Electric Cars in My Lifetime?

© David Burton 2019

Electric Cars in My Lifetime?

© David Burton 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

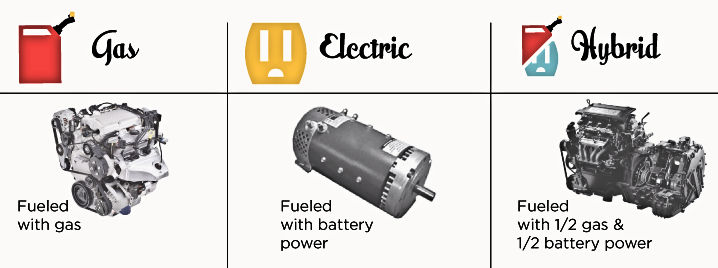

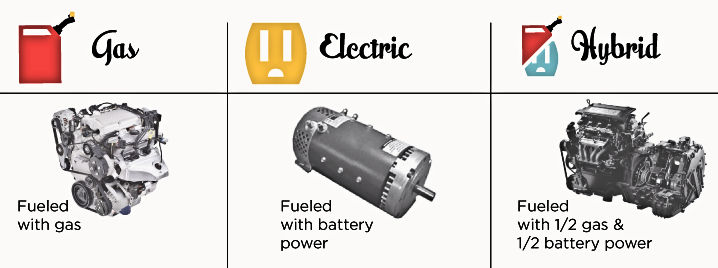

There a number of abbreviations and acronyms being thrown about in the discussions, controversies and pontifications over the future of Electric Vehicles. Herein is a quick identification of what most of the important ones mean. EV - Electric Vehicle: Vehicles that employ electric motors and batteries for propulsion. HEV - Hybrid Electric Vehicle: Vehicles that use both internal combustion engines and electric motors and batteries for propulsion, such as a Toyota Prius. BEV - Battery-only Electric Vehicle: Vehicles that use only electric motors and batteries for propulsion, such as a Tesla electric car. ICE - Internal Combustion Engine: An engine that uses hydrocarbon fuels, such as gasoline, diesel fuel, propane, natural gas, etc. ICEV - Internal Combustion Engine Vehicle: A vehicle powered with an internal combustion engine. BSEV - Battery Swapping Electric Vehicle: An Electric Vehicle that swaps out depleted battery packs for fully charged battery packs instead of constantly recharging depleted batteries. PEV - Plug-in Electric Vehicle: An Electric Vehicle that recharges its battery pack by plugging into an electric outlet rather than swapping out depleted battery packs. PHEV - Plug-in Hybrid Electric Vehicle: A Hybrid Electric Vehicle that recharges its battery pack by plugging into an electric outlet rather than swapping out depleted battery packs. Compared to vehicles that are powered by internal combustion engines, it’s true that, in terms of direct emissions, EV’s have the advantage. Electric vehicles produce zero pollutant emissions at the tailpipe — there’s no tailpipe! Quite simply, electric vehicles can cut emissions that contribute to both smog and climate change, thus boosting public health and reducing ecological damage. But let’s remember that the energy that powers the EV must be generated in a power plant, and that power plant may be producing polluting emissions. Still, the net result is unquestionably in favor of electric vehicles. If you are an environmental zealot, then the question of whether or not to switch to EVs is mute. All the drawbacks of EVs such as, economics, driving range, recharge times, inadequate infrastructure, etc. are all irrelevant issues. The important question then becomes, “What percentage of vehicle owners place environmental issues above all other concerns?” The answer is “A very low percentage.” So, while environmental issues enter the discussion, the factors relating to the environment do not drive the final answer to the question: “Will Electric Vehicles take over the roads in my lifetime?” There have been lots of promises and highly optimistic predictions about the rapid takeover of the American highways by EVs. The reality has so far been otherwise. For instance, just this past November, General Motors confirmed that it plans to cease production of the Chevrolet Volt in March of 2019. Let’s remember that, to date, a large percentage of the electric car sales has been as a result of federal tax credits to buyers and these credits will be running out. Will buyers want to pay the higher prices of EV’s while putting up with the on-going problems of EVs that have yet to be sufficiently ameliorated or eliminated? The Volt overcame drivers’ “range anxiety” by adding a small gasoline engine to its electric drive train, while the all-electric Nissan Leaf depended on a network of public charging stations. All the EV companies offered home chargers to their owners. [2] “The Volt was the first production plug-in car sold in the U.S. when it went on sale in 2010, but has struggled with slow sales and high incentives recently as consumers have been inspired by pure electric models such as the Chevy Bolt EV and cars from Tesla. “Early next year, the Volt and Bolt EV are expected to face reduced federal tax credits as the automaker will reach its limit of 200,000 of the full $7,500 credits. Most of those have gone to buyers of the Volt, and the lack of credits is expected to have a negative effect on sales. - - - “The Volt has the longest electric range of any plug-in hybrid electric car sold in the U.S., EPA rated at 53 miles all-electric. "GM began production of the second-generation Volt in 2015, and the car was due for an update for 2020. . . . “The company also . . . announced it would end production of the plug-in hybrid version of the Cadillac CT6 outside China in March {2019}.” (Ref. 3) Back in 2008, when oil prices were soaring and experts were pondering how best to make electric cars a reality, a small company in Israel was frequently heralded as the industry's savior. The name of the company was a Better Place. “Better Place's {Israeli founder}, Shai Agassi, had a simple but potentially revolutionary idea. The knock on electric cars has always been that the batteries are too pricey and take hours to charge. Agassi had a way around this: Customers would buy the cars, but Better Place would own the batteries. When drivers needed to recharge quickly, they could simply swap out their batteries — in five minutes — at a Better Place station. [Emphasis mine]” (Ref. 4) But, Better Place only sold 750 cars in Israel and lost close to a billion dollars by the time it went out of business in 2013. The most credible reason for the Israeli company’s demise was gross mismanagement. Today, some 5 years later, its battery swapping technology remains the only practical solution to the problem of replacing the depleted electrical energy stored in the vehicle’s batteries in a timely fashion. Recharging the electric vehicle’s batteries simply takes too much time compared with a gasoline or diesel fuel fill-up. One of the reasons – perhaps the main reason – why vehicle owners are not purchasing large numbers of electric vehicles that require battery recharging is that very few drivers will buy electric cars unless the proper charging infrastructure is in place. At the same time, EV companies are having difficulty setting up and financing those charging infrastructures without large numbers of customers buying their electric cars – another chicken and egg conundrum. Here in the United States, utilities and policymakers have made half-hearted attempts to build an infrastructure of electric-charging stations that benefit plug-in electric vehicles. For the battery-swapping concept of Better Place to catch on, some country or state will need to take aggressive and proactive steps to institute and demonstrate how that it can work. That step may be taking place in China, not here in the United States. Battery swapping addresses the major problem faced by all-electric vehicles: Without battery-switching, pure electric cars have a limited range and they take a long time to recharge. Let’s admit it, “The gasoline fuel tank is a pretty phenomenal storage device for energy. . . . The battery may never really compare, at least not in the next 20 years. “Then again, whatever their flaws, there’s no doubt that electric cars generate what economists call ‘positive externalities.’ They’re good for the environment and for a nation’s security because they reduce dependence on oil imports. That’s why the Obama administration . . . {threw} its support to electric cars, providing about $2.5 billion in loans and grants to electric-car manufacturers and battery makers, as well as $7,500 in tax credits to electric car buyers.” (Ref. 2) While EVs are all the rage in some circles, they have also become the sacred cows you can’t criticize, particularly by the liberal elite, the environmental zealots, and technical groupies. As a result, often, one can’t question the economic realities of the industry. So what are the facts? Are the promises of Electric Vehicles going to come to fruition in any reasonable span of time? Or is there too much puffery, public relations propaganda and salesmanship involved? Perhaps now is a good time to ask just how green electric cars really are. Are policies to ban diesel and gasoline cars at some arbitrary point in the future likely to unleash a barrage of unintended consequences that no one’s yet considered? As of 2017 – and most likely today – “the bad news for EV fans is . . . that the cost of ownership of an EV still far exceeds that of an internal Combustion Engine Vehicle (ICEV), even after subsidies are accounted for. [Emphasis mine] “With numbers crunched, a comparison between the Chevy Bolt EV and two equivalent ICEVs, the Chevy Sonic and the Opel Astra, over 100,000 miles, shows that there’s no denying EVs are still more expensive than ICEVs. “Three points come up in particular.

“The numbers above can thus be adapted for a ‘What If…’ scenario, wherein GM actually begins selling the Bolt at average corporate profitability. “In that case the numbers get even more bleak. Excluding subsidies, a Bolt would be $26,900 more expensive in the US than the equivalent ICEV, $29,300 more expensive in Germany and $24,000 more expensive in France.” (Ref. 5) And let’s remember that EV subsidies are scheduled to shortly end in the U.S. and elsewhere. They are unlikely to remain in effect forever in nearly all countries that currently have them. “White House economic adviser Larry Kudlow said on Monday the United States will end subsidies for electric cars and other items including renewable energy sources. “Asked about actions planned after General Motors announced U.S. plant closings and layoffs last week, Kudlow pointed to the $2,500-to-$7,500 tax credit for consumers who buy plug-in electric vehicles, including those made by GM, under federal law. " ‘As a matter of our policy, we want to end all of those subsidies’. Kudlow said. . . “ (Ref. 6) What are some of the economic realities facing “Pure Play” EV vendors like Tesla? One reality is that, “unlike integrated auto manufacturers, they can’t use many of the same components from ICEV production, limiting economies of scale. “But the common denominator for all EVs is the cost of batteries . . . since that’s a commodity. It’s also the key factor behind the faster rate of depreciation of EVs versus ICEVs. “Here, arguably, some significant issues are being overlooked. For example, while the consensus view is that EV battery prices have been experiencing price declines over the past few years (in the order of 8 to 14 per cent), the analysts themselves could not find any evidence to support that position. [Emphasis mine] “. . . {As of 2018 and in} the case of the Bolt, GM lists the cost of its battery pack as $15,734. . . {almost the full price I paid for my 2015 Toyota Corolla} - - - “{Analysts} suspect it may be part of GM’s commercial strategy to subsidize the battery packs so as not to show EV buyers that a replacement battery is overwhelmingly expensive. [Emphasis mine] - - - “{Also, consider the inconvenient truth that} GM’s own expectation is that, depending on use, the battery may degrade as little as 10 per cent to as much as 40 per cent of capacity over the {battery’s 8-year} warranty period. [Emphasis mine] “Battery durability is at least as important as price when it comes to the overall cost of ownership. - - - “On the battery degradation issue specifically, . . . analysts suspect the industry is being far too optimistic about how much better batteries are getting year to year. The view that batteries are getting longer lasting, they say, flies in the face of what every consumer has experienced with mobile phones, notebook computers or any other cordless device. - - - “Batteries aside, . . . it should be slightly cheaper to manufacture EVs versus similar ICEVs, due to the reduction in complex moving parts. This cost reduction is slightly offset, however, by the need for more robust chassis and suspensions due to the weights of the batteries, the requirement for electric powered air conditioning and regenerative braking. - - - “{The fact is that} most people are encouraged to buy EVs because of {government} subsidies or free parking promises. {But,} how long {can these} EV subsidies persist? {Here in the U.S., the current administration has announced that they are being ended.[6]} Fundamentally, the economics dictate that they can only really be affordable to governments as long as the number of vehicles sold remains small. If EV sales accelerate swiftly, these subsidies would get very costly for government coffers very quickly . . .” (Ref. 5) Most, if not all, of the economic issues regarding electric-vehicle ownership harks back to a one key EV component: the battery pack. Lithium-ion battery packs, which today typically cost more than $10,000, determine whether or not EV ownership will cost more than equivalent ICE vehicles. Depreciation happens at alarming rates, too, mostly because of concerns over the pack’s declining range, and worries about their eventual disposal. “One potential answer to this conundrum is to take the battery out of the equation—by selling or leasing the vehicle without the battery included, then letting the owner essentially subscribe to a guaranteed supply of batteries. “That’s already happening in China. Beijing Electric Vehicle Company (BJEV), the top electric-car producer in China, earlier this month {July 2018} revealed a version of its budget EV300 small car, priced at the equivalent of about $11,700, with unlimited battery swaps allowed on a monthly battery subscription of about $64. “. . . {Another Chinese auto Maker}, Nio, is aiming for a similar plan in its home market. There, its Power Mobile service vehicles and temporary battery-swap stations would help drivers swap power packs quickly, in a location that makes the best sense without interrupting their driving patterns. As of earlier this month {July 2018}, Nio intends to have more than 1200 vehicles and more than 1100 stations up and running in China by 2020. - - - “The logistical hurdles of such schemes are {significant.} . . . {The required} vans would ‘carry tens of fully charged batteries and drive to an EV to swap a battery within a relatively short fixed period of time.’ . . . {It’s} anticipated that for each vehicle, there would need to be at least two good battery packs in use in order to cover the time spent charging the packs, storing them, and moving them to where drivers might next need them. “And, physically, the task of swapping batteries on any regular basis is {significant}. Battery-swap operations would likely need to raise the vehicle and then lift and position battery packs that can weigh {many} hundreds of pounds. . . “. . . {as previously noted, Israel's} Better Place designed an entire ecosystem through which the company could swap out a nearly dead battery (with proprietary hardware) and install a fresh one in just a couple of minutes. But massive infrastructure costs and expensive installation costs for those battery-swap stations kept that effort from catching on. “Tesla, too, conceived a 90-second battery-swap process for its Model S, but it noted a lack of demand for the service as the reason for abandoning the idea after a limited pilot program. Although that system relied on a permanent installation, Tesla last year showed signs that it was also looking into a mobile method, with documents proposing a battery-swapping rig that could be custom built onto a trailer. “But the idea of lighter, more mobile battery swapping does have some new life, and there has been a new round of partnerships formed around it. Earlier this year, the startup Japanese EV maker Fomm and the established technology supplier Fujitsu entered an alliance aimed at developing what it calls a Battery Cloud Service; it would give users the choice between charging batteries at home or exchanging a depleted one for a fully charged pack at a service station in just five minutes. The partnership will start with a battery solution that provides a very small four-wheeled urban EV, to be sold in Thailand initially, with a 100-mile driving range. “Honda earlier this year revealed the Mobile Power Pack World—intended for a wider ecosystem that could be used to power a home in a power outage, a work site, or a campsite. Its partner in the effort is Panasonic, which is also the official supplier of lithium-ion cells for Tesla vehicles and Tesla’s partner in the Gigafactory that supplies them. And then this month Honda announced a first ‘research experiment’ with the Mobile Power Pack in Indonesia, where it will be given a market test in electric motorcycles and other mobility products. At charging-station kiosks, users will be able to exchange their battery instantly for a fully charged one. “At this point it would be a competitive disadvantage—and, perhaps, a new challenge for safety regulations—to sell or lease a U.S. electric vehicle without a battery pack, as the federal EV tax credit is dependent on the car’s battery capacity. But as the tax credit phases out for Tesla and others and the ownership model evolves, separating batteries from the equation could give electric vehicles a boost in the market—and the phrase ‘batteries not included’ might then be the future, not the past.” (Ref. 7) The time it takes to recharge a depleted battery pack remains one of the biggest drawbacks of EVs. So called fast charging is attempting to resolve this problem. At the end of 2018, the number of electric charging stations in the US was small but growing. “As of September 2018, there are an estimated 22,000 public charging stations in the US and Canada that are classified as level 2 and DC fast charging. (Typically, fast-charging stations supply 60 to 80 miles of range for every 20 minutes of charging.) By comparison, there are seven times more gas stations: about 168,000 . . . - - - “The longer-range EVs that are coming to market to allay drivers’ range anxiety will have larger and more powerful batteries. That means they will require larger charging systems to expedite dwell times, or the amount of time it takes to charge the battery. . . “Tesla has an early charging advantage . . . thanks to an expensive, capital-intensive effort to build out its network of proprietary Superchargers. There are 1,344 Supercharger stations worldwide, around 580 of which are in the US. For years, Tesla officials have been talking about the possibility of opening up their network to other automakers, but that hasn’t yet happened. In the meantime, a worldwide network of chargers built solely for Tesla’s loyal customer base remains one of Tesla’s main competitive advantages. “Volkswagen plans to install 2,800 electric vehicle charging stations in 17 of the largest US cities by June 2019 and invest $2 billion in charging infrastructure across the country . . . But aside from VW, most automakers are largely relying on burgeoning networks installed by governments, utilities, and third-party companies. It’s a cheaper route, but it also brings more uncertainty and less control. “For customers who lack experience with EVs, this patchwork network can bring frustration. EV owners are required to sign up for multiple services, each with its own access card or app. Maintenance can be hit or miss, and the last thing an EV driver running out of juice wants to do is pull into a charging stall and find it out of service.” (Ref. 8) Optimistic claims have been made for fast or ultra-fast EV charging posts and stations. “Ultra-fast electric-vehicle chargers on the way promise to replenish drained batteries in a matter of minutes, and many industry insiders believe a vast public network of such devices may be needed for these vehicles to win over larger numbers of new-car buyers. “But it’s unclear how many of the dozens of battery-electric vehicles on the way for the early 2020s will be equipped to take full advantage of the advanced technology. “Few BEVs can handle the maximum charging speeds already available today, and even if ultra-fast charging becomes ubiquitous, next-generation batteries will need extensive upgrading to accommodate the much higher electricity flow rates possible. - - - “Ultra-fast chargers rated at 350 kW are now hitting the market and said to be capable of adding 124 miles (200 km) of range to a drained BEV in less than 10 minutes. But there are no BEVs today that can handle such flow rates. Tesla’s Supercharger, up to now considered the state of the art in fast charging, is rated at 120 kW and takes about 40 minutes to replenish a Tesla Model S battery to 80% capacity. “Most other EVs charge at rates below 50 kW, although there are some that can handle higher flows. . . Tesla’s Model 3 is rumored to be capable of charging at a rate of 184-210 kW, but even that would fall short of the new ultra-fast technology on the way. “Level 2 chargers, the type most widely available that can be installed in private homes and seen in retail and office parking lots, charge at rates below 20 kW, and many current EVs limit the flow to much less than that. [Emphasis mine] - - - “. . . the costs associated with a network of ultra-fast-charging stations – both for infrastructure and the batteries needed to use it – ultimately could be prohibitive, potentially limiting BEV market penetration predominantly to urban areas, where drivers have shorter commutes and Level 2 chargers more adequate. “. . . Plug-in hybrids are a better answer . . . the combination of short-range electric and long-range gasoline power offers ‘the best of both worlds.’ “. . . fast charging, though convenient, could drive up the operating costs for BEVs, making them an even less attractive alternative for new-car buyers. “When you start to do a lot of fast charging, the cost of ownership starts to deteriorate, because the cost of electricity in the daytime is a lot higher than when you are charging (at night), when there’s less capacity on the grid . . .” (Ref. 9) In China, which has long standing issues with air pollution, changes are being made in the EV market, faster and on a larger scale than here in America. Part of the reason for this is the fact that China has a form of government where there can be little to no opposition to what the government directs. We here in America will not stand for this form of totalitarian rule, so it is not so easy to simply impose a policy that may have very unpleasant side effects. In the past, untold millions of people have died as the result of such totalitarian actions. Having said that, we should note that. “One of China’s major cities and a hub for technology companies, Shenzen, is now {2018} home to a vast fleet of electric buses. Last June {2018}, authorities announced that the Shenzhen Bus Group had replaced all 5,698 of its buses with electric vehicles.” (Ref. 10) In 2018 BJEV, (Beijing Electric Vehicle Company) launched a battery-swap service to get ahead in China’s competitive market. They announced that they would install the first 100 battery changing stations in Beijing that year as an add on to their EV300 model electric vehicle. Moreover, this indicated a comeback of battery swapping, only this time with more refined business models than that of the now defunct Better Place Israeli EV car company. BJEV was not the first of China’s carmakers to look into battery-swaps. Another Chinese company, Nio, had started the service earlier in 2018 with the launch of their ES8 electric SUV. Nio considered a whole network of so-called Swap Stations and wanted to install 1,100 stations across China between 2018 and 2020. According to BJEV, a change of battery takes less than three minutes. Another scenario for successful battery exchange models is in EV fleets, such as with electric scooters. In Taiwan they operate battery vending machines. In addition, battery swapping could also facilitate battery recycling. This will grow in importance, particularly in China, where Beijing introduced a new battery monitoring system. It is designed to hold manufacturers responsible for their batteries.[11] A further indication of China’s commitment to replacing internal combustion powered vehicles with EV’s is indicated with business moves by one of China’s major vehicle manufacturers. “Beijing Automotive Industry Holding Co. Ltd (BAIC) is 60% owned by the Chinese Government. BAIC spun its electric vehicle business into a separate unit, Beijing Electric Vehicle Company (BJEV). . . . “The German company, Daimler AG, acquired a 12% shareholding in BAIC during November 2013. BAIC is the fourth largest vehicle manufacturer in China . . . - - - “. . . BAIC . . . announced . . . that it would stop producing Internal Combustion Vehicles (ICE) at its Beijing plants from the end of July 2018 and focus on EV manufacturing. The move is part of a major restructuring of the company’s operations which involve its partnership with Mercedes. . . . BAIC Beijing will manufacture all Mercedes pure electric EVs (EQ brand). . . .” (Ref. 12) “In terms of production and sales of electric cars, no other nation comes close to China. [Emphasis mine] By 2020, the country is expected to account for a staggering 59% of global sales before easing slightly to 55% by 2025 . . . The rise of mini-EVs with smaller battery packs designed for short-range driving {around 60 - 100 mi} has helped boost the popularity of EVs in China. Prices for mini-EVs start at around $6,250 making them affordable. J.P. Morgan’s Research team forecasts the compound annual growth rate of China’s new electric vehicle market (All-electric EVs and Plug-in Hybrid EVs) is set to hit 46% by 2020 . . . This forecast is based on a few key drivers: “EV battery manufacturing is dominated by a relatively small number of players. Asian manufacturers hold the lion's share of global production . . . Battery prices have fallen dramatically this decade from around $1,000/kilowatt hour (kWh) in 2010 to about $210-230/kWh last year {2017}. For EVs to be cost competitive with ICE vehicles, battery costs must fall to around $100/kWh, something that could be achieved by the middle of next decade or earlier . . . - - - “As the adoption and use of electric vehicles grows, charging infrastructure needs to catch up and China is winning on that front too. By 2020, the State Council has a target of 4 million new charging posts and 12,000 charging stations, in which state-owned companies . . . are investing heavily to support. - - - “In China, BAIC, BYD and ZhiDou are among the major producers. BAIC's EC180 was China's best-selling electric car {in 2017}, which after subsidies starts at around $7,750, with a range of around 110 miles and a top speed of 62 miles per hour. General Motors recently announced plans to launch 10 heavily electrified vehicle models in China from 2021 through 2023, adding to the 10 it already had planned for 2016 through 2020.” (Ref. 13) At this time, major problems remain with all-electric vehicles. 1) Battery Cost: At last look, the batteries for all-electric vehicles were adding about $10,000 to the cost of the vehicles. This was somewhat offset by the elimination of the cost of the internal combustion engine and the transmission system. 2) Driving Range: Combustion engine powered cars had ranges up to 500 or 600 miles on a full tank of fuel while driving ranges for all-electric vehicles was in the low hundreds of miles range, or less. 3) Long Charging Times: Refueling times for petroleum powered vehicles is about five minutes, while times for a full battery charge is typically measured in hours. 4) Lack of Infrastructure: Gasoline stations are ubiquitous throughout the United States and in all developed nations around the world while electric recharging stations are still few and far between, especially fast-charging sites. In some places, e.g., China, this is changing, but even in China, the pace is slow, mainly as a result of the enormous size of the country. Have you ever run out of fuel while driving somewhere? I have. What did I do? I took a 2-gallon gas can out of my trunk and hitched a ride to the nearest gas station, after which I returned to my car and poured the gasoline into my car’s fuel tank and then drove back to the station to fill up my car. If I didn’t have a gas can in my trunk, the gas station would have lent me one – asking me to leave a deposit to ensure my returning it. If the gas station had been close enough, I would have walked to and from it. Now, suppose you exhaust the battery pack in your EV. What do you do? How do you get a bucket of electrical energy to your stranded car? Try carrying a battery pack to your car – it won’t be light in weight. And how long would it take to transfer charge from the portable battery to your car's battery pack? Maybe you can call AAA for a tow or a battery charge sufficient to get you to a charging station - wherever that may be. The success of all-electric vehicles will require sizeable investments in R&D, the acceleration of vehicle charging infrastructure and, possibly, legislation for the installation of charge points in new homes. This transition to Electric Vehicles seems to be gaining momentum, albeit very slowly. While electric cars and trucks may account for a tiny percentage of vehicles on the road today (4 million electric vehicles versus over one billion gasoline and diesel cars), adoption is accelerating. It took over 20 years to sell the first million electric cars. Now, a million electric vehicles have been sold in just four to five months. The question remains: Is this a growing trend, or just a temporary trend, fostered by environmentalists and deep-pocketed trend setters, along with generous government subsidies? Pilot projects have been successfully running in Norway, Canada and China on green vehicles including electric and hydrogen cars, making them both distinct and visible to other road users. A number of car manufacturers such as Volvo, Jaguar and Land Rover announced that they will stop launching new models powered by internal combustion engines after 2020, the adoption of low emission vehicles seems to be gaining impetus. But, while offering a cleaner and more environmentally-friendly alternative, EVs pose several infrastructure challenges beyond just ensuring that recharging stations are plentiful. Energy grids (transmission and distribution networks) are likely to be severely stretched to satisfy a growth in the adoption of electrical vehicles on the road. To ensure that electric or hybrid vehicles are actually low-emission, the energy grid needs to be powered by a much higher percentage of renewable energy power plants and a reduction in electric power plants the rely on carbon fuels. Currently, electrical energy is largely created and used on demand. Renewable energy sources are, to a large extent, unpredictable, mainly because of weather (wind and clouds) and diurnal factors. [14] One area of concern that needs to be resolved is that of the electrical connectors that are needed to charge depleted batteries - There needs to be agreement among EV makers that all electrical connectors must be common to all Electric Vehicles. All gasoline powered vehicles on the road utilize common fuel fill ports. In each country or region in the world, electrical outlets are of uniform design. How would you like it if you owned a Chevrolet and went into a gas station to refuel and found out the nozzles on the gas pumps only fit Fords? All charging posts and charging stations must accommodate all EVs This should be true for both slow and fast charging posts and stations. One recent optimistic prediction for EVs come from the financial sector where JPMorgan Chase and Co. forecasts major growth in the EV marketplace within the next decade. “Automakers are preparing to phase out cars powered solely by internal combustion engines (ICEs) as governments look to tackle fuel emissions. The growth in electric vehicles (EVs) and hybrid electric vehicles (HEVs) is climbing and by 2025, EVs and HEVs will account for an estimated 30% of all vehicle sales. Comparatively, in 2016 just under 1 million vehicles or 1% of global auto sales came from plug-in electric vehicles (PEVs). ”By 2025, J.P. Morgan estimates this will rise close to 8.4 million vehicles or a 7.7% market share. While this jump is significant, it doesn’t compare to the kind of growth expected in HEVs - cars that combine a fuel engine with electric elements. This sector is forecast to swell from just 3% of global market share to more than 25 million vehicles or 23% of global sales over the same period. This leaves pure-ICE vehicles with around 70% of the market share in 2025, with this falling to around 40% by 2030, predominantly in emerging markets. [Emphasis mine] {Very interesting! J.P. Morgan sees hybrids outselling all-electrics by 3 to 1} “For both North America and Europe, hybrids and BEVs {Battery-only EVs} are set to lead over the next decade as plug-in hybrids are not proving too popular in either region. In Europe, plug-in electric vehicles (BEVs and PHEVs {Plug-in Hybrid EVs}) will rise from roughly a 2% share of total new sales in 2017 to around 9% by 2025 . . . A dramatic move away from ICE-only vehicles is expected and by 2025 only plug-in electric vehicles and HEVs will likely be sold. [Emphasis mine] . . . overall EV sales – including BEV, PHEV and hybrids – are estimated to account for over 38% of total sales in 2025. - - - As the adoption and use of electric vehicles grows, charging infrastructure needs to catch up . . . By 2020, {China} has a target of 4 million new charging posts and 12,000 charging stations . . . In Europe, utilities and oil majors will be the main drivers . . . In the U.S., California is taking the lead with plans to invest $1 billion in the charging network. “At the end of {2017}, just under 600,000 public charging points were installed globally, with 320,000 of these in China . . . The majority of these are {‘slow’ – 4 to 8 hour chargers}, with only around 20% of all public charging points offering ‘fast’ chargers. - - - “Headquartered in California, Tesla specializes in premium BEVs, with prices for its Model S sedan and Model X SUV closer to $100,000. The automaker launched the ‘mass market’ Model 3 last summer for around $35,000, but production delays have hampered its roll out. [Emphasis mine] In Europe, the sporty BMW i8 is one of the priciest EVs on the market, starting from over $140,000. But the Nissan Leaf and Renault Zoe are proving the most popular, with 20.6% and 19.3% of the {Battery-only Electric Vehicle} market respectively, thanks to their high range (150mi-180mi) and low cost.” (Ref. 13) So, my answer to the question, Will the all-electric car replace the century old internal-combustion-engine-powered car in my lifetime? is NO! But then I’m now in my 8th decade of life. What’s the answer for the younger members of society? My answer is a big, NOT LIKELY!. The currently unresolved problems need to be dealt with. Today’s electric car buyers are few in number because the problems are too many and too limiting. Here in the U. S., without government subsidies, it’s questionable if there would be many electric-car buyers, and these subsidies are ending. Who wants to take a trip in a vehicle with limited range, with very few recharging stations and the need to wait from one to eight hours while your battery pack is being recharged at one these far-between charging posts, charging stations, at work or at home? Can technology (and the government) solve the electric vehicle’s current shortcomings fast enough to make them practical within the lifespan of today’s population? MAYBE! I have faith in technology being able to solve almost any problem, given enough incentive to do so. At the same time, I don’t have a much faith in the government being able to rapidly and efficiently solve the problems. BUT, I would hold out hope for a more rapid resolution of EV problems by a combination of private sector technology advancement, intelligently supported by appropriate government actions. The technology of EVs is improving all the time, with every little breakthrough and every marginal gain. Over time, many of the core drawbacks of EVs could be eliminated entirely. While the EV battery range is limited today, it is improving. Driving range may someday come close to or equal that of vehicles with internal combustion engines. In my lifetime? Probably not. Typical time to fully charge EV batteries today is measured in hours. That's way too long to wait if you've got somewhere to be right now, especially when filling up an empty tank at the gas station typically takes only two or three minutes. Battery technology research has pushed hard toward faster charging times as well as greater battery storage capacities. A past breakthrough out of Singapore's Nanyang Technological University reported improvements on existing lithium-ion battery construction to gain charging speeds 20 times faster than what's currently possible. Another breakthrough from Japan promises similar improvements in charging speed using a different improvement to the same lithium-ion foundation.[15] Will charge times get close to the time it takes to refill your gas tank? Possibly, but likely not in my lifetime. I hold out little hope for Battery-only EVs completely taking over the automotive market in the foreseeable future. There are just too many problems to be eliminated with this technology. BUT, I do see Hybrid EVs and Plug-in Hybrid EVs continuing to grow their market share. These technologies circumvent the most serious problems presented by Battery-only EVs. Hybrid EVs and Plug-in Hybrid EVs offer the advantages of both Battery-only EVs and Internal Combustion Engine Vehicles and eliminate most of the drawbacks of both. So, my answer to the question, Will Hybrid EVs and Plug-in Hybrid EVs replace Internal Combustion Engine Vehicles in my lifetime? is a definite POSSIBLY, BUT NOT LIKELY! ------------------------------------------------------------------------------------------------------------------------ References:

|

| 7 February 2019 {Article 348; Suggestions?_18} |