| |

My wife and I are retired seniors who live off the following sources of “income”:

Social Security benefits – which we and the companies for which we worked, paid into for some

40 years; pensions from companies for which we worked for some 30 to 40 years; Individual

Retirement Accounts (IRAs) – which we, and the companies for which we worked, paid into for some 30

to 40 years; and investment income from savings that we accumulated for some 50 years. Since we

no longer work, we do not earn an income in the conventional sense of the term “earned income”. Take note of the

fact that our retirement income comes from monies that my wife and I earned and saved and from company

contributions to our pensions, retirement plans, and Social Security. The federal government contributed

to none of them.

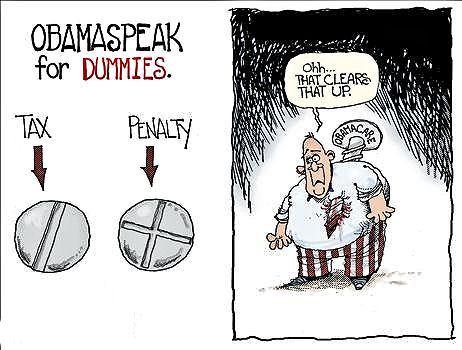

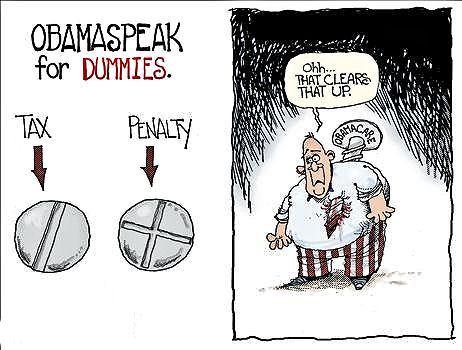

Once again, as a senior citizen, we’ve been hit with another of those “unintended

consequences” of Obamacare that seem to be happening with frightening regularity. We both recently received notices

in the mail from the Social Security Administration that our social security benefits this coming year would be

reduced by nearly $3,000. Why? The answer is that the president and the architects of Obamacare needed to find

some way to pay for the costs of the Patient Protection and Affordable Care Act (PPACA), which is the official

name of Obamacare. One of the ways to raise the needed revenue was to create a non-tax (remember the president

promised no new taxes with Obamacare) that would be imposed on “high-income earners” in addition to the cost of

their normal health insurance. In other worlds, he would “tax the rich” by making “high-income earners” pay

additional amounts into Medicare. This increased Medicare income is being used to help pay for Obamacare in

addition to the $500 billion that Obamacare is taking from Medicare during the first ten years of its

implementation.

In the case of my wife and myself, we became “high-income earners” because we sold our

home of some 45 years in 2014 in order to move into a smaller condominium that would require much less care and

maintenance. Our former old house had a small apartment which we rented out. For the 45 years we lived in our house,

we dutifully reported the portion of the house rented out as rental property on our annual income tax returns.

Upon selling our home, we reported the profit from that portion of the sale apportioned to the apartment as a capital

gain and paid the appropriate capital gains tax. This one time capital gain in 2014 will now make my wife and me

“high-income earners” in 2016 and bump up our Medicare B premiums in 2016 by $3,000.

According to the Social Security Administration, “The law {Obamacare} requires some

people {my wife and I in this case} to pay a higher premium for their Medicare Part B and prescription drug

coverages based on their income.” The Social Security Administration may call the $3,000 reduction in our 2016

Social Security benefits a premium increase, but I call it double taxation. We paid a

capital gains tax based upon the sale of a portion of home in 2014 and we will now be paying an additional

Obamacare tax based upon the same sale in 2016.

This not the first time that we’ve seen our Social Security benefits decrease because

of Obamacare. At the end of 2014, we were notified by the Social Security Administration that our benefits in

the coming year would increase because of a Cost Of Living Adjustment (COLA). BUT, did

we actually receive an increase in Social Security benefits? NO! Why not? In actuality, our

Social Security benefits were reduced because of an increase in our Medicare premiums – again to help fund

Obamacare.

Is the experience of my wife and myself with Obamacare and Medicare the exception?

Apparently not - if you are a senior, consider the following.

“Nearly a third of the roughly 50 million elderly Americans who depend on Medicare for

their physician care and other health services could see their premiums jump by 52 percent or more next year.

That’s because of a quirk in the law that punishes wealthier beneficiaries and others any time the Social Security

Administration fails to boost the annual cost of living adjustment.

“. . . a financial time-bomb of sorts may go off in 2016 because of the festering premium

problem in Medicare Part B – the premium-based government health insurance program that covers seniors’ visits to

doctors and other health care providers, out-patient care and durable medical equipment.

“. . . an estimated 15 million seniors, first-time beneficiaries or those currently

claiming dual Medicare and Medicaid coverage will see their premiums jump from $104.90 per month to $159.30 for

individuals, according to an analysis by the Center for Retirement Research at Boston College. Higher-income

couples would pay multiples of that increase.

“A spokesperson for the Centers on Medicare and Medicaid Services . . . confirmed that

the premium hike is in the works . . . “ (Ref. 1)

On behalf of all senior citizens in these United States of America, I want to thank

President Obama, Congresswoman Nancy Pelosi, Senator Harry Reid and the rest of their legislative colleagues for

presenting us with the gift of this “affordable” white elephant. While there has been a 9% increase in the cost

of living due to inflation since Obamacare went into law in 2009, the Social Security repayments

of the contributions that my wife, myself and the companies for which we worked made to Social Security will have

actually been reduced over that same period of time – entirely due a few of the many “unintended consequences” of

Obamacare.

---------------------------------------------------------------------------------------------

References:

- Millions Facing a Hefty Increase in Medicare Premiums in 2016, Eric Pianin, The Fiscal

Times, 30 August 2015.

|

|