| |

Background (Ref. 1):

Barney Frank was born on March 31, 1940 and is currently (November 2011)

the U.S. Representative for Massachusetts's 4th congressional district. He is a liberal Democrat and has been

a representative since January of 1981. He is the former chairman of the House Financial Services Committee

(2007–2011) and is considered the most prominent gay politician in the United States. Frank remains the

ranking Democrat on the House Financial Services Committee.

Frank is a graduate of Harvard College and Harvard Law School. In 1980, he

was elected to the U.S. House of Representatives with 52 percent of the vote and has been re-elected ever

since by wide margins. In 1987, Frank became the first member of Congress to voluntarily come out as gay.

In 1968, Frank started his political career as Boston mayor Kevin White's

Chief Assistant, a position he held for three years. He then served for a year as Administrative Assistant

to Congressman Michael J. Harrington. In1972 Frank was elected to the Massachusetts House of Representatives

where he served for eight years. Frank made a name for himself in the mid-1970s as a political defender of

the Combat Zone, Boston's notorious red light district. As a means of dealing with crime in the area, Frank

introduced a bill into the Massachusetts General Court that would have legalized the sex-for-hire business

but would have kept it quarantined in a red light district that would have been moved to Boston's Financial

District. The bill never came up for a vote. To date, Congressman Frank has been reelected fifteen times.

In 1985, Frank hired Steve Gobie for sex, a male prostitute, and they became

friends more than sexual partners. Frank housed Gobie and hired him with personal funds as an aide, housekeeper

and driver and paid for his attorney and court-ordered psychiatrist. In 1987 Frank kicked Gobie out after he was

advised by his landlord that Gobie was still involved in homosexual prostitution in Frank’s residence. Later that

year Frank asked the House Ethics Committee to investigate his relationship "in order to insure that the public

record is clear." The Committee found no evidence that Frank had known of or been involved in the alleged

illegal activity; they recommended a reprimand for Frank using his congressional office to fix 33 of Gobie's

parking tickets and for misstatements of fact in a memorandum relating to Gobie's criminal probation record.

The House voted 408–18 to reprimand Frank.

Barney Frank is known for his quick wit. Over the period from 2004 through 2010,

in surveys of Capitol Hill staffers, Frank has been called the "brainiest", "funniest", "a workhorse", and

"most eloquent" member of the House. He has also been called "one of the brightest and most energetic

defenders of civil rights issues."

In 2001 Frank authored of the States' Rights to Medical Marijuana Act, an

attempt to stop federal government from preempting states' medical marijuana laws. He has consistently voted

for the Hinchey-Rohrabacher amendment that would prohibit the United States Department of Justice from

prosecuting medical marijuana patients. In March 2008, he proposed the Personal Use of Marijuana by Responsible

Adults Act of 2008, which would have decriminalized small amounts of the drug but died in committee

during the 5th Congress. On June 18, 2009 he re-introduced the bill as the Personal Use of Marijuana by

Responsible Adults Act of 2009. In 2003 he was rated "A" by the Vote Hemp organization.

In 2001 Frank co-sponsored "the MX Missile Stand-Down Act" to take fifty

peacekeeper missiles off of high-alert status. As of the 9th Congress, Frank is advocating a 25 percent

reduction in the overall Military budget of the United States. Frank supports having fewer F-35 Joint Strike Fighter

planes, but also supports a $3 billion backup engine project that the Pentagon does not want. Notably,

the backup engine would be manufactured in the General Electric plant in Frank’s home state of Massachusetts.

Frank stated that he actually wanted to cut the entire F-35 program, but as long as military spending

continued he would fight for his district's share of it.

In 2003, while the ranking minority member on the Financial Services Committee,

Frank opposed a Bush administration proposal, in response to accounting scandals, for transferring oversight of

Fannie Mae and Freddie Mac from Congress and the Department of Housing and Urban Development to a new agency

that would be created within the Treasury Department. The proposal, supported by the head of Fannie Mae,

reflected the administration's belief that Congress "neither has the tools, nor the stature" for adequate

oversight. Frank stated, "These two entities ...are not facing any kind of financial crisis ... The more

people exaggerate these problems, the more pressure there is on these companies, the less we will see in

terms of affordable housing." In 2003, Frank also stated what has been called his "famous dice roll":

"I do not want the same kind of focus on safety and soundness [in the regulation of Fannie Mae and Freddie Mac]

that we have in the Office of the Comptroller of the Currency and the Office of Thrift Supervision.

I want to roll the dice a little bit more in this situation towards subsidized housing." Barney rolled the dice,

but it has been the people of the United States have been paying the price ever since.

Frank was criticized by conservative organizations for campaign contributions

totaling $42,350 from Fannie and Freddie between 1989 and 2008. It was claimed that the donations from

Fannie and Freddie influenced his support of their lending programs. Furthermore, it was charged that Frank

did not play a strong enough role in reforming the institutions in the years leading up to the Economic

crisis of 2008.

Frank’s Role in theThe Financial Crisis of 2008

In an article in the Boston Globe in April of 2008, columnist Jeff Jacoby wrote

about Barney Frank’ and the then developing financial crisis of 2008. (Ref. 2)

The following paragraphs summarize the material contained therein.

According to Mr. Frank “THE PRIVATE SECTOR got us into this mess.

The government has to get us out of it.” That was Barney Frank's story then and still is today. As Barney explained it,

the financial crisis was the spawn of the free market run amok, with the political class guilty only of

failing to rein the capitalists in. The Wall Street meltdown was caused by "bad decisions that were made by

people in the private sector." Frank went on to say that the country was in dire straits "thanks to a

conservative philosophy that says the market knows best."

While the mortgage crisis that was convulsing Wall Street in 2008 had its

share of private-sector culprits, they weren't the ones who "got us into this mess." Mortgage lenders didn't

wake up one fine day deciding to junk long-held standards of creditworthiness in order to make ill-advised

loans to unqualified borrowers. It would be closer to the truth to say they woke up to find the government

twisting their arms and demanding that they do so - or else.

The roots of this crisis go back to the Carter administration. That was when

government officials, egged on by left-wing activists, began accusing mortgage lenders of racism and "redlining"

because urban blacks were being denied mortgages at a higher rate than suburban whites.

The pressure to make more loans to minorities (read: to borrowers with weak

credit histories) became relentless. Congress passed the Community Reinvestment Act, empowering regulators

to punish banks that failed to "meet the credit needs" of "low-income, minority, and distressed neighborhoods."

Lenders responded by loosening their underwriting standards and making increasingly shoddy loans.

The two government-chartered mortgage finance firms, Fannie Mae and Freddie Mac, encouraged this "subprime"

lending by authorizing ever more "flexible" criteria by which high-risk borrowers could be qualified for

home loans, and then buying up the questionable mortgages that ensued.

All this was justified as a means of increasing homeownership among minorities

and the poor. Affirmative-action policies trumped sound business practices. A manual issued by the

Federal Reserve Bank of Boston advised mortgage lenders to disregard financial common sense.

"Lack of credit history should not be seen as a negative factor," the Fed's guidelines instructed.

Lenders were directed to accept welfare payments and unemployment benefits as "valid income sources"

to qualify for a mortgage. Failure to comply could mean a lawsuit.

As long as housing prices kept rising, the illusion that all this was good public

policy could be sustained. But it didn't take a financial whiz to recognize that a day of reckoning would come.

As far back as 1995, columnist Jacoby had written: "What does it mean when Boston banks start making many

more loans to minorities? Most likely, that they are knowingly approving risky loans in order to get the

feds and the activists off their backs . . . When the coming wave of foreclosures rolls through the inner city,

which of today's self-congratulating bankers, politicians, and regulators plans to take the credit?"

When the wave of foreclosures hit, Frank denied culpability.

But his fingerprints are all over this fiasco. Time and time again, Frank insisted that Fannie Mae and Freddie Mac

were in good shape. In 2003, when the Bush administration proposed much tighter regulation of the two companies,

Frank was adamant that "these two entities, Fannie Mae and Freddie Mac, are not facing any kind of financial crisis."

When the White House warned of "systemic risk for our financial system" unless the mortgage giants were curbed,

Frank complained that the administration was more concerned about financial safety than about housing.

When the bubble finally burst and the "systemic risk" became apparent to all,

Frank blithely declared: "The private sector got us into this mess." Well, give the congressman points for gall.

Wall Street and private lenders have plenty to answer for, but it was Washington and the political class that

derailed this train. If Frank is looking for a culprit to blame, he can find one suspect in the nearest mirror.

Barney Frank used influence with Fannie Mae, the failed mortgage giant

bailed out by taxpayers. “Barney Frank tenaciously opposed efforts to reform Fannie Mae and Freddie Mac,

the government-sponsored mortgage giants that were bailed out at a cost to taxpayers of between $148 billion

and $363 billion.” It was reported that “he got his partner a ‘handsomely rewarded gig at Fannie Mae’

while Frank ‘was helping to inflate the housing bubble’ by pushing affordable housing mandates and policies

that encouraged Fannie Mae to buy up risky mortgages.

“Fannie Mae and Freddie Mac engaged in massive accounting fraud and other abuses.

But Fannie Mae’s collapse was not entirely due to bad policies of its own making. Pressure from liberal

lawmakers like Frank to buy up risky mortgages was also a factor in triggering the mortgage crisis,

judging from a story in the New York Times. For example, ‘a high-ranking Democrat telephoned executives

and screamed at them to purchase more loans from low-income borrowers, according to a Congressional source.’

The executives of government-backed mortgage giants Fannie Mae and Freddie Mac ‘eventually yielded to

those pressures, effectively wagering that if things got too bad, the government would bail them out.’

“Despite his key role in causing the financial crisis, Frank became even

more influential after President Obama took office. As the New York Times noted, the massive financial

overhaul later passed in response to the financial crisis is ‘largely the product of extensive conversations’

between the Obama administration and ‘Representative Barney Frank of Massachusetts and

Senator Christopher J. Dodd of Connecticut.’” It is claimed that the law, “ known as the

Dodd-Frank Act, harms the economy, and violates both the Constitution’s separation of powers,

and private property and equal-protection rights.” (Ref. 3.)

Barney Brings “Discredit Upon the U.S. House of Representatives”

“In 1991, Barney Frank received an official reprimand for reflecting ‘discredit upon the House.’

The reprimand came as a result of his relationship with a man named Steve Gobi, a male prostitute whom

Frank initially paid $80 for sex. Frank later took Gobi to live with him in his home, making him a personal aide.

He paid him $20,000 in compensation (unreported to the IRS) and let him use his car. Subsequent investigation

revealed that in the course of their relationship, Frank used his congressional office and stationary to

fix Gobi's 33 parking fines. Frank also used his congressional letterhead to write a reference letter to

Gobi's probation officer -- Gobi was under court supervision as a convicted felon with a prison record --

in which he gave false information. Most damningly, the investigation found that Gobi ran a prostitution

ring from Frank's home. In his defense, Frank asserted he knew nothing of Gobi's illicit enterprise.

“The Democrat-controlled House voted 408-18 to reprimand Frank after a heated

debate during which some Republicans demanded expulsion. They pointed out that the claim that Frank did not

know of Gobi's criminal activities was incredible to say the least.” (Ref. 2)

Arrogance aka Chutzpah

If any one word can be said to describe Congressman Frank, it is the word

arrogant. At one town hall meeting, Frank told one member of the audience, “Talking to you is like

talking to a dining room table.” Sometime later, he “attacked the intelligence of a Harvard law student

for asking legitimate questions about Frank’s role in the financial meltdown.” (Ref. 4.)

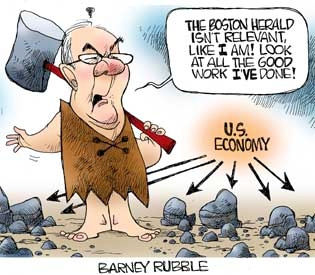

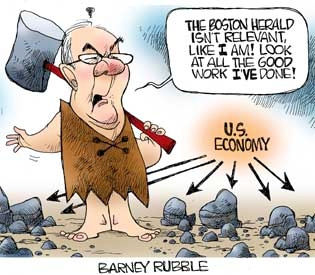

Perhaps a more accurate description of Barney Frank’s arrogance is found in the Yiddish word “chutzpah”.

“As the financial meltdown accelerated in 2008, politicians came forward with their plans to fix the problem.

Barney Frank showed the most chutzpah. Barney crawled from beneath the rubble of his own ‘man’–made disaster

and immediately pointed the finger at the private sector.” (Ref. 5.) Heaven forbid that

any of the blame could be laid on our “never wrong” Barney.

Barney Doesn’t Like to be Criticized

Following Barney Frank's 2010 victory over challenger Sean Bielat, “ Frank appeared

to be angry that he had faced actual competition in his heavily gerrymandered district in the bluest of blue states,

and that one of two big local daily newspapers had the nerve to publish unflattering things about him.

Edward Mason and Jessica Heslam of the Boston Herald report{ed the following}:

"’With the re-election of the Massachusetts delegation and Gov. Deval Patrick,

we can reaffirm the complete political irrelevance of the {conservative} Boston Herald {newspaper},’ Frank told

more than 100 supporters at the Crowne Plaza in Newton. ‘There is no limit to the bias and vitriol they unleashed.’

“Howie Carr of the Herald explain{ed} what the ‘vitriol’ was:

“Now, we know one of Barney's big problems with this newspaper is that reporter

Dave Wedge videotaped his partner, James Dude Ready, giving the needle to Sean Bielat after a debate a couple

of weeks ago. Wedge rolled tape. In Barney's world this {videotaping of James Ready’s actions} is bias and vitriol.

“See, no one is supposed to say anything about Barney. Certainly the {liberal Boston}

Globe {newspaper} treats him with kid gloves. For example, he's present at a house in Maine with marijuana plants

growing, but he doesn't know what marijuana looks like. He used to live with a male prostitute named Hot Bottom,

but you can't mention that either, because it's homophobia. And then there was Barney's former partner, Herb Moses,

who made a six-figure salary at Fannie or Freddie - I can never remember which.

“Frank faces a major comedown, losing his chairmanship of the powerful

House Banking Committee. He also faces, for the rest of his life (he is 70 years old), a reckoning for

his role in creating the subprime mortgage crisis that has ruined lives, financial institutions, and retirement

accounts. I lived in Mass{achusetts} when Frank began his career in the state legislature, and remember him being

a witty smart-aleck. Now he has degenerated into a cranky curmudgeon. It doesn't look like it's much fun to be

Barney Frank these days.” (Ref. 6.)

Barney Doesn’t Like Dissent

An example of Barney Frank’s arrogance and abhorrence of dissent occurred during

the late summer of 2011. In August of 2011, 3 members of the Federal Open Market Committee (FOMC) had the audacity

to oppose “an indefinite extension of the very low interest rates of the last three years.” The extension was

proposed and supported by the President and Representative Frank. The extension was passed by the FOMC, 7-3.

But Frank was appalled that the approval was not unanimous. So Frank submitted a bill to “strip the presidents

of the Fed’s 12 regional banks of their right to vote. Frank stated that he was opposed to allowing the bank

presidents to vote because they were “overwhelmingly representative of business,” and particularly the financial sector,

therefore “they are not representative in any way of the American economy.” Wait a minute!

Presidents of Federal Reserve Banks are not representative of the American economy? From what planet

does Barney come? What Representative Frank was really saying was that dissent with his Liberal agenda was unacceptable.

In his words, dissent “has now become a significant constraint on national economic policymaking.” Clearly he

favors mandatory harmony ala totalitarian regimes around the world. “One of liberalism’s steady aims is to

break more and more institutions to the saddle of centralized power” (Ref. 7).

Barney’s Never Wrong

At a 2003 House hearing, Frank asserted: “I do not think we are facing any kind of a crisis.

That is, in my view, the two government-sponsored enterprises we are talking about here, Fannie Mae and Freddie Mac,

are not in a crisis. … I do not think at this point there is a problem with a threat to the Treasury.”

(Ref. 8).

Barney Frank has never owned up to the role he played in the collapse of the

housing market that led to recession of 2008. He simply says that “he had ‘ideological blinders’ about Freddie/Fannie.

His push to put the taxpayer on the hook for high-risk loans to special-interest borrowers was done in the name of

liberal politics, not economic rationality.

“He now claims he just didn’t know any better. But everybody knew better in the summer

of 2008 when Frank claimed ‘Freddie and Fannie are not in danger’.

“Two months later they were bankrupt.” (Ref. 4.)

Barney Has No Problem Bending the Rules to Get His Way

Winters in new England can be cold and harsh. Energy for heating comes mainly

from oil, gas and Liquefied Natural Gas (LNG). “New Englanders get about 20 percent of their energy from natural

gas and LNG imports ensure an adequate supply and reasonable prices.” An LNG terminal, approved by the Federal

Energy Regulatory Commission, was scheduled for a river in Fall River, Massachusetts. The city objected, so the

Barney Frank led Massachusetts congressional delegation “tucked language into a transportation bill that blocked

the demolition of an ‘historic’ bridge – even though a new span was already in the works upriver – thus making it

impossible for large tankers to get to the LNG terminal.” The old bridge was no more historic than my mother-in-law’s

dental bridge, but to Barney Frank, a bit of prevarication to get his way has never been a problem.

“Then the delegation got really creative, managing to secure ‘wild and scenic’

designation for the industrial waterway, a designation typically reserved for rivers that are well, ‘wild and scenic.’”

As any of us who have ever viewed the river at issue can tell you, no one in his right mind would ever describe the

Taunton River as wild or scenic.

The LNG terminal developers redid their plan by moving the plant a mile away. To thwart

this new plan, Barney Frank and another representative secured language “in a House appropriations bill that would

essentially block the Department of Energy from conducting a required regulatory review.” (Ref. 9.)

So, for Barney Frank, it’s to hell with those in New England looking forward to lower fuel prices, the assurance

of an adequate supply of heating fuel and a reduction in the amount of pollution dumped into the atmosphere. For Barney,

rules, laws and regulations are simply obstacles to be overcome by whatever devious means he can conceive – and,

if nothing else, Barney Frank is smart and, when necessary, highly devious.

Conflicts of Interest Have No Meaning for Barney

“Representative Barney Frank helped his then-companion land a job at mortgage giant

Fannie Mae in the early 1990s at the same time Congress was writing legislation to improve oversight of the lender,

according to New York Times reporter Gretchen Morgenson, who recently wrote a book examining the financial crises.

Frank was a member of the House Financial Services Committee in 1991 when he ‘actually

called up the company and asked them to hire his companion, who had just gotten an MBA from the Amos Tuck School of

Business,’ Morgenson said during a recent appearance on National Public Radio.

"’Of course the company was happy to provide a job for his companion and rolled out the

red carpet in a series of interviews with a variety of executives, and it ultimately did hire the man,’ she said.

‘And he stayed there for I believe seven years.’

“Morgenson did not say the hire had anything to do with the collapse of Fannie Mae in 2008,

but gave it as an example of the cozy relationship that Fannie Mae executives had with lawmakers who were charged with

overseeing them.

“She said Frank aggressively defended the mortgage giant after it hired his live-in partner,

Herb Moses.

"’He was very aggressive to, for instance, the head of the Congressional Budget Office at that

time, who was trying to call for increased capital requirements and to call for a focus on safety and soundness at

Fannie Mae, that Frank really took him apart in testimony,’ Morgenson said, according to a transcript of NPR's Fresh Air.”

“Frank told the {Boston} Globe last fall that he missed the warning signs of the mortgage

giant's insolvency and risky lending practices because he was wearing ‘ideological blinders,’ and thought attacks on

the lender were partisan and without merit.

“Frank defended practices at Fannie Mae until 2007, when he was chairman of the

Financial Services Committee, but by then the agency had underwritten millions of dollars worth of risky mortgages.

"’It really was far too late, and he had been such a vocal supporter for so long that

it was sort of an odd turnabout,’ Morgenson said.” (Ref. 10.)

If anything, Barney Frank is consistent with respect to his ignorance of or his

disregard for conflict of interest issues. “Rep. Barney Frank might sympathize with the Occupy Wall Street protesters,

but he’s still got friends in the financial world.

“The Massachusetts Democrat headed to New York hoping to raise tens of thousands

of dollars … at a fundraiser at the home of Charles Myers, a senior investment banking adviser at Evercore Partners.

Myers is one of several Wall Street execs listed on the invite soliciting up to $2,500 from attendees for Frank’s

reelection committee.”

“Frank, the co-author of the sweeping financial regulatory reform bill signed into

law last year, said in a recent interview with POLITICO that he didn’t see any conflict between supporting the

protests and taking financial services money. (Ref. 11).

How about accepting expensive gifts from someone in an industry that he helps to

regulate? “Congressman Frank saw no impropriety in accepting a free vacation in the Virgin Islands from a

Wall Street tycoon – a “person whose industry he regulates” as chairman of the House Finance Services Committee.

(Ref. 4)

Frank said that he saw “‘no conflict of interest whatsoever’ in his free trip to

the Virgin Islands with a billionaire hedge fund honcho.” The 2010 Republican opponent for his seat in Congress

commented that “It’s another example of inappropriate use of office. It may not be illegal but it’s wrong.”

The Democratic controlled “House ethics panel … granted permission for the trip, saying it was an ‘unusual’

case that warranted an exception to rules restricting gifts to members of Congress.” Worthy of note is the

fact that, when Frank was chairman of the House Financial Services Committee, the tycoon’s hedge fund got a

$200 million payment from AIG “after the insurance giant received a $180 billion bailout in 2008”. “In a

November 2009 press release the company {AIG} listed {the hedge fund company} as one of a dozen firms it

paid with billions in ‘public aid.’” While the actual cost of the trip is open to question, “aviation

experts said a one-way private jet flight from Maine to the Virgin Islands would cost up to $30,000. (Ref. 12).

You Will Do What I Tell You, Or Else!

Even after the financial meltdown of 2008 that he helped to create,

Frank continued his vendetta with the financial community in his continuing attempt to have everyone

own their own home – whether or not they could afford to do so. In the pursuit of getting his way,

Congressman Frank can be very blunt. He doesn’t shy away from wielding a sledge hammer when it suits his purpose.

For example, in 2009: “House Financial Chairman Barney Frank threatened banks yesterday, saying that if

they don’t volunteer to save homeowners from foreclosure, Congress will make them.” In addition, “Frank also

said his committee won’t consider legislation to help banks lend unless there is a ‘significant increase’

in mortgage modifications.” (Ref. 13.) In other words, Commissar Frank issued orders that,

in effect, said to the banks: You will do what I tell you, or else!

The New Capitalism According to Barney Frank

With Barney Frank, the “new capitalism” of the Democratic administration means

browbeating business leaders, bribing America’s corporations and having government administrators dictating

what actions these companies and their CEOs have to take to avoid government repercussions. In 2009, then

chairman of the House Financial Services Committee, Congressman Frank “praised {the then} Bank of America chairman …

for acting in ‘the public interest’ for caving in to bribes and threats from {the} Treasury Secretary …

and Federal Reserve chairman … regarding B of A’s takeover of Merill Lynch.” The B of A chairman “wanted to

back out of the deal when he discovered the scope of Merill’s losses. But {the federal administrators}

decided that Merill shouldn’t fail, so they bribed the B of A CEO with $20 billion of taxpayer funds,

instructed him to conceal the agreement from his shareholders and told him his job would be on the line

if he didn’t play ball – which he did.” In Barney Frank’s eyes, these actions are called economic patriotism

and are deserving of his praise! “Welcome to the new capitalism, where pols rule, irresponsible behavior is rewarded,

and theft is legal.” (Ref. 14.)

Big Brother Will Be Watching You

It seems abundantly clear that Congressman Barney Frank is a firm believer

in Big Brother watching over business, if not outright control over business decision-making. He is in favor

of government control of business risk taking and executive compensation. While it was OK for him to encourage

government agencies and mortgage companies to take unwarranted risks in making bad housing loans to

prospective homeowners who were bad credit risks, he is opposed to similar risk taking on the part of

private business. While he championed mortgages for all – even if they can’t afford it, he wants

the government to control executive compensation and bonuses on Wall Street. “U.S. Rep Barney Frank wants

federal regulators to review Wall Street pay packages, banning any bonuses that promote reckless risk-taking.”

Frank’s bill would require firms to disclose how they compensate top executives, prohibiting any bonus that

‘encourages inappropriate risks (that) could have serious adverse effects on (the economy.”

(Ref. 15.) Presumably, Frank or some government bureaucrat possess the intelligence and business acumen to determine what is an acceptable level of risk and what is an appropriate level of compensation. Frank’s bill would have the government overseeing and over-regulating our free enterprise system. The road to socialism in the U.S. lies before us. If Barney Frank would have his way, Big Brother will be watching you and Big Brother will be deciding for you.

Why?

The focus of this writing is not so much on the actions and doings of

Congressman Barney Frank, but on the voting constituency in my home state of Massachusetts. I ask the

following question. Why do the voters in my home state of Massachusetts repeatedly vote to keep in

his congressional seat a person who consistently does and says what’s listed below and acts in the following manner?

- Had sex with a male prostitute and took questionable ethical actions on the man’s behalf, resulting in a congressional reprimand

- Used his congressional position to recommend his male partner for a position in a government agency over which he had

congressional oversight

- Provided congressional oversight over a government agency in which his male domestic partner was employed

- Accepted free and expensive travel from a businessman whose company is affected by actions taken by Frank in his

position in Congress

- In his position on a congressional oversight committee, denied problems in the agencies which his committee oversaw

as these agencies were going bankrupt and helped to lead the nation into a long-lasting economic crisis of gigantic proportion

- Browbeat financial institutions into granting mortgages to individuals who were unable to afford these mortgages,

thus helping to create the housing collapse the led to the ongoing recession that started in 2008

- Accepted campaign contributions from the federal agencies over which his congressional committee had oversight

- Has been a consistent advocate in Congress for the legalization of marijuana

- Has been a constant advocate in Congress for reducing the defense budget by 25%, which, by any measure,

would place the defense of the United States in jeopardy while global Islamic terrorism persists, Iran pursues

a nuclear weapons capability, and while Russia and China build up their military capabilities

- Has used his position in Congress to bend the law and the rules in order to frustrate the construction of a

much needed LNG terminal in his district.

In spite of Barneys’ foibles, arrogance and even apparent violations of congressional ethics, “these {Massachusetts}

suburban liberals don’t understand the issues or care about the results.” (Ref. 4).

Massachusetts is the only state in the union that unquestionably longs for the establishment of a monarchy –

that of the Kennedy clan. Over the years, they have elected and re-elected members of the Kennedy clan,

including that Dinosaur of the Senate, the late Senator Ted Kennedy. The name Kennedy on any ballot in the state

is almost a guarantee of eletion to public office. Massachusetts voters are locked

in the New Deal time warp of the 1930’s. They re-elected their liberal Democratic governor who has

consistently refused to require law enforcement agencies across the state to check on the immigration

status of immigrants arrested for felonies in order to avoid potentially offending the state’s

Democratic-supporting Hispanic community. They have famously voted into office a beloved Democratic politician,

Michael J. Curley, while he was serving jail time. At election time, they vote with candidates that

have a “D” next to their name on the ballot as opposed to those with Republican “R” next top their names.

Both houses of the state legislature, along with the state’s federal congressional delegation, are, have been,

and are likely to remain overwhelmingly Democratic. Once elected to public office, Democratic officeholders

are almost guaranteed that they will remain in office as long as they desire, irrespective of their

performance or non-performance while in that office.

“All those who care about the future of this country should be greatly

concerned that Barney Frank … is presently one of the most powerful politicians in America. His recent

actions and statements make it amply clear that he will seek to use his present influence to implement

as much of his extreme agenda as he possibly can.” (Ref. 16) Do the citizens of

Massachusetts understand this? Do they care? I sincerely doubt it!

---------------------------------------------------------------------------------------------------------

References:

- Barney Frank, Wikipedia: http://en.wikipedia.org/wiki/Barney_Frank, Accessed 2 November 2011.

- Frank’s fingerprints are all over the financial fiasco, Jeff Jacoby, The Boston Globe, 28 September 2008.

- Barney Frank Used Influence with Fannie Mae, the Failed Mortgage Giant Bailed Out by Taxpayers, Hans Bader,

Openmarket.org; http://www.openmarket.org/2011/05/26/barney-frank-used-influence-with-fannie-mae-the-failed-mortgage-

giant-bailed-out-by-taxpayers/, 26 May 2011 {Accessed 4 November 2011}.

- Barney a tough sell, Michael Graham, Boston Herald, Page 19, 15 October 2010.

- Welcome to the Latest Government SNAFU Part II, Dr. Charles Ormsby, The Valley Patriot, Page 5, June 2009.

- Barney Frank, angry in victory, Brian Schwarz and Thomas Lifson, American Thinker: July 28, 2011;

http://www.americanthinker.com/blog/2010/11/barney_frank_angry_in_victory.html,

{Accessed 2 November 2011}.

- Frank’s democracy devoid of dissent, George F. Will, Boston Herald, Page 23, 29 September 2011.

- Barney Frank’s Friends with Benefits; Update: New Fannie/Freddie lavish comp figures, Michelle Malkin,

Michelle Malkin; http://michellemalkin.com/2011/05/27/barney-franks-friends-with-benefits/, 27 May 2011

{Accessed 4 November 2011}.

- Rough seas for LNG, Editorial, Boston Herald, Page 16, 23 August 2010.

- Book: Frank helped partner get Fannie Mae job, Donovan Slack, Boston Globe, 26 May 2011.

- Barney Frank supports protests, raises Wall St. cash, Anna Palmer & Robin Bravender,

POLITICO; http://www.politico.com/news/stories/1011/66412.html, 19 October 2011 {Accessed 4 November 2011}.

- Frank stands ground on free flight, Dave Wedge, Boston Herald, Page 8.

- Frank warns banks about foreclosures, Associated Press, Boston Herald, Page 28, 30 July 2009.

- Barney’s just bad business, Star Parker, Boston Herald, Page 21, 4 May 2009.

- Frank: Ban risky bonuses, Jerry Kronenberg, Boston Herald, Page 16, 18 July 2009.

- Who is Barney Frank?, Vasko Kohlmayer, American Thinker:

http://www.americanthinker.com/2009/03/who_is_barney_frank.html, 5 March 2009.

|

|