| |

So a temporary budget compromise has been reached and the threat of a credit

default by the U.S has been put off another 4 months. All our fiscal problems are now behind us –

THINK AGAIN! Despite the posturing and chest thumping, nothing has really been settled.

The country’s financial problems have not been resolved. Actually, they have gotten worse. The national

debt has not been reduced. It is getting bigger - that’s why the debt ceiling had to be raised. A

realistic federal budget still has not been agreed to – that’s why sequestration is still in effect

and why the budget compromise is only for 3 months’ duration. The problems have not been solved –

they will come back to haunt us in 3 or 4 months. All the screaming and panic about shutting

down the government and not raising the debt ceiling was nothing but a smokescreen to mask the real

problem – spending and borrowing beyond our means!

The President and the Democratic leadership in Congress had been demanding

that Congress raise the federal debt limit and fund government operations to put an end to the

government shutdown. Republicans had been demanding that spending cuts be made to the budget before

they would agree to raise the debt ceiling and approve a budget. The Democratic administration was/is

blaming the Republicans for the government shutdown and for putting the credit rating of the country

in jeopardy. The President and the Democratic leadership insisted that no compromise was possible –

the Republicans had to first raise the debt ceiling and approve funding of the government to end the

shutdown. Afterwards, the Democrats would consider sitting down to negotiate with the Republicans.

Instead of the politically driven finger-pointing, name-calling, and blame-placing, let’s take a

look at the simple facts concerning the federal budget and the federal debt without getting bogged

down in the contentious issue of who was/is right or wrong in the standoff. The facts are as

follows.

The Gross Domestic Product (GDP) of the United States is $15,684,800,000,000 –

that’s $15.8 trillion. The federal debt is $16,754,723,662,789 (and getting bigger each and every day) -

that’s $16.8 trillion and amounts to 106% of GDP. In other words, what we as a nation owe is

equal to the total of all goods and services that this country produces in a year! In recent

years, the federal debt has been rising at a rate of roughly $1 trillion a year. The population of the

United States is 317 million. That means the federal debt is nearly $53,000 for each and every man,

woman and child in these United States - and that number is increasing by more than $3,000 every

year.

Federal spending in 2013 is projected to amount to $3.7 trillion while federal

revenue, i.e., taxes collected, is estimated to amount to $2.7 trillion. In other words, spending

amounts to 137% of revenue and debt equals more than 6 times annual revenue.

This also means that the federal government is spending $1 trillion more than it is taking in

each year. The interest on the debt is $415,688,781,248 – that’s $0.4 trillion or 15% of

revenue. That means for every dollar collected in taxes, 15 cents of that dollar goes to just

pay off interest on the debt - and much of that goes to China.

It’s hard to comprehend what these astronomical numbers mean. So, let’s put them

in a context that you and I may be able to comprehend. Let’s look at a hypothetical family of four –

spendthrift spouse, fiscally conservative spouse (otherwise known as mom and dad), daughter, and

son. Let’s assume that our family is doing relatively well – mom and dad are holding down good jobs and

their annual gross income is $100,000 - this corresponds to the U.S. tax revenue. Our family likes to live

high off the hog – they are spending $137,000 each year, i.e., 137% of their income - just like our

federal government. To date, our family has run up debt amounting to $620,000 or more than 6 times their

annual income - again, just like our government. The annual payment on their debt - interest only –

is $15,000 or 15% of income - just like the government’s interest payment rates on the national debt. In the

family's case, the lender must really like our family since the interest rate - $15,000 on a principal of

$620,000 – is 2.4%, just like the government. But, unlike the U.S. government, you or I could never

take out a loan with that low an interest rate, especially with the poor credit rating the family would have!

A more realist interest rate for our family’s financial obligations would be on the order of 10% or

higher, meaning their annual interest expenses would be about $62,000 – some 62% of income –

clearly an unsustainable financial burden.

Now we come to an impasse. Spendthrift spouse wants to keep on spending beyond

the family’s means. This means attempting to borrow more and increasing the family’s already sky-high

debt. Unfortunately, there is no rational lender who would lend more money to this family. They are

already in debt beyond their ability to pay back what they have borrowed. Unlike the federal government,

they cannot print more money to pay their bills and they don’t have the AAA credit rating of the U.S.

government to borrow more. In truth, the AAA credit rating of the U.S. government was downgraded

once before and was in danger of being lowered again during the recent government shutdown and debt

ceiling standoff.

Fiscally conservative spouse is insisting that the family’s debt not be

further increased and that spending must be scaled back so that the debt can begin to be reduced.

Spendthrift spouse is furious that fiscally conservative spouse would take such a position and

calls fiscally conservative spouse unreasonable. Spendthrift spouse refuses to make any concessions

and reduce spending and borrowing Spendthrift spouse claims to not understand how fiscally

conservative spouse would want to forego all the benefits that their profligate spending has gotten

them to date and refuse to talk about the reality of their tenuous financial position. Fiscally

conservative spouse is appalled at the thought of putting the family into bankruptcy and of passing

the enormous financial burden the family has incurred upon the shoulders of their two children - but

our fiscally conservative spouse gives in to our spendthrift spouse in order to maintain peace in the family.

Exactly where do you think you or I would be if we tried to live like our

hypothetical family? We’d be in jail or we would have long since gone through bankruptcy proceedings.

Similarly, our country cannot continue down the economic path on which it finds itself. Sooner or later,

the bills will come due! Either we start to pay off those bills now, or our children will have to pay a

much higher bill later. Time is running out.

I should think that the message is clear – you and I, along with our hypothetical

family of four, could never spend and borrow the way our government has been spending and borrowing.

More to the point, our government cannot continue to spend and borrow as it is now doing without ultimately

going bankrupt. You and I will probably never have to pay off that $52,854 for every man, woman and child

that is continually growing, but our children and their children will someday have to pay the piper –

and paying the piper later, rather than now, will be excruciatingly painful.

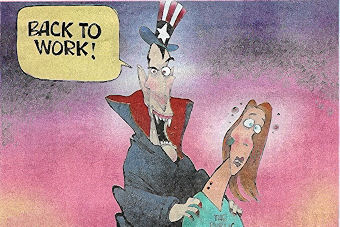

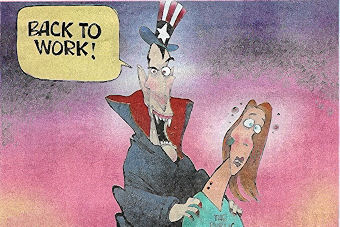

The President can play the demagogue and blame the Tea Party for not passing his

budget and not raising the debt ceiling, but all the Tea party and fiscal conservatives are doing is

warning the American people of the economic disaster facing them and trying to put an end to the

spend-and-borrow cycle that has brought us to the financial situation in which this country finds itself.

Simply raising the nation’s debt ceiling without reducing spending is a recipe for disaster. As the

numbers above show, whether it’s the nation or our hypothetical family, continuing to spend more than

we take in and without reducing our debt is unsustainable. We either face the consequences now and

generate a budget that begins to reduce our debt or we leave a legacy of bankruptcy and economic

disaster to our children. We can either follow the Democratic Pied Piper to rack and ruin and stick our

collective heads in the sand or we can face up to reality, swallow the bitter pills being proposed by

the Tea Party and the Republicans and start to head off the impending doom before it’s too late.

Now is the time to open our eyes to reality instead of the fantasy world being

foisted upon us by the President and the Democratic leaders in Congress. One does not have to be a

financial genius or a rocket scientist to read the writing on the wall. The numbers tell it all.

|

|