Why It Costs So Much to Go to College

© David Burton 2022

Why It Costs So Much to Go to College© David Burton 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Some ten years ago, I began to call attention to the high costs of a college education. In the decade

since then, the situation has only gotten worse - much worse!

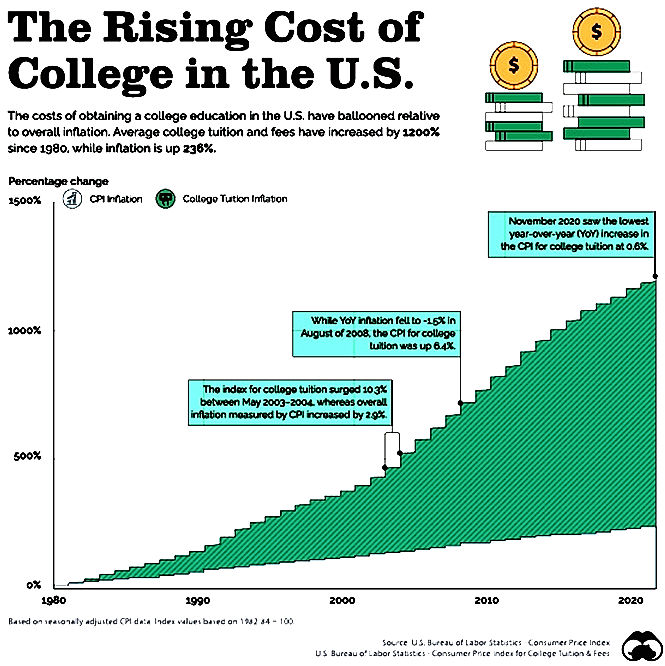

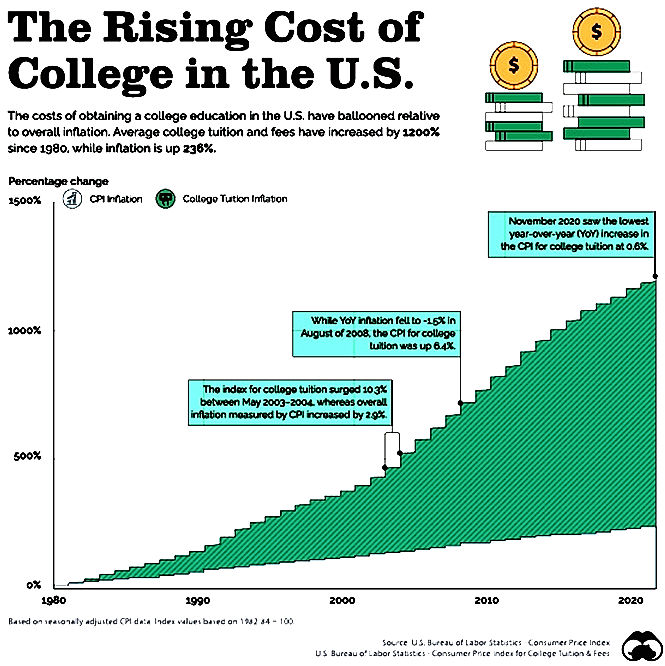

Along with astronomical direct college costs, the cost of borrowing to pay the expenses continues to rise, “Federal student loan interest rates are set to rise for the 2022-23 academic year, following the U.S. Treasury Department’s 10-year note auction. “The new rates will be 4.99 percent for undergraduate loans, 6.54 percent for graduate Direct Unsubsidized Loans and 7.54 percent for PLUS loans. These rates will go into effect on July 1. “Every May, federal student loans are given a new fixed interest rate for the upcoming school year. These rates are calculated by combining the high yield on the 10-year Treasury note with a fixed congressional premium of 2.05 percent. “With this increase, rates will now be the highest they’ve been since the 2018-19 academic year, prior to the COVID-19 pandemic. “Private student loans are also likely to see rate increases throughout the year.” (Ref. 2) Why has a college education become so expensive? One of the major reasons college costs have increased so much is because government funding has not kept pace with the underlying cost of college, shifting the burden of paying for college from the government to the families. That’s especially true following the 2008 financial crisis, as state-level funding never rebounded following the recession. Between 2008 and 2018, 41 states spent less per student. On average, states spent 13% less (about $1,220) per student. Meanwhile, the average tuition in all 50 states increased by an average of 37%. The retail cost of college is largely a reflection of supply and demand. “Over the last three decades, the demographics of college-age children reflect the echo of the baby boomers, a generation for whom the college experience was often life changing.” . . . “A large percentage of that group want their children to have a similar, if not better, experience.” Colleges understand how to market to this parent group and that boomers often equate price with quality. It’s common for colleges to create the illusion of selectivity by building a pipeline of applicants well beyond what they can accept. “That, coupled with use of tuition discounting, allows them to set an artificially high retail price and then offer scholarships - really just discounts - that bring the net price down.” Another reason why college tuition has skyrocketed is that college attendance has steadily increased since the end of World War II, when the federal government made it more affordable for military veterans and average citizens to enroll. As enrollment increased, there was less money available per student. So not only was less aid available to schools, but the dollars don’t go as far as they used to. As a result, colleges have jacked up their prices to support the number of students attending. When many people think of financial aid, they imagine scholarships, grants, and other free aid that doesn’t need to be paid back. However, financial aid also includes low-cost student loans through the federal government. And the increased availability of these loans has also pushed college costs higher. In the 1990s, for example, unsubsidized federal loans were made widely available to students and their families, so schools haven’t been incentivized to keep their tuition prices down. Their students have simply borrowed more and more to defray the costs. “And the wheel just keeps on spinning because these students and their parents continue to believe that a college degree will increase their lifetime earnings considerably over that of peers who didn’t advance past the twelfth grade.” Because colleges receive less funding, they have had to operate more like businesses to stay afloat. That means competing against other schools for the most affluent, qualified students. One of the ways colleges do this is by providing top-tier amenities and services, such as state-of-the-art athletic equipment, palatial dorms, restaurant-quality food options, and more. To afford these upgrades, colleges have had to increase their revenue by raising prices.[1] So, while college education costs keep spiraling upward, the government keeps pouring money into higher education. Politicians from both sides of the isle tell us they are working hard to solve the problem and promise still more funding to address the problem. Obviously, all of this isn’t working. The high cost of a college education has been with us for a long time. In 2012, it was written that “Over the past three decades, college tuition has increased at more than double the rate of inflation. Outstanding student loan debt in the United States now exceeds $1 trillion, a national burden even greater than that of credit cards.” (Ref. 3) And while this was debt for students, it was revenue – and a lot of revenue - for colleges and universities. As bank-robber Willie Sutton exclaimed when asked why he robbed banks, “That’s where the money is.” So it is with college education. Colleges and universities are anything but stupid. They quickly realized that they could make lots more money by enrolling more students, knowing that, a) the federal government would pick up the tab, or b) the federal government would guarantee student loans, i.e., even if the student defaulted on paying back his or her student loan, the federal government would cover the default. In other words, the college or university could not lose. In addition, colleges and universities could raise their prices without fear of pricing themselves out of the marketplace. No matter what they charged, Uncle Sam would pay the bill - one way or another. “Schools know that students have access to tens of billions of dollars in grants and loans, … and they raise tuition because the aid lets them do it.” (Ref. 3) In the case of for-profit colleges, they can opt to either receive federal aid or to refuse it. A Harvard and George Washington University study found that the schools receiving federal grants and loans set their tuition roughly 75 percent higher than those institutions that go without government support.[3] In economics 101, we learn that there is something called price elasticity which regulates supply and demand. As the cost of a good or service rises, the profit rises up to a certain point. Beyond this point, profit falls because the consumer refuses to pay the higher price and the number of customers declines. With higher education, we tend to have no such constraint. As the price of a college education rises, the number of customers (students) has not declined because the government, more-or-less, absorbs the price increase rather than the student – either in the form of outright grants or by lending the money to the student to pay off the cost of college at a later date. If income is effectively guaranteed by the state and federal governments, colleges and universities have little incentive to control costs – they will cover their costs, no matter how high they may be. A college professor, once tenured, is essentially guaranteed lifetime employment, no matter how ineffective or inefficient he/she becomes; the cost of university buildings and classrooms is irrelevant – the more elegant the better; salaries are not necessarily based on the marketplace nor the teaching quality of the individual – a recognized name is often more important than teaching ability. “The presidents of the universities, the senior officials, the key faculty do not get rewarded by being efficient, by teaching more students for the same amount of money or whatever, by using buildings efficiently, six, seven days a week, et cetera. There's no incentive in that for them. “So, there's no great compulsion to reduce costs, and yet spending more money often has rewards. It can help improve your rankings in the magazine rankings like US News or Forbes. And it is actually beneficial to colleges, or at least it's perceived to be beneficial to colleges, to spend more money: nicer facilities for students so you attract more students, better students, whatever, lower teaching loads for faculty so that they're happy and content and not likely to cause a lot of problems. “So the job of a university president is to raise a lot of money, tons of money, and distribute it, and not too much attention is placed on lowering the cost to the consumer.” (Ref. 4) A seemingly unassailable case can be made for the argument that the government is at the root of the problem of the high cost of a college education. The reasoning for this claim is the same as the reasoning that the collapse of the housing market that led to the recession of 2008 was caused by government insistence that everyone, irrespective of financial considerations, had a God-given right to own their own home. The government backed up their insistence by forcing banks and other lending institutions to approve mortgages for many who had no means of repaying the mortgage loans. The same situation exists with respect to a college education. Our government has told the public that everyone is entitled to a college education. Our politicians declare that it’s a national obligation to go to college – irrespective of whether or not that individual is realistically qualified to go to college. At the same time, the government has set up loan and grant programs to ensure that the colleges and university in this country have every incentive to enroll more and more students at ever increasing costs. After all, the government is providing the money, or, at least guaranteeing that loans to students will be repaid. The more students the colleges admit and the more colleges charge, the more money they receive and the greater is their profit. Colleges have no incentive to reduce or contain costs and our college-age youth are repeatedly told by our politicians that they all are entitled to a college education – no matter whether they can afford it; no matter whether they are really qualified for it; and no matter whether they would be better off financially in the long run without the college education. As the 2012 presidential election neared, President Obama made the message clear to all prospective college students when he said, “We’ve got to make sure every young person can afford to go to college.” (Ref. 5) Notice, he didn’t use the adjective qualified. In higher education, the push to give something to everyone by entitlement, whether or not they need it, can afford it, or are qualified for it, has driven up the cost. The high cost of a college education is being driven by entitlement and the lack of true competition and a free market. “IF INSANITY is doing the same thing again and again but expecting a different outcome, then the federal government’s strategy for keeping higher education affordable is crazier than Norman Bates. “For decades, American politicians have waxed passionate on the need to put college within every family’s reach. To ensure that anyone who wants to go to college will be able to foot the bill, Washington has showered hundreds of billions of dollars into student aid of all kinds – grants and loans, subsidized work-study jobs, tax credits, and deductions. Today, that shower has become a monsoon. . . . government outlays intended to hold down the price of a college degree have ballooned, in inflation-adjusted dollars, from $29.6 billion in 1985 to $139.7 billion in 2010.” (Ref. 6) “And what he we gotten for this vast investment in college affordability? Colleges are more unaffordable than ever. “Year in, year out, Washington bestows tuition aid on students and their families. Year in, year out, the cost of tuition surges, galloping well ahead of inflation. And year in, year out, politicians vie to outdo each other in promising still more public subsidies that will keep higher education within reach of all. Does it ever occur to them that there might be cause-and-effect relationship between the skyrocketing aid and the skyrocketing price of a college education? That all those grants and loans and tax credits aren’t containing the fire, but fanning it? [Emphasis mine] “Apparently not. “’We’ve got to make college more affordable for young people,’ President Obama proclaimed during campaign appearances at the universities of Iowa, North Carolina, and Colorado . . .” Apparently, he, along with most other politicians in Washington didn’t get it! “The myth that government can control the price of higher education by driving up the demand for it has broad and bipartisan belief. . . . Rising government aid underwrites rising demand for higher education, and when demand is forced up, prices follow suit.” (Ref. 6) It’s not rocket science, it’s just economics 101! “Federal financial aid is a major source of revenue for colleges and universities . . . That gives schools every incentive to keep their tuition unaffordable. Why would they reduce their sticker price to a level more families could afford, when doing so would mean kissing millions of government dollars goodbye? Directly or indirectly, government loans and grants have led to massive tuition inflation. That has been a boon for colleges and universities, where budgets, payrolls and amenities have grown amazingly lavish. And it has been a boon for politicians, Republicans and Democrats alike, who are happy to exploit anxiety over tuition to win votes. “. . . The more government has done to make higher education affordable, the more unaffordable it has become. More of the same won’t yield a different outcome. By now, even Norman Bates would have figured that out.” [Emphasis mine] (Ref. 6)[7] So here in 2022, it was reported that Boston University (BU) is raising its tuition by 4.25%, which means a whopping bill of $61,050 per year for undergrads. “We are caught in an inflationary vise between the institutional pressures and the impact on our students and their families,” BU President Robert Brown wrote in an end-of-year letter to faculty and staff. Back in 1980, the Harvard Crimson reported that BU’s tuition was heading for a hike. Undergraduate tuition that year was set to soar to a total of $5,515. That $5,515 in 1980 would be $19,349.95 in today’s dollars, a cumulative inflation rate of 250.9%. But today’s students aren’t paying $19,349.95 — they’re due to fork over $61,050. That’s one heck of an inflationary spike! BU is not alone — college tuitions are astronomical. Tufts University estimates the cost for the 2022-23 academic year is $63,804. At Northeastern, the cost for the 2021-22 year is $56,500. A BU spokesman would not say if President Brown and other high-paid staffers would be taking pay cuts. Brown earns $2.1 million annually, according to a recent 990 tax form. Five other faculty members top the $1 million mark. Students should pay a reasonable tuition for a college education — they shouldn’t have to shoulder the inflated salaries of university staff.[8] College costs are out sight because there is no incentive for colleges to reduce costs. Quite the contrary, they have every reason to keep costs high. Most of the reason for this state of affairs originate with the federal government and our politicians. College education costs will remain high as long as college administrators understand they can charge exorbitant fees and not be punished by their customers – you and I – nor by that supposed watchdog – the federal government. As usual, our elected politicians say a lot but do nothing to reduce the cost of college. A decade ago, they mouthed all sorts of platitudes about the high cost of a college education and the urgent need to bring down those costs. Ten years later, college costs have grown exponentially and our elected officials cry crocodile tears over these costs while they continue doing the same thing they have been doing for the past ten years – NOTHING! While we can stew over the exorbitant costs of going to college and complain about our do-nothing elected officials, let’s not forget that it is you and I who are the ones who elect these politicians. Ultimately, it is you and I who are the root cause of high college costs. If we want college cost to come down, then you and I must actually do something to bring down the costs. To start, we need to elect officials who will not just say the right words, but will follow up the right words with the right actions. Maybe the right action with which to begin is to reduce the flow of easy money to colleges and universities. Maybe this will get the attention of these institutions of higher learning and force them to control their costs. As things now stand, they have no incentive to reduce costs. They can charge whatever they want and we have to pay. Even if we can't or don’t, pay, our government will pay for us. So why should our colleges and universities reduce what they charge? They collect no matter What! --------------------------------------------------------------------------------------------------------------------- References:

|

| 4 August 2022 {Article 539; Govt_94} |