,300 in the

pre-COVID era. Adding $9,300 in new cash, food, and housing benefits would bring these resources to $47,600 per year—almost

twice the current poverty level for the average poor family.

Total government spending on the average poor family will rise from $65,200 per year to more than

$76,400. When limited private earnings are added to this massive government spending, combined total resources will

reach nearly $94,600 per year for the average poor family. So who exactly is poor in this country? What does the

word “poor” even mean?

The Build Back Better plan also eliminates the work requirements from one of the government’s

largest means-tested cash programs. The plan creates a completely new system of unconditional cash grants for families that

choose not to work during the year. In making this change, the Biden plan overturns on a narrow partisan basis the fundamental

principles of the bipartisan work-based welfare reform from the Clinton era. That earlier reform was rooted in the concept

that welfare should not be a one-way handout. Instead, welfare assistance should be based on reciprocal obligation: Society

should support those who need assistance, but able-bodied recipients of aid should be required to work or at least prepare

for work in exchange for the aid given.

A sound welfare system should begin with an accurate assessment of the total taxpayer resources

devoted to supporting the poor and the actual economic resources currently available to poor families. This

information is lacking in the current system.

Any welfare system should be based on balanced, reciprocal obligations. Able-bodied recipients should

be expected to contribute something back for the very large level of taxpayer support they receive. Finally, the welfare

system should be designed so that it strongly promotes work and marriage. Not only are these the most efficient roads out

of financial poverty; they also provide strong intrinsic rewards in themselves, increasing personal, familial, and social

well-being.[8]

The Roman empire disappeared from the face of the earth as a result of a “systems collapse.” In modern

times, several nations have suffered a similar fate. This term - “systems collapse” - describes the sudden inability

of once prosperous populations to continue with what had ensured the good life as they knew it.

In a “systems collapse”, the population suddenly cannot buy, or even find, once plentiful necessities.

They find that their streets are unsafe. Laws go unenforced or are enforced inequitably. Every day things stop working. The

government turns from reliable to capricious, if not hostile.

Consider today’s Venezuela. By 2010, the once well-off oil-exporting country was mired in a

self-created mess. Food became scarce, crime ubiquitous. Radical socialism, nationalization, corruption, jailing of opponents,

and the destruction of constitutional norms were all among the culprits that led to a “systems collapse”.

Between 2009 and 2016, a once relatively stable Greece nearly became a Third World country as it too

experienced a “systems collapse”. So did Great Britain in its socialist experiment of the 1970s.

Here in America in this third decade of the21st century, Joe Biden’s young presidency may already be

leading the United States into a similar meltdown.

Hard-left “woke” ideology has all but obliterated the idea of a border. Impoverished

foreigners are entering the United States illegally - and during a deadly pandemic without either being tested or

vaccinated!

After decades of improving race relations, America is regressing into a pre-modern tribal society.

Reverse discrimination is becoming the norm. The president has announced that if you want him to nominate you for a Supreme

Court judgeship, you must be Black and female! WHITES AND ORIENTALS NEED NOT APPLY!

Crime in America’s cities soars; inflation roars; while meritocracy is ignored and libeled.

In addition, millions stay home, content to be paid by the state not to work. Supply shortages and

empty shelves have become the new norm. Urban violence, replete with looting, carjackings, and random murdering of the innocent

is flourishing while law enforcement is “defunded” or told to look the other way. Hard-left district attorneys in our major

cities refuse to charge thousands of arrested criminals - relying instead on bankrupt social justice theories. Law enforcement

has been arbitrarily defunded and libeled. Police deterrence is lost, so looters, vandals, thieves, and murderers more freely

prey on the public.

We witness an administration that cancels existing oil leases, abandons major oil pipeline projects,

shuts down oil fields and then, less than a year later begs Saudi Arabia Russia and other less that friendly nations to pump

more oil.

America’s path to systems collapse will not be not due to an earthquake, climate change, a nuclear

war, or even the COVID-19 pandemic. Instead, most of our maladies will be self-inflicted. They are the direct result of woke

ideologies that are both cruel and antithetical to traditional American pragmatism.

“Modern monetary theory” has created the illusion that printing trillions of dollars can enrich the

public, even as the ensuing inflation is making all of us poorer.

“Critical race theory” absurdly dictates that current “good” racism can correct the effects of past

bad racism. A once tolerant, multiracial nation is now taking on the appearance and factionalism of the former Yugoslavia. The

culprit again is a callous woke ideology that posits little value for individuals, prioritizing only the so-called collective

agenda.[9]

In 2022 Supreme Court Justice Stephen Breyer, at the age of 83 and after three decades of

demonstrating his brilliance and knowledge announced that he is retiring. Past comments tell us what he wants as a

replacement: someone of high legal skill to serve not as a politician seeking popularity or ideological objectives but as

an upholder of the rule of law.

BUT President Joe Biden thinks differently. His standards are that the next justice

should be Black and a woman.

This tells us what so many progressive politicians have become. They are players of identity

Politics, trying to serve the interests one group or the other at the expense of other groups. Ability and real

qualifications have little to no relevance.

Here in 2022, the social justice crowd thinks skin color is more important than merit in finding

people to place in positions that will have significant consequences for others. This mindlessness belittles the selected

group by assuming its members cannot otherwise advance. It cheats the unselected groups that may include people who attained

exceptional capabilities through exceptional effort. There are far better ways to confront racial prejudice than

smashing the principle of fair play. In short, Biden should have been looking for the person most able to serve

with wisdom in the hugely important position of Supreme Court justice, whatever race or sex that person may be. If that most

qualified person is a Black woman, then hurrah.[10]

As a result of all that is taking place here in America during our watch, we are witnessing

our great country rapidly slipping into mediocrity. Who among us will accept the challenge to step up and reverse this backward

slide?

-------------------------------------------------------------------------------------------------------------------------

References:

- Arthur Laffer, Wikipedia, Accessed 25 August 2021.

- Spending spree is income redistribution – and it won’t work, Dr. Arthur B. Laffer, Boston Herald:

Page 13,

25 August 2021.

- The Advocates of Socialism, Lindell Denham, Global Liberty Media, 23 February 2020.

- Dems’ narrative on taxing the rich collapses, again, Andrew Wilford, Boston Herald: Page 14,

6 January 2022.

- Lots to beef about in Biden’s $1B meat plan, James Davis, Boston Herald: Page 14,

4 January 2022.

- Do You Owe The IRS | Now Is The Time To Make A Deal, www.nationwide-tax-relief.com,

Accessed 1 November 2021.

- Biden bucks = cash for kids, no work required, Betsy McCaughey, Boston Herald: Page 15,

1 November 2021.

- Largest Welfare Increase in U.S. History Will Boost Government Support to $76,400 per Poor Family,

Robert Rector and Jamie Hall, The Heritage Foundation, 8 November 2021.

- Is America Heading for a Systems Collapse?, Victor Davis Hanson, The Daily Signal,

20 January 2022.

- Biden playing identity politics with Supreme Court pick, Jay Ambrose, Boston Herald: Page 15,

29 January 2022.

|

|