| |

Mr. President, you said that you were going to reduce the deficit.

“President Barack Obama continued to promote Democratic proposals to reform health care

during his {2010} State of the Union address. He rebutted charges that it costs too much and pointed out that

budget experts believe it could reduce the deficit.

“‘It would reduce costs and premiums for millions of families and businesses,’ Obama

said. ‘And according to the Congressional Budget Office – the independent organization that both parties have

cited as the official scorekeeper for Congress – our approach would bring down the deficit by as much as $1

trillion over the next two decades.’“ (Ref. 1)

Mr. President, based upon the current spending policies of you and the Democratic

controlled Congress, I seriously doubt that you will succeed in reducing the deficit. Maybe the President is

correct, but he’s only telling half the truth. What he fails to mention is that the plan to reduce the deficit

includes new taxes in addition to the so-called “cost-savings measures” in the plan. The Congressional Budget

Office (CBO) has estimated that Obama’s health care program will cost $216 billion by 2019 and then increase by

8% every year thereafter. The CBO also said that government will have to spend an additional $115 billion to

bring the cost to over $1 trillion. Unfortunately, every government controlled entitlement program has

grown to cost far more than even the most pessimistic prededictions. Obama’s promise that his health care plan

would ameliorate medical costs (and help to control the federal deficit) would “be the first time in the nation’s

history when government promises of cost containment are accurate.” . . . “If history is any judge,

the 10-year cost estimate of $1.3 trillion {for ObamaCare} will be twice or three times that.”

(Ref. 2)

“President Obama's overhaul of the health-care system has done little to improve the

nation's fiscal outlook, and his pledge to extend an array of tax cuts for the middle class would only make things

worse, congressional budget analysts said Wednesday.

“In its latest long-term forecast, the nonpartisan Congressional Budget Office predicted

that the national debt, which has surged to nearly 60 percent of annual economic output in the wake of the

recession, would continue rising in the coming decades despite cost-containment measures in the health overhaul

Obama signed this spring. (Ref. 3)

"‘Growth in spending on health-care programs remains the central fiscal challenge,’ CBO Director Douglas W.

Elmendorf said in a presentation to Obama's bipartisan deficit commission. ‘In CBO's judgment, the health-care

legislation enacted earlier this year made a dent in the problem, but did not substantially diminish that

challenge.’“ (Ref. 3)

Let’s take a look at some of the implications of the President’s attempts to reduce the

deficit while he and the Democrats show no restraint in their spending practices that have caused the federal

deficit to spiral up out of control.

The top long term capital gains tax rate is set to rise from 15% to 20% on Jan. 1, 2011,

when the Bush tax cuts expire. . . . Unless Congress acts, dividends in 2011 will be taxed as ordinary income at a

top 39.6% plus 1.2% rate.” (Ref. 4)

“Fed boss Ben. S. Bernanke likes to print money. Eventually we will pay for this with

inflation, higher interest rates and lower bond prices.”

(Ref. 4) All of these attempts to raise more income for the

federal government will adversely impact not just the rich (who can afford lawyers and accountants to figure out

ways to shield their incomes from the IRS) but also retirees like me who live on fixed incomes.

“Washington will spend $31,406 per household in 2010 – the highest level in American

history (adjusted for inflation). It will collect $18,276 per household in taxes. The remaining $13,130 represents

this year’s staggering budget deficit per household, which, along with all prior government debt, will be dumped

in the laps of our children.” (Ref. 5) Mr. President, is

this what you consider deficit reduction?

Mr. President, you said that that the debate over health care would be open and

transparent.

Mr. President, when campaigning for the presidency, you promised at least six times that

the development of a comprehensive health care reform plan would be an open and transparent process.

Instead, the American people received a flood of falsehoods, misrepresentations and

out-and-out lies and were presented with a “Teetering tower of unkept promises.”

(Ref. 6) The public has been sickened by the “Cornhusker Kickback”,

the “Louisiana Purchase”, the “Gator Aid”, and all the other special deals that were promised to a handful of

senators as a way of securing their votes. But as ugly as all this was -- as distasteful as all these deals have

been -- they were child's play compared to the scheme that Democrats cooked to get this bill over to the White

House for a signature. Americans have witnessed corrupt backroom deals to buy votes, parliamentary end-arounds,

accounting legerdemain, and finally an obscure parliamentary gimmick worthy of Niccolo Machiavelli that has

allowed members of the House to approve the Senate version of the health care bill without actually voting on

it – “deem and pass” the ultimate backroom deal! Mr. President, was this what you meant by

an "open and transparent process"?

President Obama, you promised the American people an open and transparent process and a

bipartisan approach to developing a health care reform. The American people received

neither. Instead, they have seen the Democrats develop their health care monstrosity behind closed

doors in a go-it-alone partisan process and then ram it through in spite of the opposition of the American

people.

Mr. President, you said that your health care plan would not increase health care costs to the average

American.

“Employer health care costs . . . were expected to rise 7% this year, according to

benefits consultant Towers Watson. But that was the number before ObamaCare, which will require employers to cover

dependents until they’re 26 and eliminated lifetime caps on reimbursement. . . . A 2.3% excise tax on defibrillators

and other medical devices will add $2 billion a year to the national health care bill, beginning in 2013.

“One potential perverse effect of the law . . . is that insurers might have less incentive

to drive down reimbursement rates to hospitals and doctors because that might push their administrative expenses

above the ObamaCare cap of 15% of total costs.” (Ref. 7)

One report notes that when a $14.3 billion annual tax on health insurance goes into effect

in 2014, the cost of job-based private coverage for an average family of 4 will increase by $1,000 a

year.

Mr. President, you said that if we liked our health care insurance, we could keep it.

In April, 2010, The Center for Medicare and Medicaid Services (CMS) reported that

about 14 million people now covered through their jobs will lose their insurance and be forced

into the new exchanges. In addition, about 15% of seniors with Medicare Advantage will be forced out of

the program because of cuts in Medicare.

President Obama, you repeatedly assured Americans that your health care reform “would

retain a variety of health care choices” and would allow us to retain our existing plans, physicians and would

not increase our health care insurance costs. “As the Obama administration begins to enact the new national health

care law, the country’s biggest {health care} insurers are promoting affordable plans with reduced premiums that

require participants to use a narrower selection of doctors or hospitals.”

[emphasis mine] “More Americans will be asked to pay higher prices for the privilege of keeping

their own doctors [Emphasis mine] if they are outside the new {health care} networks.”

(Ref. 8)

Government actuaries predict that cuts to the Medicare program “will force out of

Medicare Advantage half of the seniors currently enjoying it. Congress can pass feel-good phrases like ‘guaranteed

benefits,’ but if doctors and other providers no longer participate in the program, the words are meaningless.”

(Ref. 9)

Mr. President, you said that under your health insurance plan, we could chose and keep our

doctors.

Mr. President, under your health care plan, the existing supply of primary care

physicians will be unable to keep up with the increased demand caused by millions of newly covered patients.

In recent years, the U.S. has had a growing shortage of physicians and this will only worsen under ObamaCare.

Under your plan, doctor workload will increase while reimbursement rates are cut. Work more for

less won’t attract more health care workers nor increase the quality of care. Medicare payment cuts

are predicted to induce about 20% of participating doctors and other providers to cease serving Medicare patients,

and, there is already a shortage of Medicare providers.

“The exodus of Doctors from Medicare and likely from private practice altogether is

accelerating.

“The signs are undeniable: A 2008 poll by an independent Medicare commission found that

28 percent of seniors had trouble finding a primary care doctor, up from 24 percent the year before.”

(Ref. 10)

“The American osteopathic Association found only about 40 percent of physicians say they

will be able to continue seeing their current Medicare patients if the cuts occur.” . . . “Doctors also fear the

barrage of new rules and regulation. They must invest in federally approved info-tech to get paid by the

government. More paperwork – with resulting clerical expenses – will be required to prove they are following

government performance standards that many disparage as ‘cookbook medicine’” . . . “The immediate problem is

more physicians are dropping Medicare now.” (Ref. 10)

“The American Medical Association acknowledges that without significant changes to

Medicare payments, many doctors will no longer participate in the program.” . . . “The problem with

2,000-page bills that completely overhaul our health care system is the many unintended consequences.”

[Emphasis mine] (Ref. 11)

Mr. President, you said that you would create jobs and reduce unemployment.

“Mr. Obama told Americans that if it {his stimulus plan} were passed, unemployment

wouldn't rise above 8%. It is now {early in 2010} 10%. The president also said it would create 3.7 million

jobs, 90% of which would be in the private sector.” (Ref. 12)

In reality, the actual employment rate is estimated to be closer to 15% since many unemployed are not reported

and there are other part time workers that cannot find full-time employment.

“The United States Labor Department Report of May 2010” stated that unemployment was

“down from April’s 9.9% rate to 9.7%.” It further stated “that 431,000 jobs were created.” But, only 41,000 of

these were private sector jobs and the other 390,000 new jobs were “government jobs paid for by stimulus money.”

Many of the government jobs were only temporary and “were added mostly to help complete the 2010 United States

Census. So the news doesn’t contribute any sustaining help to the economy.”

(Ref. 12) Mr. President, where are those private sector jobs

that you promised?

Mr. President, you said that you would help people avoid foreclosure on their homes.

Mr. President, your “flagship effort to help people in danger of losing their homes is

falling flat.

“More than a third of the 12.4 million borrowers who have enrolled in the $75 billion

mortgage modification program have dropped out.” (Ref. 13)

“A major reason so many have fallen out of the program is the Obama administration

initially pressured banks to sign up borrowers without insisting first on proof of their income. When banks later

moved to collect the information, many troubled homeowners were disqualified or dropped out.”

(Ref. 13)

It seems like this is a repeat of the problem that caused the initial collapse of the

housing market that was induced by the social policies of President Clinton and Senator Barney Frank. Do Democrats

never learn?

Mr. President, you said that you wouldn’t raise taxes on the middle class.

Mr. President, I am a retired senior and much of my income these days comes from dividends

and interest from retirement funds that are invested in mutual funds and bonds. I consider myself a member of the

middle class with an annual income of under $100,000. My taxes are going up.

“If you are a prosperous saver, the federal tax rate on your dividends is about to

triple.” . . . “Congress has decided to bail out deadbeats and condo flippers, and to finance this generosity by

taxing marriage, work and savings.” . . . “Come next January the favorable 15% rate on dividends will expire,

making them subject to taxation as ‘ordinary income.’ At the same time the maximum rate is kicking up from 35%

to 39.6%. The third thing that will happen in 2011 is the resurrection of a rule that ostensibly limits deductions

but for the majority of taxpayers is nothing but a boost in their tax bracket. This rule adds 1.2 percentage

points to your rate.” . . . “In 2013 comes a fourth tax increase: a 3.8% surtax on investment income. Add it up.

Dividends that used to be taxed at 15% are set to be taxed at 44.6%.”

(Ref. 14) Mr. President, you lied to me and to all the other

seniors who depend on fixed incomes from dividends and interest.

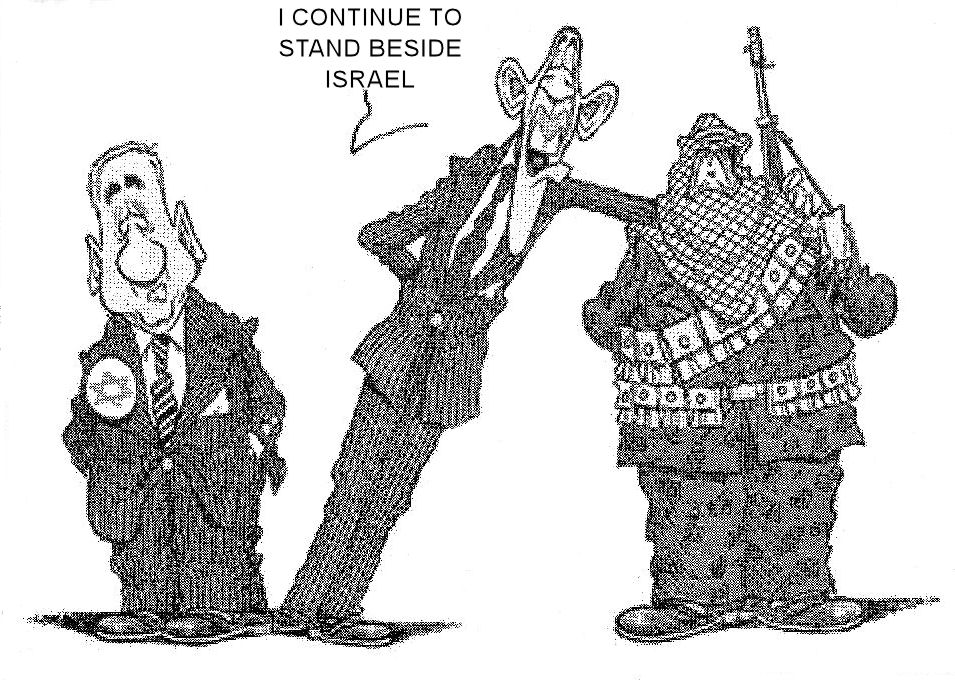

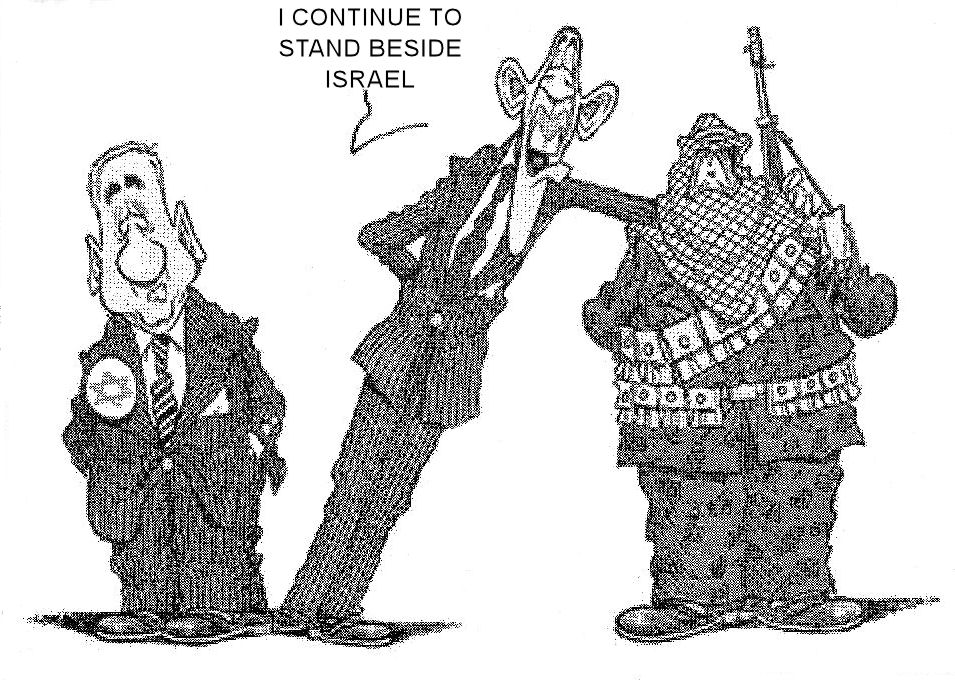

Mr. President, you have repeatedly said that you are a staunch ally of Israel.

Mr. President, if you are such a staunch ally of “the only fully functioning democracy in

the Middle East”, why does your behavior and that of your administration resemble “the behavior of an enemy”? Under

your administration, “America’s policy toward Israel is full of ‘harmful designs’ and ‘antagonistic activities.’”

(Ref. 15)

“A Washington Post headline illustrates the deteriorating relationship between the two

nations, ‘U.S. Pushes Netanyahu to Accept 3 Demands.’ There is no similar demand that the Palestinians and

especially Hamas, which has said it will agree to nothing less than the eradication of Israel, should accept

anything, not even the minimal acceptance of Israel’s right to exist. Meanwhile, Hamas has called on Palestinians

to launch a third ‘intifada’.” (Ref. 15)

Mr. President, you said that Jerusalem should remain an undivided city.

On June 4, 2008, as a candidate, you spoke to the AIPAC convention and called “for

an ‘undivided Jerusalem’ but then recant{ed} that view the very next day, saying Jerusalem had to be

negotiated.” (Ref. 16)

--------------------------------------------------------------------------------------------------

References:

- Health care reform "would bring down the deficit by as much as $1 trillion over the next two decades.",

Barack Obama, on Wednesday, January 27th, 2010 in a State of the Union speech,

PolitiFact.com, St. Petersburg Times;

http://www.politifact.com/truth-o-meter/statements/2010/feb/01/barack-obama/health-care-reform-estimates-deficit-reduction-are/,

Accessed on 5 July 2010.

- Rap on insurers ignores facts, Dan K. Thomasson, Boston Herald, Page 15,

13 March 2010.

- CBO tells Obama deficit panel that forecast remains bleak, Lori Montgomery,

Washington Post, 1 July 2010.

- Deficit Moves, Brian Winfield, Forbes, Page 40, 19 July 2010.

- $18K per household can’t cover feds’ cost, Brian Riedl, Boston Herald, Page 19,

13 April 2010.

- Plagued by dependency, George F. Will, Boston Herald, Page 15, 23 March 2010.

- Where Inflation Lurks, Daniel Fisher, Forbes, Page 28, 19 July 2010.

- Insurers hawk plans with less choice, Reed Abelson, Boston Sunday Globe, Page A10,

18 July 2010.

- Health Law Impact, Representative Eric Cantor, AARP Bulletin, Page 43,

July-August 2010.

- Just what doc didn’t order, Grace-Marie Turner, Boston Herald, Page 19,

20 March 2010.

- Obama Versus Bush on Spending, Karl Rove, Wall Street Journal, 21 January 2010.

- Government, jobs, God, and taxes, Peter Larocque, The Valley Patriot, Page 10,

July - 2010.

- 436,000 exit president’s loan aid program?, Associated Press, Boston Herald,

Page 27, 22 June 2010.

- They’re Clipping Your Dividends, William Baldwin, Forbes, Page 10, 26 April 2010.

- U.S. a fickle friend to Israel, Cal Thomas, Boston Herald, Page 13, 20 March 2010.

- Obama’s Hostility To Israel – Why the Surprise?, Morton A. Klein, The Jewish Press,

Page 7, 4 June 2010.

|

|