The Economics of Politics

© David Burton 2010

The Economics of Politics

© David Burton 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

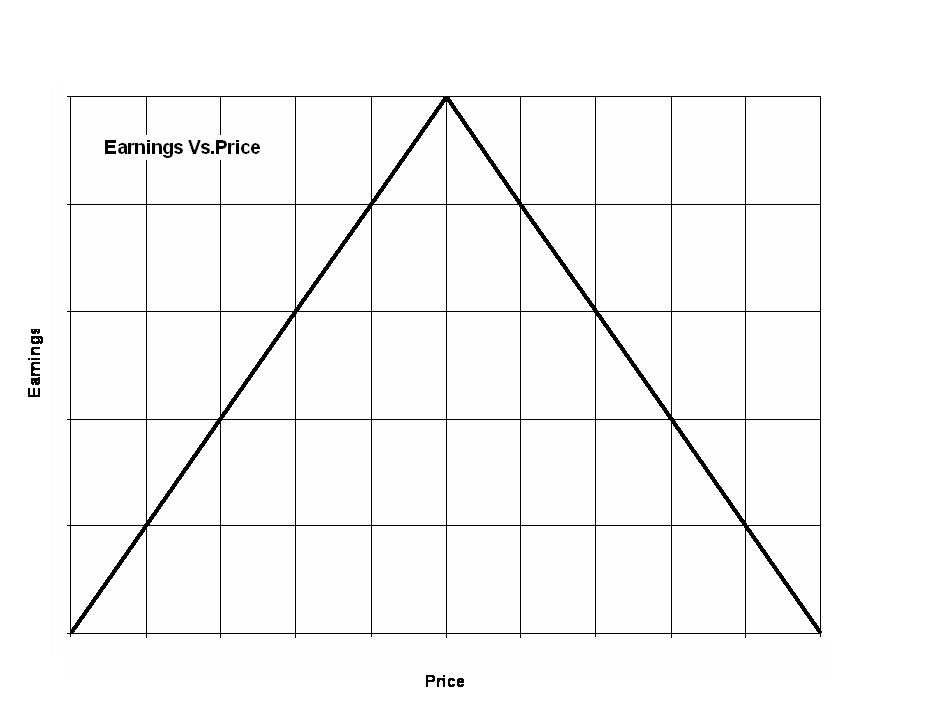

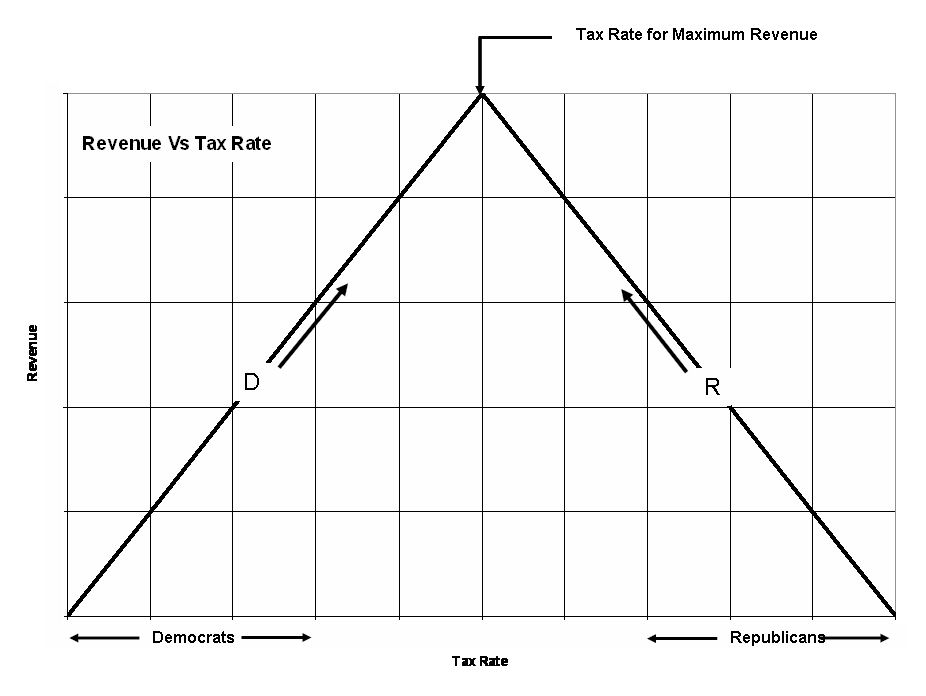

Democrats and Republicans have very different views of how the government should manage

the economy of the United States in terms of taxation. Ignoring the issue of wealth redistribution, they differ on

the question of how to increase government revenues. In the case of the Democrats, their recent historical position

has been that government revenues can be effectively increased and the economy improved by increasing tax rates.

In particular, they believe that taxes should be raised on the highest earners while supposedly keeping tax rates

on the middle and lower earners fixed, i.e. rob the rich and give to the poor.  In politics, it is postulated that the amount of revenue taken in by the government is a function of the rate of taxation imposed by the government. Fiscally liberal Democrats contend that by raising tax rates, particularly on the "rich", revenues taken in by the government will increase. Fiscally conservative Republicans contend that the opposite is true. They claim that raising taxes reduces overall productivity and results in increased unemployment which adds to the cost of government. Higher taxes cause business to cut back and some to actually go out of business. Consequently as tax rates are increased, overall government revenue actually drops. The situation is akin to the Revenue Versus Price curve shown above, but this time with Earnings being replaced by Revenue and Price being replaced with Tax Rate. Such a curve is shown below. The point on the Earnings-Price curve where earnings peak is now replaced by the point called the Tax Rate for Maximum Earnings. Fiscally liberal Democrats believe that the economy is operating to the left of the Tax Rate for Maximum Earnings point. Fiscally conservative Republicans believe that the economy is operating to the right of the Tax Rate for Maximum Earnings point.  The argument about where we are on the Revenue Versus Tax Rate curve can go on interminably, but there is only one true measure of who is correct - that measure is historical precedence. And the lesson of history, certainly modern-day history, is overwhelmingly on the side of the fiscal conservatives. Raising tax rates, particularly in economically depressed times, has nearly always failed to achieve its objectives. Increased taxes have only led to worsened economic times and have failed to increase government revenues. On the other hand, history has demonstrated that a reduction in tax rates has not only increased overall government revenues, but has led to decreased unemployment, raised consumption, increased Gross Domestic Product (GDP), and allowed American industry to be more competitive in the world marketplace. Raising taxes has been shown to siphon off a large share of personal and business purchasing power, reduce the incentive for risk, investment and effort - in effect, aborting economic recovery and stifling economic growth. Consider the following: "The 2003 tax rate reductions . . . enhanced Americas competitive advantage by reducing the tax penalty on work, investment, and entrepreneurship." Gross domestic product (GDP) grew slowly early in the first decade of the 21st century, presumably because of the collapse of the stock market bubble and the ripple effects of the 9/11 terrorist attacks. However, later in the decade, "GDP growth was quite impressive. The 2003 tax rate reductions played an important role by reducing the marginal tax rates on work, investment, and entrepreneurship." (Ref. 1) "Taxes do harm the economy in a significant and consistent way." "Likewise, when Washington has reduced federal tax burdens over the past 30 years {1960 -1990}, there has been a statistically significant positive economic and employment stimulus in the following year." "Most static economic models {have} ignore{d} completely the negative economic effects of taxation. In fact, it was not until the 1980s, when the election of President Ronald Reagan brought supply-side economists into ascendance, that the importance of marginal tax rates gained the attention of federal policymakers and some feedback models were put into use. Most economists now acknowledge that punitive marginal income tax rates of 90 or 70 or 50 percent can stifle economic activity and growth. Indeed, a wealth of economic literature on the subject of taxes and economic growth now verifies that contention." "Aggregate tax burdens--that is, the total amount of the economy's resources directly transferred to the government--may be critically important to economic growth too. If the resources allocated to the government are used inefficiently, or less efficiently than in private hands, economic growth is diminished and production falls. If additional tax dollars are used for a project that makes no contribution to productive capacity, and if the tax dollars raised prevent some private expenditure or investment that would have provided output and jobs in future years, growth is diminished. Examples of government projects with low social returns abound in the federal budget." A CATO institute economic model has shown that "taxes are a leading indicator of employment creation and economic growth. Each 1.0 percent rise in the federal tax burden leads to a 1.8 percent reduction in economic growth. Each 1.0 percent rise in the federal tax burden leads to a 1.14 percent decline in national employment." "When taxes as a percentage of GNP rise, the very next year growth in real GNP and employment will decline. The converse is also true: when federal tax burdens fall, economic growth and the unemployment picture will improve the following year." The CATO model has demonstrated "that the aggregate federal tax burden has an adverse economic impact, regardless of how taxes are collected. Taxes have a negative effect because they deprive the private sector of resources to expand growth and often produce negative incentives for desirable activities, such as business investment or increasing work effort." Furthermore, the CATO model provided one overarching policy prescription for federal lawmakers: . . . they should be easing Americans' tax burdens, not raising them." (Ref. 2) Reducing tax rates to increase government revenues, stimulate the economy, and ease the economic burdens on taxpayers and businesses is not solely a Republican concept. Consider the following quotes by Democratic President John F. Kennedy, as reported in Reference 3. "It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now ... Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus." John F. Kennedy, Nov. 20, 1962, president's news conference "Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased not a reduced flow of revenues to the federal government." John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964 "In today's economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit why reducing taxes is the best way open to us to increase revenues." John F. Kennedy, Jan. 21, 1963, annual message to the Congress: "The Economic Report Of The President" "It is no contradiction the most important single thing we can do to stimulate investment in today's economy is to raise consumption by major reduction of individual income tax rates." John F. Kennedy, Jan. 21, 1963, annual message to the Congress: "The Economic Report Of The President" "Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort thereby aborting our recoveries and stifling our national growth rate." John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session. "A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues." John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill "Our present tax system ... exerts too heavy a drag on growth ... It reduces the financial incentives for personal effort, investment, and risk-taking ... The present tax load ... distorts economic judgments and channels an undue amount of energy into efforts to avoid tax liabilities." John F. Kennedy, Nov. 20, 1962, press conference "In short, it is a paradoxical truth that ... the soundest way to raise the revenues in the long run is to cut the rates now. The experience of a number of European countries and Japan have borne this out. This country's own experience with tax reduction in 1954 has borne this out. And the reason is that only full employment can balance the budget, and tax reduction can pave the way to that employment. The purpose of cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus." John F. Kennedy, Nov. 20, 1962, news conference "The largest single barrier to full employment of our manpower and resources and to a higher rate of economic growth is the unrealistically heavy drag of federal income taxes on private purchasing power, initiative and incentive." John F. Kennedy, Jan. 24, 1963, special message to Congress on tax reduction and reform "A bill will be presented to the Congress for action next year. It will include an across-the-board, top-to-bottom cut in both corporate and personal income taxes. It will include long-needed tax reform that logic and equity demand ... The billions of dollars this bill will place in the hands of the consumer and our businessmen will have both immediate and permanent benefits to our economy. Every dollar released from taxation that is spent or invested will help create a new job and a new salary. And these new jobs and new salaries can create other jobs and other salaries and more customers and more growth for an expanding American economy." John F. Kennedy, Aug. 13, 1962, radio and television report on the state of the national economy "This administration pledged itself last summer to an across-the-board, top-to-bottom cut in personal and corporate income taxes ... Next year's tax bill should reduce personal as well as corporate income taxes, for those in the lower brackets, who are certain to spend their additional take-home pay, and for those in the middle and upper brackets, who can thereby be encouraged to undertake additional efforts and enabled to invest more capital ... I am confident that the enactment of the right bill next year will in due course increase our gross national product by several times the amount of taxes actually cut." John F. Kennedy, Nov. 20, 1962, news conference ---------------------------------------------------------------------------------------------------- References:

|

| 19 January 2010 {Article 72; Politics_12} |