| |

Individual Taxes

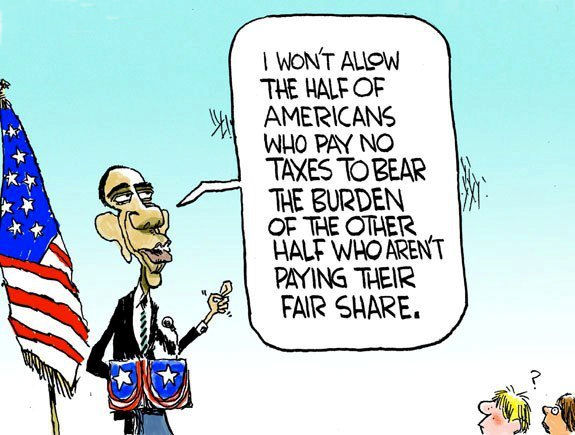

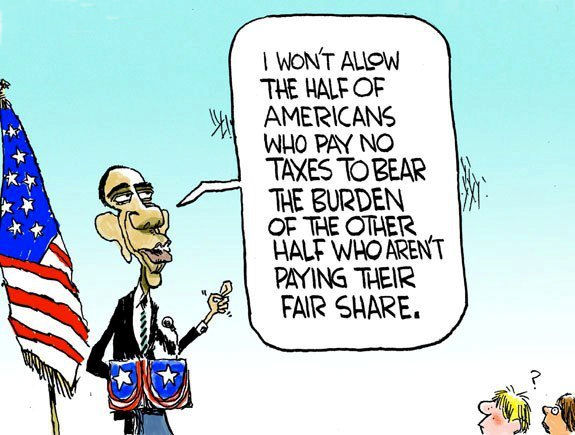

We constantly are told that the rich do not pay their “fair share” of taxes.

Just how much is a “fair share”? Today, “we have half the population piling over 97% of the burden of funding

our federal government on the other half of the population.” (Ref. 1). Is this fair?

“An analysis of tax data shows that wealthier taxpayers already pay a disproportionate

amount of taxes and that their share under the … Bush rates is actually slightly higher than at the end of the Clinton era.

“In 2008, … the infamous top 1% – those earning over $380,354 – paid 38.02 percent of

federal income taxes, according to an analysis of IRS data by the Tax Foundation. Meanwhile, the bottom 50 percent of

income earners – … shouldered just 2.7 percent of the federal income tax burden. And keep in mind, in 2008, the higher

income earners share of taxes slipped from the previous year's 40.4 percent due to the economic downturn.

“When you make this argument to liberals, they'll often respond that the only reason such

a distribution exists is that there's a lot of income inequality in America. But even if you account for that, the wealthy are paying disproportionately” more than the so-called middle and lower income portions of the American population. “The top 1 percent, for instance, earned 20 percent of the nation's adjusted gross income in 2008 – yet their share of the tax burden was nearly twice that {about 38 %}. Meanwhile, the bottom 50 percent earned 12.75 percent of the nation's income, while their share of the tax burden was about one-fifth of that {less than 3 % }.”

“Another way of looking at this is the average tax rates paid by each income level.

As you see below, it's much higher at the higher income levels.”

Income level Average Tax Rate (2008)

Top 1%

24%

Top 15%

17%

25 – 50%

7%

Bottom 50%

2%

“The question is, … if a society in which the top 1 percent already pay nearly 40 percent

of the nation's income taxes (and when combined, the top 10 percent pay nearly 70 percent), then what would it take … to

be satisfied that the rich are paying their fair share? Should the top 10 percent pay 90 percent of the taxes? Should the

bottom 50 percent pay zero income taxes?” The concept of subsidizing “the ballooning social safety net by shifting even

more of the tax burden on the wealthy – while increasing the percentage of people who are net takers in society – is simply

unsustainable.” (Ref. 2) What about taxing the rich at 100% of their income? Would even that be

enough to pay off the burgeoning national debt? If the rich paid 100% of their income in taxes, from where would come the

investments to support businesses and the creation of jobs?

There is another side to the issue of fairness in taxation. On March 16, 2011

“Rep. Jan Schakowsky (D-IL), member of President Obama’s 18-member Fiscal Commission, introduced the Fairness in Taxation Act,

which would create new tax brackets for millionaires and billionaires.”

According to Rep. Schakowsky, “In the United States today, the richest 1% owns 34 % of our

nation’s wealth – that’s more than the entire bottom 90%, who own just 29% of the country’s wealth,” Accordingly,

“It’s time for millionaires and billionaires to pay their fair share. This isn’t about punishment or revenge.

It’s about fairness.” (Ref. 3)

The Fairness in Taxation Act enacts new tax brackets for income starting at $1 million (45%)

and ends with a $1 billion bracket (49%). The bill would also tax capital gains and dividend income as ordinary income for

those taxpayers with income over $1 million. If enacted in 2011, the Fairness in Taxation Act would raise more than

$78 billion, but that is still nowhere enough to pay off the $14 trillion federal debt. In Fiscal year 2010, the interest

on the federal debt amounted to $414 billion, while the interest payment on the federal debt had already reached $413 billion

in just the first 9 months of fiscal 2011. (Ref. 4)

Warren Buffet has made a cogent argument for increasing the taxes paid by the “mega-rich”.

His position is that the super rich can and should pay more than they currently are. He points out that one reason that he

and others like him don’t pay more in income taxes is the arcane tax laws and regulations promulgated by our legislators in

Washington that grant him lower rates on his “unearned” income, i.e., largely on his capital gains and dividends. Tax rates

on “earned” income, i.e., wages and business profits, are taxed at much higher rates. As Buffet said of the politicians and

bureaucrats in Washington, “It’s nice to have friends in high places.” (Ref. 5)

“To understand why {the very rich and the not-so rich end up being taxed at different rates},

you need to examine the sources of government revenue. Last year about 80 percent of these revenues came from personal income

taxes and payroll taxes. The mega-rich pay income taxes at a rate of 15 percent on most of their earnings but pay practically

nothing in payroll taxes. It’s a different story for the middle class: typically, they fall into the 15 percent and 25 percent

income tax brackets, and then are hit with heavy payroll taxes to boot.” (Ref. 5)

According to Buffet, higher tax rates on the super-rich do not discourage them from continuing

to invest. “I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were

39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest

to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation,

I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then:

lower tax rates and far lower job creation.” (Ref. 5)

Perhaps a way for getting everyone to pay their fair share would be as follows (The numbers

here used are purely illustrative and the real numbers would have to be determined by more realistic considerations):

** Tax everyone who earns less that $1 million at the rate of perhaps 20%.

** Tax everyone who earns between $1 million and $10 million at the rate of perhaps 30%.

** Tax everyone who earns between $10 million and $100 million at the rate of perhaps 40%.

** Tax everyone who earns over $100 million at the rate of perhaps 50%

To help those at the lower end of the economic scale, the following might make sense:

** For individuals, families and civil union units earning less than $25 thousand per year, provide a tax credit of 5%

per person, up to a maximum of 2 per unmarried individual tax payer, 3 per divorced or legally separated individual,

and 4 per married couple or couple in a civil union.

** For individuals, families and civil union units earning between $25 and $50 thousand per year, provide a tax credit

of 4% per person, up to a maximum of 2 per unmarried individual tax payer, 3 per divorced or legally separated individual,

and 4 per married couple or couple in a civil union.

** For individuals, families and civil union units earning between $50 and $75 thousand per year, provide a tax credit

of 3% per person, up to a maximum of 2 per unmarried individual tax payer, 3 per divorced or legally separated individual,

nd 4 per married couple or couple in a civil union.

This type of tax break would cover families and civil unions with up to 2 children. Families

and civil unions with additional children would not get a tax break for the additional children. For unmarried single tax payers,

this type of tax break would cover the tax payer and 1 child. Unmarried single tax payers would not get a tax break for

dditional children. For divorced or legally separated single tax payers, this type of tax break would cover the tax payer

and 2 children. Divorced or legally separated tax payers would not get a tax break for additional children.

There would be no other rules – no special deductions, no special exceptions, no special

exemptions, and, most importantly, no more tax loopholes. The rates would be adjusted periodically, perhaps every 5 years,

to account for various factors – inflation, war, natural disasters, changes in productivity, etc. Could anything be fairer

than this? But remember, there are always unintended consequences for every action taken. For example: If we do tax the

rich more, does this mean that there is less money to invest in American businesses? If so, is America really better off

by taking more from the rich in terms of higher taxes or would we better off by letting them use this money to expand

American industry and to create more jobs?

Capital Gains Taxes

While we constantly hear the claim that the rich are not paying their fair share of taxes, there

are other claims that businesses in the United States are also not paying their fair share. Is this true?

In reality, “the U.S. capital gains tax rate exceeds that of any industrialized nation except

that of the United Kingdom and Australia (however, even these countries index gains for inflation, whereas the United States

does not). Because the United States must compete internationally for capital, high capital gains tax rates place the United

tates at a disadvantage relative to its competitors. Some of the United States' major competitors, such as Germany and Hong Kong,

exempt long-term gains from taxation altogether; and other countries, such as Japan, tax capital gains very lightly.

As a result, these countries typically experience higher saving, investment, and productivity growth rates than the United States.

The data indicate that a lower capital gains tax rate would help improve U.S. global competitiveness.” {Emphasis mine}

(Ref. 6) Is this fair for American businesses? Perhaps, much more important is the question -

Is this fair for America?

According to one source, “High capital gains tax rates lower the return on investment, thus

increasing the cost of capital and depressing overall investment in the economy. Conversely, a capital gains tax reduction

would lower the cost of capital and stimulate investment. The effects of increased capital formation would reverberate

throughout the economy in the form of higher wages, rising living standards, job creation, and economic growth.”

(Ref. 6)

“Capital gains taxation … effects economic and employment growth through its impact on

entrepreneurial activity and business creation. Entrepreneurship is the driving force of a market economy. It is crucial

to job creation, innovation, and productivity. … The taxation of capital gains discourages innovation, risk-taking, and

capital investment, thus diminishing entrepreneurial activity in the economy.

“Capital gains taxation effects entrepreneurship through its impact on venture capital,

an important source of funding for entrepreneurial projects. High capital gains tax rates lower the potential return from

backing innovative companies, thus restricting the amount of venture capital available to new firms.”

(Ref. 6)

Does raising the capital gains tax on business increase the amount of revenue raised by the

federal government? “Historical evidence undermines the claim that capital gains tax reductions lower revenue. …

{H}istorically, taxes paid on capital gains have tended to increase after a reduction in the capital gains tax rate.

{Emphasis mine} When capital gains tax rates were lowered in 1978 and again in 1981, revenue climbed steadily

despite government forecasters' claims that it would fall. Conversely, when the tax rate increase was enacted in 1987,

revenue began declining, although forecasters predicted it would increase.” (Ref. 6)

Will raising the capital gains tax on business be fair to Americans who are not considered rich?

“Earlier legislation to reduce the capital gains tax rate was defeated in large part because opponents of a tax cut portrayed

it as a windfall for the rich. It is obvious that affluent investors would benefit from a capital gains tax reduction,

but benefits would also accrue to individuals across the income spectrum. ‘Often overlooked benefits flow to all workers

and middle income citizens, and the overall economy wins. The middle class will benefit from greater appreciation in their

pensions...Small businessmen will gain from more generous tax treatment of the gains on their enterprise. And all employees

will see wage gains tied to investment-driven higher productivity.’” (Ref. 6) Also, reducing the

capital gains tax creates new jobs. In summary, it has been claimed that lower capital gains tax rates help most

people and hurt no one.

Still, when one hears that some U.S. companies earn billions of dollars in profits and still

pay little to no tax on these earnings, the question of fairness must be raised. One study found that, “U.S. Fortune 100

companies ‘avoided $60 billion in taxes by shuttling profits offshore.’” (Ref. 7)

This report further found, “that America’s top companies have added 44 new subsidiaries in

tax haven countries since the Government Accountability Office examined the same issue in 2008. The U.S. collects less in

corporate taxes as a share of GDP than 24 out of 26 industrialized nations. The share of the federal budget funded by

corporate income taxes has dropped dramatically since the 1940s, from 28.8 percent of the budget to 10.3 percent. … The only

companies that are capable of doing this—which is spending millions in legal fees to {legally avoid taxes on} billions in

profits — are the richest and most profitable companies in America.”

“Using data from 2006 … Wal-Mart paid an effective tax rate of 33.6 percent, and CVS Caremark

paid a rate of 38.8 percent. By comparison, General Electric paid an effective tax rate of 3.6 percent, Merck paid 12.5 percent,

and Cisco Systems paid 19.8 percent that same year.” (Ref. 7)

“There is a great deal of talk about how a small increase in taxes would not be a heavy

burden on businesses or those making over $250,000 a year. … The facts are:

-- Start with a 40% tax rate

-- Add Social Security tax of 6.2%

scheduled to return from 4.2% at the end of year.*

-- For a self employed business person, the Social Security tax is 12.4%

scheduled to return from 10.4% at the end of year).*

-- Add Medicare Tax of 1.45%.*

For small business, the Medicare Tax is 2.9%.*

-- This results in a tax rate for a small business of 55.3%”

* Based on the first $106,800 of annual income.

But, there is still more. Obamacare will increase the Medicare Tax to 3.8%

in the near future. Add in State Income Taxes, which in North Carolina is 7%, in Virginia is 5%, and

in New York is 10%. Therefore, the tax rate for a small business can be between 60.3% to 65.3%

and this does not account for

property tax or state or local licensing fees. Is Government entitled to 2/3 or more of what a small businessman earns?

Is this a “fair share”? Just what is a small business’s “fair share”? (Ref. 8)

Clearly, there are significant inequities in the system of taxation that is being applied

to U.S. businesses. Much of this inequity is the result of a rapidly growing tax code that incorporates multiple loop-holes,

special provisions for favored industries/businesses, and general incomprehensibility. The provisions of the tax code have

become a spawning ground for very expensive corporate lawyers and law firms that can develop ingenious, but legal,

tax-avoidance techniques. These lawyers and the companies that they represent are not the culprits – the tax code

and those who have developed it are the real culprits! The companies and their lawyers are rightly concerned with

maximizing the profits for their shareholders. To not do so would constitute malfeasance on their part. Do all companies

pay their fair share? - Not likely! Are they to blame? - No! Should the tax code be rewritten to make it fairer? -

Yes! It’s time to eliminate the loopholes by simplifying the corporate tax laws so all companies end up paying the same

“fair share” tax rates. No more sheltering of profits overseas.

So, What Needs to be Done?

So, what is a “fair share”? That depends on whether it’s your ox that is being gored

or is the one doing the goring. Many would argue (and have so argued) that the rich don’t need all their wealth and therefore

should pay much more to help the less fortunate. Others would argue that the wealthy already pay more than their fair share

and that taking still more from them, instead of helping the already poor, just makes everyone ultimately poorer. Their not

unsupported premise is that those with the most money make the greatest contributions to the economy in terms of job-creation,

entrepreneurship, and tax revenue. Taking from the rich (through increased taxation of the wealthy) and giving to the poor

(called wealth redistribution) is akin to giving the hungry person a fish, which solves his immediate hunger, instead of

giving him the tools and training to catch fish, which solves his long-term hunger problem. So, once again, what is a

“fair share”? That depends on whether one seeks to satisfy his immediate appetite or whether one considers the

long range implications of one’s actions. Are today’s headlines from our socialistic brethren in Europe indicating the

results of taking from the productive elements in their societies and redistributing the wealth among the less (or least)

productive?

“In his excellent new book ‘After America,’ Mark Steyn reports that ‘In one-sixth of British

households, not a single family member works. They are not so much without employment as without need of it.

“But they do need it, because the money is going to run out. In fact, in Britain it

already has. They’re under an ‘austerity’ budget already.” (Ref. 9)

“In the culture of work, if you need something you go out and earn it. But in a

‘spread the wealth’ society, you can just take what you want from somebody who already has it.

“The rioters on the streets of London have figured out how this works. Let’s hope

Americans do, too.” (Ref. 9)

Basically, what might be considered to be fair is something resembling “a flat tax

and cutting loopholes that allow American corporations to stash trillions on untaxed dollars overseas.”

(Ref. 10) The very rich might be asked to pay more than they now do, and personal income

tax rules and regulations might be reduced to a few pages with nearly all exceptions eliminated. Corporate tax laws

might be greatly simplified with special considerations for political favorites eliminated and capital gains tax

rates made competitive with the corporate tax rates of other countries against whom American companies compete.

Some other thoughts on making sure that everyone contributes his Fair Share

include the folllowing. In almost every case where a country has got itself into the kind of

financial hole created by the U.S.'s current massive deficit, "they've adopted some kind of consumption tax,

usually a value-added tax. You pay the tax on things you buy, not on your salary, or your capital interest,

or dividends. The tax is levied on imports, but not on exports. So it has an indirect benefit of making you

more competitive." Also, "Get rid of all the numerous deductions, exemptions, and special deals so that you could

lower marginal tax rates while raising as much (if not more) money" than the present tax system.

Nearly everyone agrees that, "fundamental tax reform would help our economy both in the short and long term."

(Ref. 11)

--------------------------------------------------------------------------------------------

REFERENCES:

- The Parasitic Left Says “FEED ME!”, Charles Ormbsby, The Valley Patriot, Page 5, August 2011.

- If rich aren't paying their "fair share," then what's fair?, Philip Klein, Washington Examiner.com;

http://washingtonexaminer.com/blogs/beltway-confidential/2011/04/if-rich-arent-paying-their-fair-share-then-whats-fair,

April 19, 2011 {Accessed 10 August 2011}.

- Schakowsky Introduces Bill to Tax Millionaires and Billionaires,

http://schakowsky.house.gov/index.php?option=com_content&view=article&id=2877&catid=22, March 16, 2011 {Accessed 11 August 2011}.

- Interest Expense on the Debt Outstanding, TreasuryDirect; http://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm,

August 04, 2011 {Accessed 11 August 2011}.

- Stop Coddling the Super-Rich, Warren E. Buffet, The New York Times; The Opinion Pages, August 14, 2011.

- The Economic Effects of Capital Gains Taxation, Shahira ElBogdady Knight, Joint Economic Committee Study;

U.S. Congress; Jim Saxton, Chairman, June 1997.

- Greenlining Institute Report Looks at Effects of Corporate Tax Havens, Catherine Dunn,

The Greenlining Institute; http://www.greenlining.org/news/in-the-news/2011/greenlining-institute-report-looks-at-

effects-of-corporate-tax-havens, July 28, 2011 {Accessed 11 August 2011}.

- Exactly What is a Fair Share To Pay In Taxes?, billmoore353,

http://billmoore353.wordpress.com/2011/08/08/exactly-what-is-a-fair-share-to-pay-in-taxes/, August 8, 2011.

- U.S. better take notice of Britain’s riots, Michael Graham, Boston Herald, August 11, 2011.

- See Prez Fumble, Bill O’Reilly, Boston Herald, August 13, 2011.

- Five leaders. Five ideas for fixing the economy. It's a start, Gillian Rich, Boston Sunday Globe,

pages G1, G5, August 28, 2011.

|

|