| |

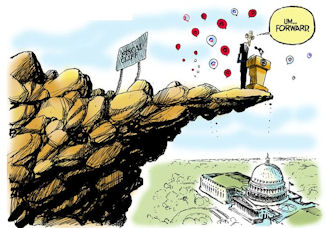

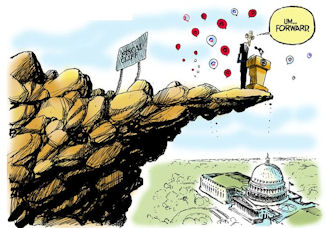

As we come to the end of 2012, we have the President, members of the House of

Representatives and members of the U.S. Senate bickering over who to tax and how much to tax them. All

of this in response to an imminent fall off a “fiscal cliff” at the start of 2013. It’s all a

smoke screen!!! The real issue is not who should pay higher taxes or how much, but how to reduce

our outlandish federal debt and curb the out of control federal spending!!

Yes, we must increase revenues. But, we need look no further than to Greece,

Spain, Italy and those other countries that have spent more than they could afford to see the consequences

of profligate spending. America must be weaned off the entitlement and handout culture that has arisen over

the past decade or two. Our addiction to unlimited government spending without a commensurate increase in

revenues must be put to an end. The reasons we need to increase revenues or taxes are very simple. First,

we have now run up an enormous debt and the interest payments on that debt are becoming intolerable; second,

we are spending well beyond our means. Rising interest payments and profligate spending are the real culprits.

The real solution is not to simply raise tax rates – The rise in tax rates is counterproductive because it

strangles the job-producing economy and, most importantly, raising taxes alone is insufficient to

pay off the debt and cover run-away spending.

Just imagine that you had borrowed $1 million and had to pay interest on the loan

of $100,000 a year and, that you were also spending another $100,000 over and above what you needed for bare

necessities, (for food, basic shelter, medical care, and a minimal allowance for clothing). Let’s

assume that you had income of $200,000 a year, of which you were “taxed” at a rate of 25% to pay off your

loan (principal and interest) and to pay for your spending beyond the “bare necessities”. This means that

you were spending $200,000, but applying only $50,000 to cover these expenses. To fix the problem, you

could increase the amount you applied to cover your expense, equivalent to the government raising tax rates.

But notice, that even if you were “taxed” at 100%, you would only cover interest costs and “excess spending.

You’d have nothing left for “bare necessities.” The real solution is to reduce the “excess spending”

and pay down the debt, while, at the same time, increasing the revenue. Simply increasing revenue

is insufficient.

Let’s look at the facts.

The United States has now run up a deficit of more than $16.2 trillion,

which means that every citizen of the U.S. is now in debt to the tune of over $51,600 and every single

taxpayer in the U.S., rich or poor, owes more than $141,700.

(Ref. 1)

Government outlays were $3.5 trillion in the 2012 fiscal year, and receipts totaled

about $2.45 trillion. This means that our government spent more than a trillion dollars more than it

took in in FY 2012. (Ref. 2)

The U.S. will pay more than $5 trillion in interest payments over the next decade.

Over the next ten years, more than 14% of all revenue the government is projected to collect will be sucked

up by interest payments. Between 2013 and 2022, estimated interest costs will be: higher than Medicaid

spending; equal to half of Social Security spending; close to what is spent on all of defense.

(Ref. 3)

In the year 2011, all federal revenues covered only mandatory spending

and interest on debt. All discretionary spending – defense and non-defense - is borrowed! We

can’t continue to spend like this! The government needs to spend less than it takes in until we get our

debt under control and then we need to get serious about a balanced budget.

Raising taxes on “the rich” won’t Hack it! While the Republicans

have in the past taken a stand that no taxes should ever be increased and that the budget should be balanced

with spending cuts. That won’t fly. The Democrats have argued for increased federal spending and increased

taxes on the very rich. Not only won’t that work, but increasing spending is like pouring gasoline on a fire

in an attempt to extinguish the fire.

What about just raising taxes on the very rich? If our friends in Washington were

to let all of the Bush tax cuts expire at the end of 2012, it would save $3.8 trillion over the next decade.

Letting the tax cuts expire for those making more than $250,000 would save $700 billion. But, $700 billion

over 10 years is only $70 billion a year which is a drop in the bucket and inconsequential in terms of the

trillion-dollar-plus annual deficit that we are currently running. The effect of raising taxes on the very

rich is mainly symbolic and will not solve the problem. Raising taxes on the very rich sounds good in

speeches but won't make a significant dent in the deficit. If taxes need to be raised, then they will

have to be raised on everyone! (Ref. 4) But, the

fundamental problem remains – too much spending and too much debt.

Just where is all this spending going? Most of it goes to four places:

1) Income Redistribution [The Departments of Health and Human Services, HUD, and Agriculture (food stamps)],

2) Social Security, 3) Defense, and 4) Treasury. Treasury spending is mostly debt payments and revenue

collection, which are not likely to be touchable. That leaves Income Redistribution (entitlements),

Social Security and Defense. By far, the biggest drivers of the debt and spending are entitlement

spending and Medicare. We spend three times as much on entitlements as on defense.

(Ref. 5) If spending and debt are to be reduced,

then entitlement spending, along with Medicare spending must be reduced. ObamaCare cannot help but

make the health care spending problem even worse. This is where the focus of avoiding the fiscal

cliff must be centered – not on the peripheral and much less significant issue of who to tax and how

much to tax him/her! The tax issue is nothing but a smoke screen to hide the real problems which are

income redistribution and social security. Our Washington politicians don't want to face these issues!

They need to stop rearranging the deck chairs on the ship of state while it is in danger

of sinking! Our leaders in Washington need to focus, like a laser beam, on two objectives –

1) Reduce the federal debt, and, 2) Reduce federal spending. They need to cowboy up to the unpopular

truth that a major portion of the spending reductions will have to come from entitlements and social

security.

------------------------------------------------------------------------------------------------------

References:

- U.S. Debt Clock, http://www.usdebtclock.org/,

Accessed 13 November 2012.

- Federal Deficit for 2012 Falls to $1.1 Trillion, Annie Lowrey, The New York Times:

Business Day, 12 October 2012.

- Washington's $5 trillion interest bill, Jeanne Sahadi, CNN Money:

http://money.cnn.com/2012/03/05/news/economy/national-debt-interest/index.htm,

12 March 2012.

- GUEST COLUMN: Both Democrats, Republicans have created America's economic crisis,

Harold T. Muir, Heritage.com:

http://www.heritage.com/articles/2012/08/25/opinion/doc5038e6bb22a75624573163.txt,

25 August 2012.

- Entitlements Push Nation Toward Economic Abyss, Bruce Thornton, The Jewish

Press, Page 6, 21 December 2012.

|

|