| |

College Education costs keep spirally upward while the government

keeps pouring money into higher education. Politicians from both sides of the isle tell us

they are working hard to solve the problem and promise still more funding to address the problem.

All of this isn’t working. Why?

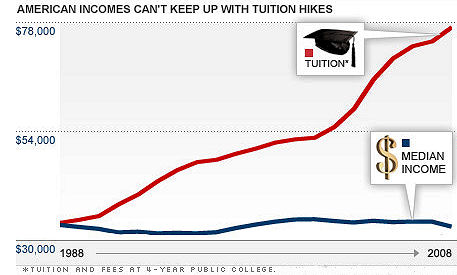

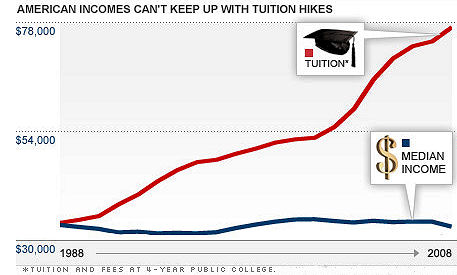

“Over the past three decades, college tuition has increased at more

than double the rate of inflation. Outstanding student loan debt in the United States now exceeds

$1 trillion, a national burden even greater than that of credit cards.”

(Ref. 1) While this is debt for students,

it is revenue for colleges and universities.

As bank-robber Willie Sutton exclaimed when asked why he robbed banks,

“That’s where the money is.” So it is with college education. Colleges and universities are anything

but stupid. They quickly realized that they could make lots more money by enrolling more students,

knowing that a) the federal government would pick up the tab, or b) the federal government would

guarantee student loans, i.e., even if the student defaulted on paying back his or her student loan,

the federal government would cover the default. In other words, the college or university could

not lose. In addition, colleges and universities could raise their prices without fear of pricing

themselves out of the marketplace. No matter what they charged, Uncle Sam would pay the

bill - one way or another. “Schools know that students have access to tens of billions of

dollars in grants and loans, … and they raise tuition because the aid lets them do it.”

(Ref. 1)

In the case of for-profit colleges, they can opt to either receive federal

aid or to refuse it. A Harvard and George Washington University study found that the schools

receiving federal grants and loans set their tuition roughly 75 percent higher than those institutions

that go without government support.” (Ref. 1)

There are multiple ways to rein in the high costs of advanced education.

One step in that direction is for the government and the public to acknowledge that a) not everyone

is qualified for higher education, and b) not everyone needs a college education – it may be

desirable to go to college but it is not absolutely necessary. Another step in that direction is

for the government to award student grants and to guarantee tuition loans on the basis of both

qualification and need, i.e., to provide financial support only to best-and-brightest who are in

real need and not solely on the basis of need.

In economics 101, we learn that there is something called price elasticity

which regulates supply and demand. As the cost of a good or service rises, the profit rises up to a

certain point. Beyond this point, profit falls because the consumer refuses to pay the higher price

and the number of customers declines. With higher education, we tend to have no such constraint.

As the price of a college education rises, the number of customers (students) has not declined

because the government, more-or-less, absorbs the price increase rather than the student – either

in the form of outright grants or by lending the money to the student to pay off the cost of

college at a later date.

If income is effectively guaranteed by the state and federal governments,

colleges and universities have little incentive to control costs – they will cover their costs,

no matter high they may be. A college professor, once tenured, is essentially guaranteed lifetime

employment, no matter how ineffective or inefficient he becomes; the cost of university buildings

and classrooms is irrelevant – the more elegant the better; salaries are not necessarily based on

the marketplace nor the teaching quality of the individual – a recognized name is often more important

than teaching ability.

“The presidents of the universities, the senior officials, the key faculty do

not get rewarded by being efficient, by teaching more students for the same amount of money or whatever,

by using buildings efficiently, six, seven days a week, et cetera. There's no incentive in that for them.

“So, there's no great compulsion to reduce costs, and yet spending more

money often has rewards. It can help improve your rankings in the magazine rankings that go on by

magazines like US News or Forbes. And it is actually beneficial to colleges, or at least it's

perceived to be beneficial to colleges, to spend more money: nicer facilities for students so you

attract more students, better students, whatever, lower teaching loads for faculty so that they're

happy and content and not likely to cause a lot of problems.

“So the job of a university president is to raise a lot of money,

tons of money, and distribute it, and not too much attention is placed on lowering the cost to

the consumer.” (Ref. 2)

A seemingly unassailable case can be made for the argument that the government

is at the root of the problem of the high cost of a college education. The reasoning for this claim is

the same as the reasoning that the collapse of the housing market that led to the recession beginning

in 2008 was caused by government insistence that everyone, irrespective of financial considerations,

had a God-given right to own their own home. The government backed up their insistence by forcing banks

and other lending institutions to approve mortgages for many who had no means of repaying the mortgage

loans. The same situation exists with respect to a college education. Our government has told the public

that everyone is entitled to a college education. Our politicians declare that it’s a national

obligation to go to college – irrespective of whether or not that individual is realistically

qualified to go to college. At the same time, the government has set up loan and grant programs to

ensure that the colleges and university in this country have every incentive to enroll more and more

students at ever increasing costs. After all, the government is providing the money, or, at least

guaranteeing that loans to students will be repaid. The more students the colleges admit and the more

colleges charge, the more money they receive and the greater is their profit. Colleges have no

incentive to reduce or contain costs and our college-age youth are repeatedly told by our politicians

that they all are entitled to a college education – no matter whether they can afford it; no matter

whether they are really qualified for it; and no matter whether they would be better off financially

in the long run without the college education.

As the 2012 presidential election neared, President Obama made the message

clear to all prospective college students when he said, “We’ve got to make sure every young person can

afford to go to college.” (Ref. 3) Notice, he didn’t use the

adjective qualified.

In addition to the issue of whether every person should be entitled to go

to college, there is the question of whether or not it makes financial sense for every person to go to

college. “An Associated Press analysis found that more than half – 53.6 percent – of bachelor’s

degree-holders under the age of 25, either couldn’t find a job, or were underemployed last year.”

(Ref. 3) It was also pointed out in Harvard University’s education

magazine that “even in the 21st century, most jobs do not require a bachelor’s {degree}.”

(Ref. 3) According to the Harvard study, “Thirty percent of new jobs

will only require an ‘associate’s degree or a post-secondary occupational credential.’”

(Ref. 3) In higher education, as in housing and health care,

the push to give something to everyone by entitlement, whether or not they need it, can afford it,

or are qualified for it, has driven up the cost. The cost of a college education is being driven

by entitlement and the lack of true competition and a free market.

“IF INSANITY is doing the same thing again and again but expecting a

different outcome, then the federal government’s strategy for keeping higher education affordable

is crazier than Norman Bates.

“For decades, American politicians have waxed passionate on the need to put

college within every family’s reach. To ensure that anyone who wants to go to college will be able to

foot the bill, Washington has showered hundreds of billions of dollars into student aid of all

kinds – grants and loans, subsidized work-study jobs, tax credits, and deductions. Today, that shower

has become a monsoon. . . . government outlays intended to hold down the price of a college degree

have ballooned, in inflation-adjusted dollars, from $29.6 billion in 1985 to $139.7 billion in 2010.”

(Ref. 4)

“And what he we gotten for this vast investment in college affordability?

Colleges are more unaffordable than ever.

“Year in, year out, Washington bestows tuition aid on students and their

families. Year in, year out, the cost of tuition surges, galloping well ahead of inflation.

And year in, year out, politicians vie to outdo each other in promising still more public subsidies

that will keep higher education within reach of all. Does it ever occur to them that there

might be cause-and-effect relationship between the skyrocketing aid and the skyrocketing price of a

college education? That all those grants and loans and tax credits aren’t containing the fire,

but fanning it? [Emphasis mine]

“Apparently not.

“’We’ve got to make college more affordable for young people,’ President

Obama proclaimed during campaign appearances at the universities of Iowa, North Carolina, and

Colorado last week.” Apparently, he, along with most other politicians in Washington don’t get it!

“The myth that government can control the price of higher education by driving up the demand for it

has broad and bipartisan belief. . . . Rising government aid underwrites rising demand for higher

education, and when demand is forced up, prices follow suit.” (Ref. 4)

It’s not rocket science, it’s just economics 101, stupid!

“Federal financial aid is a major source of revenue for colleges and universities

. . . That gives schools every incentive to keep their tuition unaffordable. Why would they reduce their

sticker price to a level more families could afford, when doing so would mean kissing millions of government

dollars goodbye? Directly or indirectly, government loans and grants have led to massive tuition inflation.

That has been a boon for colleges and universities, where budgets, payrolls and amenities have grown

amazingly lavish. And it has been a boon for politicians, Republicans and Democrats alike, who are happy

to exploit anxiety over tuition to win votes.

“. . . The more government has done to make higher education affordable,

the more unaffordable it has become. More of the same won’t yield a different outcome. By now, even

Norman Bates would have figured that out.” [Emphasis mine]

(Ref. 4)

There may be another, more significant, unintended consequence of the

government pouring money into our higher education system. We are told that American students no

longer are the best and the brightest in the world. Could this be because our universities take

in many less-qualified students and keep them enrolled in order to ensure that they receive the

government monies being used to send them to college? If a college took in only the top 10% of candidates,

they could teach at the level of the top 10%. On the other hand if they take in the top 50%, then they

must teach at the level of those at the bottom of the range to keep the poorer students from flunking out,

which would mean that the college would lose the funding that these poorer students (with government funding)

contribute. So, to keep the money rolling in, educational standards have to be lowered. Only the most

elite of colleges can survive on reputation, the rest need lots of money and, consequently, that requires

lower educational standards!

------------------------------------------------------------------------------------------------------

References:

- Why is college so expensive, Paul Kix, Boston Sunday Globe,

Pages K1 and K3, 25 March 2012.

- Does A College Education Have To Cost So Much?, Talk of the Nation,

NPR Radio, http://www.npr.org/11/12/14/143718677/does-a-college-education-have-to-cost-so-much,

14 December 2011 (Accessed 26 March 12).

- Commonsense lesson for college students, Cal Thomas, Boston Herald,

Page 11, 5 May 2012.

- The government’s college money pit, Jeff Jacoby, The Boston Globe,

Page K9, 29 April 2012.

|

|