| |

“The U.S. government’s budget deficit through February {of 2021} hit an all-time high of

$1.05 trillion for the first five months of this budget year, as spending to deal with the coronavirus pandemic surged at

a pace far above an increase in tax revenue. [Emphasis mine]

“The Treasury department reported Wednesday {10 March 2021} that the October through February

deficit was 68% larger than the $624.5 billion deficit recorded during the same period last year.

“It easily surpassed the previous five-month deficit of $652 billion set in 2010 when the government

was spending to try to lift the country out of the deep recession caused by the 2008 financial crisis.

“The congressional Budget Office has projected that the deficit for the budget year that

ends Sept. 30 will be $2.3 trillion. however, that estimate does not include the cost of president Biden’s $1.9 trillion

cOVid relief measure . . . [Emphasis mine] (Ref. 1)

“America’s federal debt is set to exceed the size of the entire U.S. economy this year for

only the second time since the end of World War II, [Emphasis mine] a reflection of the extraordinary emergency

measures approved by Congress in response to the coronavirus pandemic, the nonpartisan Congressional Budget Office said {in

early February 2021.}

“The remarkable surge in federal borrowing is due largely to the more than $4 trillion in spending

approved by the federal government to fight the pandemic since March {2020}. As a result, the federal government’s

debt burden will - in 2021 - be larger than the size of the total U.S. gross domestic product — a measure of all the goods

and services in the economy, [Emphasis mine] according to the CBO. 2020 was the first time this had occurred since

1946, when the country was fresh out of the Second World War.

“{As of February 2021,} Democratic lawmakers and many economists {said} another spending blitz {was}

necessary to stabilize an economy that {had} stalled out and a job market that {faced} the prospect of permanent scarring.

{The} Federal Reserve Chair . . . said the unemployment rate for January should be considered closer to 10 percent, rather

than the official number of 6.3 percent, due to misclassification errors and workers permanently leaving the labor force.

“But Republican lawmakers and deficit hawks {warned} that such unprecedented levels of peacetime

spending {threatened} a risk to the economy. A sudden surge in inflation - not currently considered likely or imminent -

could force the Federal Reserve to raise interest rates, which would in turn dramatically increase the costs of U.S. borrowing.

The central bank has vowed to keep interest rates low.

“The CBO’s debt estimates {in mid-February 2021 were} based on {then-}current policy and {did} not

account for the $1.9 trillion stimulus package Democrats {were} expected to pass in a matter of weeks.

“ ‘It’s pretty horrific. The trouble is it’s high and escalating and on an unsustainable trajectory,’

{said a former} director of the CBO and . . . chief economist to Sen. John McCain (R-Ariz.) . . . of the debt figures. ‘World

financial markets will at some point lose their faith in the ability of the U.S. to make the numbers add up, and they will

either cut us off entirely or charge prohibitively high rates.’

“Democrats {were} expected to press forward with their relief package despite the federal debt.

America’s economic recovery from the coronavirus {had} sputtered as the pandemic {raged} across the country this winter.

Alarmingly, job growth in the United States {had} all but stalled out, even as about half of the 22 million jobs lost during

the crisis {had} returned.

“President Biden’s relief package would devote hundreds of billions of dollars to the U.S. response

to the public health crisis, including vaccine distribution; another round of stimulus payments for millions of American

households; extended unemployment benefits through August {2021}; and spending for schools and local governments. Biden . . .

frequently downplayed the potential danger of spending too much, and White House officials . . . pointed to a range of Wall

Street analysts who have said more spending is necessary.

“Additionally, inflation . . . remained firmly in check, and the central bank . . . signaled it would

not hike rates even with modest price increases. . . {Inflation} ‘has been much lower and more stable over the past three

decades’ than it had before.

“ ‘The biggest risk is not going too big, if we go - it’s if we go too small,’ Biden said . . .

- - -

Yet {a} former Obama administration economic adviser . . . penned a column in The Washington Post

warning that another big stimulus package would bring some risk of setting off inflation.

“ ‘There is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal

recession levels will set off inflationary pressures of a kind we have not seen in a generation, with consequences for the

value of the dollar and financial stability,’ he wrote.

“When asked about {the} column, {a} White House senior economist denied that the administration was

dismissing inflationary risks but said: ‘This is risk management. This is balancing risks. And in our view, the risks of doing

too little are far greater than the risks of doing too much.’

“To be sure, even the CBO has warned about the challenges in their projections. Its debt and deficit

projections could worsen significantly if the pandemic or new coronavirus variants continue to wreak havoc on the American

economy. {BUT, the} CBO projects that higher levels of vaccinations will dramatically reduce the number of coronavirus

cases, with economic growth quickly returning to pre-pandemic levels by as soon as the middle of 2021.

[Emphasis mine]

“Even under this relatively rosy scenario, the CBO projects the national debt is now on

pace to grow to 107 percent of the GDP by 2031 — which would be an all-time high in American history.

[Emphasis mine]

- - -

“Other budget experts point out that tackling the federal deficit requires more structural reforms

to the nation’s economy, such as its low federal tax rates and projected increases in spending on Medicare and Social

Security.

“The United States is projected to hold about $21 trillion in debt in 2021, and that number is

expected to increase to $32 trillion by 2030. A $1.9 trillion stimulus bill represents a fraction of that increase, although

White House officials have also discussed trying to approve a multitrillion-dollar infrastructure package later this year.

The CBO projections also assume the expiration of numerous provisions of the 2017 GOP tax law aimed at the lower and middle

class by the middle of this decade.

“{A} senior vice president at the Committee for a Responsible Federal Budget, which pushes for

deficit reduction, said lawmakers face a long-term challenge in getting spending and deficit levels to balance. That is not

something that hinges on the precise size of Biden’s stimulus package . . .

“ ‘Even without the $1.9 trillion, we will be at record-high debt levels’ in a few years, he said.

‘Realistically, it’s going to come much sooner than that.’ (Ref. 2)

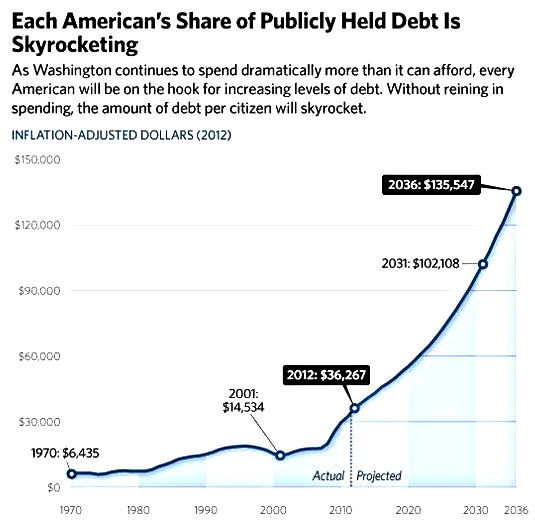

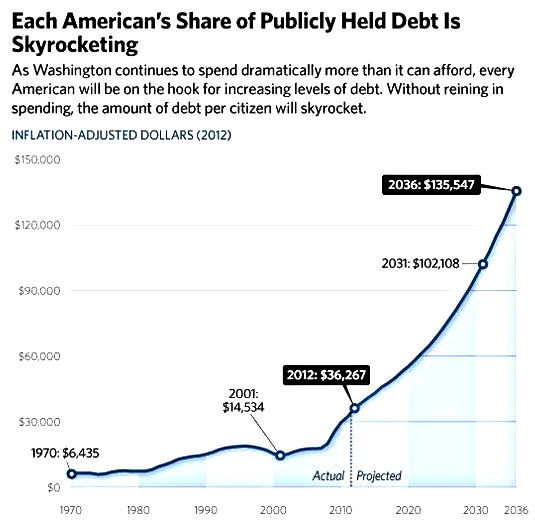

America needs to get ready to pay off the federal debt at some point down the road when the bill we

have run up comes due. You and I may not have to pay the bill, but our children, their children and/or some future

generation(s) will - one way or another. Borrowing without repaying simply cannot go on forever. The question is not whether

a future generation will have to pay the bill, but rather: which generation(s) will have to pay the bill, how much will

they have to pay, over what period of time will the payments be made, and how will the payments be made?

Over the past 15 years, Congress has made several attempts to lower the national debt but hasn't

been able to reduce the growth of what we owe. Since these attempts didn't work, what can and should be done?

Most creditors don’t worry about a nation's debt until it's more than 77% of gross domestic product

(GDP) - that's the point at which added debt cuts into annual economic growth, according to the World Bank.

In the second quarter of 2020, the U.S. debt-to-GDP ratio was a record

135.64%.

So what's stopping the United States from eliminating its debt? There are three main reasons

why:

First - U.S. economic growth has historically outpaced its debt. For example, the U.S. debt was

$258.68 billion in Aug. 1945 but the economy outgrew that in less than three years. By 1960, the GDP more than doubled.

Congress believes that today's debt will be dwarfed by tomorrow's economic growth.

Second - Congressional representatives have a lot to lose by cutting spending. For example, if

elected officials cut Social Security or Medicare benefits, they could lose their next election.

Third - Raising taxes can be politically unpopular. For example, experts believe President

George H.W. Bush lost re-election because he raised taxes after promising he wouldn't raise taxes at the 1988 Republican

convention. He raised taxes in 1990 to reduce the deficit, and voters remembered.

Congress suspended the debt limit until after the 2020 presidential election. It wanted to avoid a

repeat of the 2011 and 2013 debt crises that hampered Congress during an election year.

There are four ways the United States can pay off its debt. In most discussions about paying off

debt, there are two main themes: cutting spending and raising taxes. There are other options that may not enter most

conversations but can aid in debt reduction.

Cut Spending: The 2010 bipartisan Simpson-Bowles report is a good example

of how the government could cut spending to reduce debt. The report proposed balancing the budget through a mix of spending

cuts and tax reform. Though Congress didn't adopt the complete plan, the government implemented parts of it with some success.

However, a 2015 report from the Committee for a Responsible Federal Budget indicated that, while a piecemeal approach reduced

debt, full-fledged adoption of the Simpson-Bowles plan might have produced a significantly lower debt-to-GDP ratio.

Raise Taxes: Raising taxes can generate revenue the government can use to

pay down debt. However, if the government raises taxes too high, it can cut into tax revenue and hurt the economy. Finding

that tipping point is a conundrum expressed by a concept known as the "Laffer Curve." But even though tax cuts are tricky,

they proved successful in the mid-1920s, the mid-1960s, and the early 1980s.

Grow the Economy Faster Than the Debt: Increasing the GDP has a two-fold

benefit: it generates extra revenue to pay down debt and it reduces the debt-to-GDP ratio if GDP growth outpaces debt growth.

Therefore, driving economic growth is one way to reduce debt. However, Congress tends to disagree on how to create that

growth. Most Democrats push increased spending, while most Republicans champion lower taxes.

Shift Spending: Congress could shift spending from defense and entitlement

programs to job-creation areas like infrastructure and education. In the case of military spending, almost 15% of the

federal spending goes to the military. Yet past studies indicate that the money spent on the military is less effective in

creating

jobs as money spent in other areas. For example, education and mass transit spending could produce more than four times the

jobs created by military spending. In many cases, job creation can help boost the GDP, which can help lower the nation's

debt-to-GDP ratio. The impact of shifting spending from entitlement programs would be even greater since spending on

entitlements is significantly greater than military spending.

The bottom line is: Federal debt is at its highest point in American history; cutting

spending and

raising taxes can help reduce debt but jeopardize elected officials' popularity; raising taxes and cutting spending are the

two most popular solutions for reducing debt; driving up the GDP can help reduce the debt-to-GDP ratio; and, diverting

spending from non-productive areas of the budget to other sectors of the budget can boost job growth, help the economy and

ultimately help in reducing the federal debt.[3]

While many would focus their cost-cutting efforts on defense spending, they would be ill-advised

in doing so. Cutting spending on entitlement or social programs would be much more sensible! – But it would be much less

popular! Back in 2013, 19% of the budget paid for defense and security-related international activities. But, 24%

of the budget paid for Social Security, while about 12% of the federal budget supported programs that provide aid (other

than health insurance or Social Security benefits) to individuals and families facing hardship. Another 6% of the budget

went to interest payments. The remaining fifth of federal spending went to support a wide variety of other public services.

These include providing health care and other benefits to veterans and retirement benefits to retired federal employees,

assuring safe food and drugs, protecting the environment, and investing in education, scientific and medical research,

and basic infrastructure such as roads, bridges, and airports.

Note that in 2013 a full 58% of the federal budget went to social programs and debt service,

i.e., Social Security, Medicare, Medicaid, Children’s Health Insurance Program, safety net programs, and interest on the debt,

while only 19% of the budget paid for defense and security-related international activities.[4] By 2017,

Defense spending as a percentage of the budget had declined to 15% while social program spending had gone

up.[5] Did threats to America’s security decrease between 2013 and 2017? Have America’s defense

needs decreased between 2013 and now?

Here in America, we have an economic transformation going on. “The Biden administration promises

to help the middle class by handing out trillions of dollars of free money to citizens and paying people more money for not

working than working. We will borrow trillions of dollars and pray that the Chinese continue to buy up our bonds and that

our currency holds up. . .

“{As a first step toward deficit reduction, a} sock-it-to-the-rich tax increase is coming that will

make the productive class and the job creators pay their ‘fair share’ with tax rates of 50%, 60% and 70%.

“Will this story have a happy ending?

“The answer to that question might be contained in the frightening example of what happened in

Chile. (Ref. 6)

“Back in the 1970s, the nation of Chile embarked on one of the boldest sets of free market economic

reforms in history. The government called in the Chicago Boys, as they were called, led by Milton Friedman and other University

of Chicago free market economists.

“They were given a free hand to redesign the Chilean economic system with property rights, a low

flat tax, privatization of the Social Security system and industry deregulation. In 1991, Friedman wrote that Chile now ‘has

all three things: political freedom, human freedom and economic freedom. Chile will continue to be an interesting experiment

to watch to see whether it can keep all three.’

“For four decades, the experiment worked better than anyone could have imagined.

[Emphasis mine] According to a study by economist Axel Kaiser for the Cato Institute: ‘Between 1975 and 2015 per capita income

in Chile quadrupled to $23,000, the highest rate in Latin America. As a result, from the early 1980s to 2014 poverty fell from

45% to 8%.’ Chile became one of the wealthiest nations in South America. And it happened in three decades, an eye blink of

history.

“The Marxists and intellectual class of Latin America always hated the free market reforms. They

disparaged the Chicago Boys as ‘fascists.’ They spent decades attacking the policies (with the stooges in the American media

echoing their protests), even as Chile became the jewel of South America.

“The Marxists invented a narrative of ‘inequality’: ‘The rich were getting richer, and the poor were

getting poorer, and capitalism is evil.’

“They infiltrated all of Chile’s cultural institutions: the media, the schools, the universities,

the Catholic Church, the arts, the unions and even the corporate boardrooms. They spread their poisonous creed of collectivism

to the populace.

“Is any of this sounding familiar to our situation today?

“Eventually, the leftists pulled off a political coup. In 2013, the left won the Chilean presidency.

The free market reforms were systematically replaced with ‘spread the wealth’ platitudes. In October 2020, voters approved a

rewrite of the constitution, and now property rights and the rule of law are in danger.

“Chile is now in economic free fall. The poor are getting crushed. The rich are pulling their money

out of the country. They have arrived at ‘equality’: Nearly everyone is suffering.” [Emphasis mine]

(Ref. 6)

The lesson for all Americans: When the bill comes due, the socialists and Marxists will come out of

their hiding places in droves to tell us capitalism doesn’t work, that capitalism exploits the poor and benefits only the rich,

that the only way to economic salvation is to embrace socialism and Marxism. They will rewrite or erase history that shows the

eternal failures of their economic fairy tales. America must resist such persistent temptations to buy into the

ever-attractive blandishments of a free lunch and the nonexistent easy fix to our problems.

Some advice from the former Republican Governor John Kasich, of Ohio might just be worth considering.

Summarized below is what he suggested shortly before the COVID Relief bill was approved. First, let me repeat, verbatim, his

opinion of the $1.9 billion coronavirus relief package that Congress was getting ready to pass toward the end of February

2021.

“Outrageous! That’s my shocked reaction after looking deep into details of the $1.9 billion

coronavirus relief package Congress is considering. Outrageous, not because I’m against valid and much-needed COVID relief

for individuals and businesses truly hurt by this pandemic. And not because increased spending isn’t needed for testing,

vaccine distribution and other health care responses to the virus.

“But money to help those with real needs will likely add up to less than half of the bloated spending

that’s been crammed into this package in the guise of ‘relief.’ Every unwarranted, special-interest dollar stuffed into this

bill adds an additional burden to our already unsustainable national debt. Yet few Americans seem to mind. The debt has

disappeared as a public concern in a national fit of amnesia — even as it grows by leaps and bounds.

“The debt poses a grave threat to our democracy, economy and peace of mind. The federal

government’s addiction to unrestrained spending and our disregard for the destructive impact of growing debt poses an

increasing risk of fiscal crisis, lower income, higher interest payments and a weakened ability to respond to other urgent

problems. It’s a bomb that could explode at any time if Americans and our elected leaders don’t wake up.” [Emphasis

mine](Ref. 7)

Stripping the coronavirus relief package back to essentials would have been a good place to start.

Ah - would’ve, could’ve, should’ve . . .

Gov. Kasich’s thoughts on the federal deficit are that America’s increasing deficits endanger this

country’s future growth and prosperity. The exploding national debt threatens our national economic wellbeing and response

capacity. He states that he’s never seen more ominous signs of crisis than those that he’s seeing today. For starters, he

notes that the Congressional Budget Office recently projected that sometime in 2021, the total federal debt will exceed the

size of the entire U.S. economy. If current laws governing taxes and spending generally remain unchanged, the CBO projects

that the federal budget deficit will total $2.3 trillion this year and federal debt will reach 102% of the U.S. gross domestic

product. By that measure, we’re headed for the second worst deficit since the wartime spending of 1945, a terrifying omen of

even greater deficits to come.

What he says is even worse because those numbers were calculated before factoring in President

Joe Biden’s $1.9 trillion coronavirus relief bill. Even if the overstuffed relief package had been scaled back to

necessities, it would have been one more heavy straw on the camel’s back.

Some will tell you “there’s nothing to see here,” that deficits don’t matter, and that Democrats

and Republicans alike have ignored them for years. But deficits, debt and their root cause, uncontrolled spending, truly do

matter because they hold back economic growth and national prosperity. They affect far more than the federal government and

its programs. Their economic corrosion eventually spreads throughout our economy, to businesses large and small, and to

America’s standing in the world.

Some may not be taking the debt crisis seriously because of a misguided belief that America can

just print more money as it’s needed and painlessly spend its way out of insolvency. But that’s like thinking we can repeal

the law of gravity. These deficits and debt will have to be borne by our children and grandchildren. It is our

urgent obligation to stop this endless buildup of debt by reordering federal priorities, balancing the budget and getting

spending under control.

All that may seem impossible, given today's political climate. But there are strategies that have

succeeded. The White House and Congress used them more than 20 years ago, the last time the federal budget was balanced.

Here’s a start on how to get it to work now:

- Strip out the politics. Be fair-minded. Drop any favoritism, examine every program and ask whether it should exist,

whether it should be privatized, or whether a public-private partnership can take on the responsibility. The federal government

must be willing to decentralize and send some responsibilities (like highways) back to the states. Think in terms of the

21st century, where reform should be the order of the day.

- Believe that good governing produces good politics. It doesn’t work the other way around. Successful budget-setting

requires looking at the problems real people are facing, then working to fix them without regard to who’s going to scream

the loudest or what special interests might be upset. Look at the problems, then come up with solutions that work for

people.

- Ignore the extremes. That gets more difficult every year, but it has to be done. Otherwise, bending to the extremes, both

left and right, will lead to endless gridlock and even greater deficits and crushing debt. Bipartisanship and moderation have

become dirty words to the dug-in margins of both political parties. But both those qualities are essential if we’re ever to

see a balanced federal budget and get this deficit monster under control.[7]

There is one thing that is certain about this country’s national debt: Like every debt, the

federal debt will have to be paid back. Lenders want to get their money back – plus interest. And basically, our

government can only get its money from you, from me, and from profit-earning businesses. But, putting too big a tax bite on

private companies can drive them out of business, depriving the government of the tax revenue from these then-defunct

businesses and leaving you and me without work and without the means to pay our taxes. Too high a corporate tax rate will

make American companies non-competitive in the world market, either reducing the profits of these or driving them totally out

of business. Trying to get too much money from foreign sources through tariffs and by taxing foreign companies and individuals

only goes so far until foreign companies and individuals won’t have anything to do with the U.S. Foreigners can simply take

their ball and play elsewhere if the U.S. is too expensive.

So, as our national debt continues to climb with no end in sight, the question that we all need to

ask isn’t whether or not Americans will have to pay off the national debt, but rather, when will the bill come due and how

will the costs be distributed? But, make no mistake, that bill will come due! As long as we continue to

engage in reckless deficit spending without taking steps to reduce and/or pay off the federal debt, the hole we are digging

ourselves into will only get deeper and the walls of the pit only steeper. Climbing out of that financial hole will only get

more difficult and more painful the longer we wait and the less we do now.

------------------------------------------------------------------------------------------------------------------------

References:

- U.S. budget deficit hits record $1.05T, the balance, 13 February 2021.

- U.S. federal debt to exceed size of economy even before Biden stimulus is approved, CBO says,

Jeff Stein,

The Washington Post, 11 February 2021.

- Why Our Debt Is So High and How We Can Fix It, Kimberly Amadeo, The Washington Post,

11 February 2021.

- Let’s Cut Defense Spending!, David Burton, Son of Eliyahu: Article 203, 10 October 2014.

- Summary for Fiscal Year 2018-November 7, 2018, CBO Monthly Budget Review,

Accessed 11 March 2021.

- The fall of Chile offers a warning to United States, Stephen Moore, Boston Herald: Page 11,

26 March 2021.

- Overstuffed $1.9 trillion COVID relief bill endangers future growth and prosperity, John Kasich,

USA today,

26 February 2021.

|

|