| |

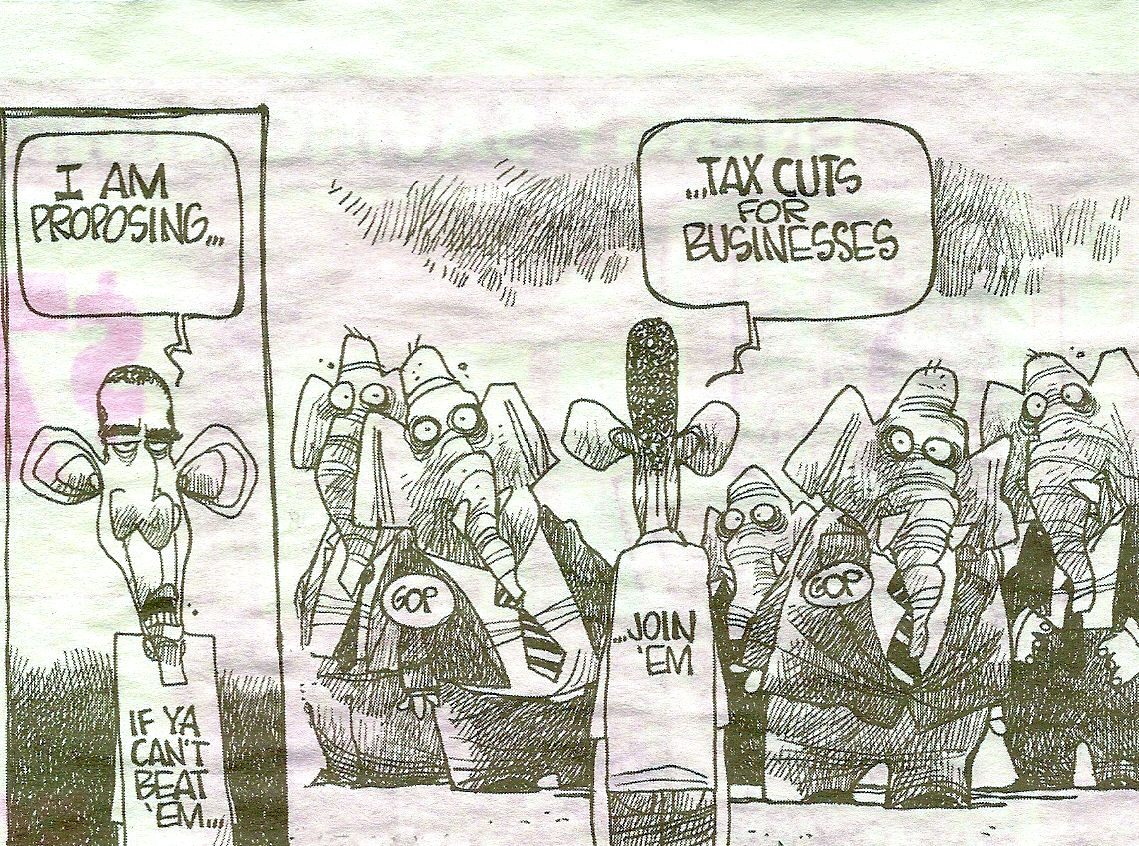

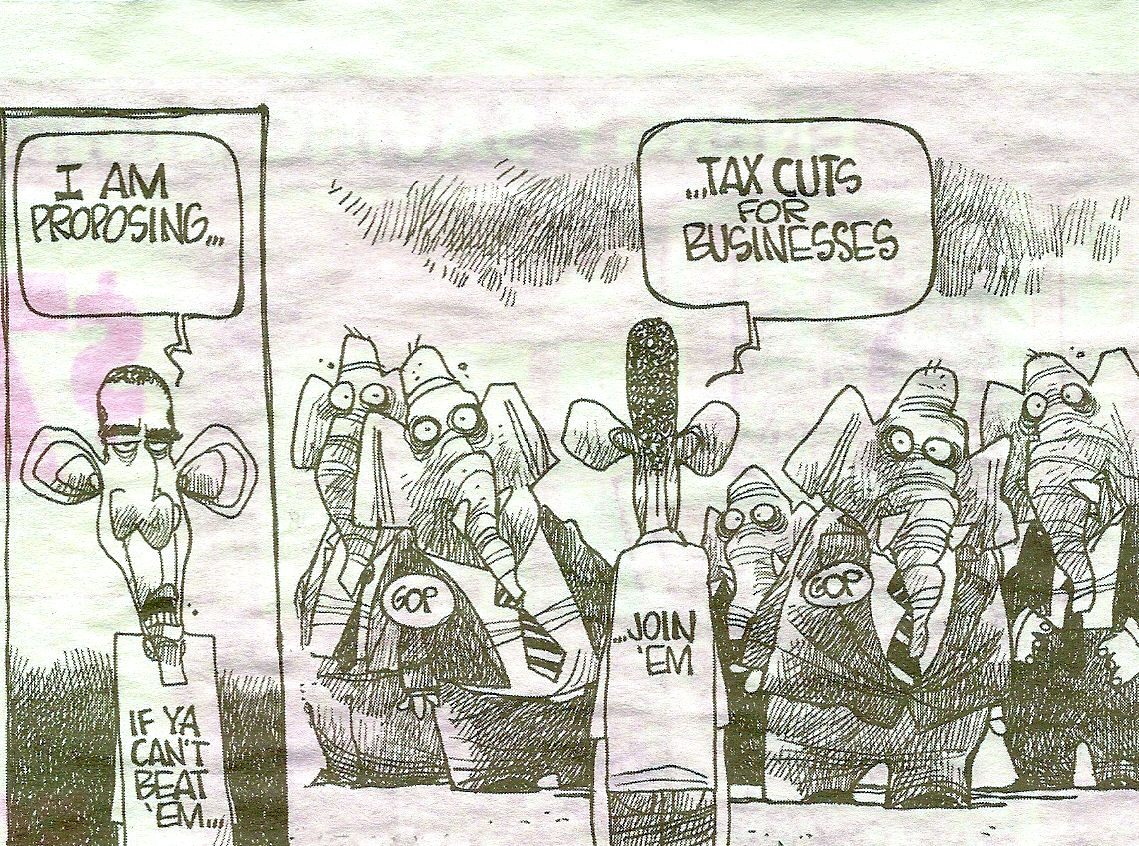

“President Obama exhorted Congress yesterday to make passing a long-languishing

small-business aid package its first order of business when it returns next month from its summer break.”

The President mentioned “extending Bush tax cuts due to expire this year … and tax cuts.”

(Ref. 1)

It’s great to see our President finally realize that public works programs and throwing

massive amounts of money at the problem are not the solutions to moving our country out of the economic morass

that it has been in for the past two years. The solution is to stimulate businesses, and particularly small

businesses, to expand, hire and prosper.

While the President is now prepared to help small businesses, which historically provide

the majority of job growth in our economy, much of the previous actions by the President, his administration,

and the Democratically controlled Congress has ignored and stifled - not helped, small business growth. To date,

Obama and the Democratic Congress have been totally focused on stuffing their social policies down the throats

of the American people while ignoring the economic impact of ignoring and actually hindering the private sector

of the American economy. Their futile attempts at reviving the economy have been guided by their socialistic

leanings that demand bigger government, massively increased federal spending, higher taxation, and enormous debt.

America has begun to recognize the adverse consequences of nearly 2 years of “binge spending, increased tax

burdens and government power-grabbing” (Ref. 2) on the

economy.

As opposed to the failed and failing socialistic or ‘statist’ policies of the Obama

administration and the Democratic party, history has shown that “democratic capitalism is the world’s greatest

success story. No other system has improved the lives of so many people” as modern China is rapidly learning.

Under democratic capitalism, the sole economic role of the government “should be to create a stable, hospitable

environment for economic activities – allowing businesses to be businesses and entrepreneurs to take risks and

invest in job creation.” (Ref. 3) Social engineering does not

fit this criterion.

To quote Paul Johnson who quoted Benjamin Disraeli, President Obama is “’a

sophisticated rhetorician, inebriated with the exuberance of his own verbosity.’ If only he would talk less

and think more.” (Ref. 4)

“The Bush-era tax cuts of 2001 and 2004 – the most sweeping in a generation – are due

to expire in January. If that is allowed to happen – if middle class families are hit with the Alternative

Minimum Tax – it could rapidly send the current very shaky economy into a death spiral.

“But Obama and Pelosi are determined to extend the tax cuts only for those earning less

than $200,000 a year. They are betting that class warfare works in the political arena, and that they can

then accuse Republicans of favoring the ‘the rich.’

“The problem is, of course, that voters aren’t stupid, They know that ‘the rich’ as

defined by Pelosi and company includes small business – the nations’ largest generator of new jobs.”

“Voters are also developing a healthy distrust of politicians whose definition of

‘the rich’ tends to move, depending on how much money government needs to suck out of taxpayers.”

(Ref. 5)

Recently “the National Bureau of Economic Research (NBER) officially scored the

recession as starting in December 2007. Since World War II, 65 years ago, the average duration of recessions

has been 10 months, with the longest being 16 months. In April of this year, NBER issued a statement saying it

could not yet determine an end of the recession 28 months after it began.” Clearly, the Obama/Pelosi/Reid

economic recovery program has not worked.

Some “economists are saying that the comprehensive across-the-board tax rate increases

on the nation’s employers and investors now scheduled for next year will make … a double-dip downturn

inevitable.”

“The job-killing policies of the Obama/Pelosi/Reid regime include the 2009 ‘stimulus’

package, which drained nearly $1 trillion out of the private economy essential to the private capital investment

that creates jobs. Another job killer is the across-the-board increase in the top tax rates for every major

federal tax now scheduled to begin next year. That has killed the incentive for the investment necessary to

create jobs.

“Other job killers include rising budgets and deficits, the health care takeover

legislation with its new taxes and regulatory burdens that will sharply increase health and employment costs.

Pending cap-and-trade tax legislation and EPA global warming regulation threaten to cripple the economy with

high-cost, unreliable energy.” (Ref. 6)

The Obama administration created a $787 billion stimulus bill to ‘stimulate the economy’

and ‘create jobs’. Their plan has failed to accomplish either goal. What their plan has done is to take money

away from those elements of the economy that create the jobs and power America’s economic engine. The $787

billion stimulus bill “was based on the myth that government spending is a free lunch. But every dollar Congress

injects into the economy must first be taxed or borrowed out of the economy.” The private sector of our

economy is not growing or creating jobs. One major reason is that the private sector has billions of dollars

less to spend because of the stimulus bill. “It is tempting to believe that government spending creates income

and jobs because we can see the factories and people put to work with government funds. We don’t see the jobs

that would have been created or factories utilized elsewhere in the economy with those same dollars had they

not been lent to Washington.” Government job creation is highly inefficient compared to job creation in the

private sector.

“If governments could spend their way to economic growth, then Germany, Spain and

Greece would be wealthier than America, instead of stagnating and seeing downgraded credit ratings. If budget

deficits stimulated growth, then this year’s original $1.2 trillion budget deficit would have overheated the

economy … It clearly did not.

“In reality, individuals and business drive economic growth through work, investment,

innovation and entrepreneurship. This requires less government spending, taxes and budget deficits –

not more.” (Ref. 7)

“Government spending does not create prosperity. If it did, the Soviet Union would have

won the Cold War. Low tax rates positively change incentives: Entrepreneurs, venture capitalists and investors

are induced to take more risks; businesses become more expansion-minded; and individuals positively adjust their

own behavior, knowing they can keep more of what they earn and that success will not be punished.

(Ref. 8)

The Obama administration’s attempts to end the recession with a number of stimulus

programs has created an economic environment that has completely stifled the growth of the private sector,

and small businesses in particular. Since February 2008, the Obama Administration has passed the following

stimulus packages: $170 billion in the form of the Economic Stimulus Act, $345 billion in the form of the Housing

& Economic Recovery Act, $787 billion in the form of the American Recovery & Reinvestment Act, and a $410 billion

omnibus bill with $12 billion in pork barrel spending for 9,000 earmarked projects. These attempts to stimulate

the economy and create jobs with federal spending have failed miserably. As of the end of 2009, “the national

debt {had} increased to $2.9 trillion while the unemployment rate rose to a 26-year high before backing off

slightly to {around} 10%.”

Instead of hogtieing small businesses with economic uncertainty, higher taxes, more

red tape, and unavailability of money for credit, the government should have been doing the following:

1) reducing the payroll tax to free up cash “for every employer to hire and invest”, 2) allowing “small

businesses to deduct 100% of new-equipment expenses to help them invest in more-productive technologies”,

3) reducing “the tax burden on businesses ... {ours} is the second highest in the world”, 4) reduce the capital

gains tax to zero “to encourage investment”, 5) “abolish the death tax … {which} would create hundreds of

thousands of new jobs”, and 6) developing “more of America’s … domestic energy resources, which can generate

millions of new jobs and billions in new tax revenues.” The government needs to balance the budget and

reduce taxes “on small businesses and entrepreneurs to reward job creation, work, savings and investment.”

(Ref. 9)

As one Harvard economist has said, “more spending will just make the financial crises

worse.” For nearly 2 years, this has fallen on deaf ears within the ranks of the Democratic Congress and the

Obama administration. So far, in spite of the massive government spending, the financial crisis remains

unresolved. According to the economist, “the solution is to spend less, not more. That would reduce government

debt (which crowds out private needs for capital) and cut the demand for tax increases (which depress

investment).” Indeed, “the pressure for further stimulus just adds to the problems coming from undisciplined

growth of entitlement spending.” (Ref. 10)

For the past 2 years, the Obama administration has been denying small business the

capital they need to grow and create jobs, has created an air of uncertainty regarding small business taxes and

costs, and has continued to apply regulations and mandates that increase the costs of doing business. “The

government’s increasing domination and distortion of the capital markets … crowds out other credit seekers

{such as small businesses} in the marketplace.” Uncertainty arises when “the administration” undermines “private

credit markets with its cavalier tearing up of contract law. In a move worthy of Argentina, the government

stiffed senior creditors in the way it reorganized GM and Chrysler as payoff to the United Auto Workers for

vigorously supporting the president during his campaign. Even more damaging is what it has done to the mortgage

market. Only the Fed and severely wounded Fannie and Freddie still buy mortgage-backed securities these days.

Why? Because private investors no longer know what the rules of the game are.”

Small businesses continue to suffer as “Sarbanes-Oxley and other regulations have hampered the resurgence of a

vigorous IPO market.” If small businesses cannot obtain credit, they cannot grow. “Where will innovators today

get the wherewithal to expand and capital providers the access needed to produce and find what makes business

vibrantly workable?” (Ref. 11)

Businesses, entrepreneurs and investors abhor uncertainty. Uncertainty leads to lack of

investment, reduced expansion, and less job creation. President Obama’s potential support of cap-and-trade

legislation favored by many Democrats has created more uncertainty in the minds of our business leaders.

“Making carbon fuel more expensive for {the U.S.} while not making them more expensive for China and Co.

means that fossil-fuel users will move their businesses to the developing world faster while costs and taxes

for consumers will skyrocket.” (Ref. 12) Small business is

inclined to wait and see what will transpire before taking actions that could lead to economic growth and

job creation. Why invest when the government might make your investment worthless?

The Democratic leadership of Obama, Reid and Pelosi are imposing a ”host of new taxes

and higher tax rates on the so-called wealthy. The idea is as old as Robin Hood, but instead of growing the

economic pie, redistributing wealth ends up shrinking it.

“If the president were really serious, he’d put more money back in the hands of those

capable of creating jobs: individual investors and private business. The United States has the second highest

tax rates in the world – 39 percent.”

“In addition, we penalize investors by taxing dividends and capital gains at relatively

high rates.” With the Democrats proposing to end the 2003 Bush tax cuts in 2011, long-term capital gains and

certain qualified dividends will be taxed at 20% and short term gains will be taxed at a rate as high as 39.6

percent starting in 2011. Why take the risk of investing when Uncle Sam will take 20 to 40 percent of your

profits while incurring no risk to government? While Democrats may claim that tax cuts drive up the deficit,

the truth is that “when businesses use their new-found gains {from reduced taxes} to expand and hire workers,

they’re creating wealth, and that leads to higher tax revenues over time, even with lower tax rates."

Democrats have been trying “to introduce a host of new bills aimed at creating jobs,

from public works programs favored by unions to special breaks of minority businesses to more loans for small

businesses. But the problem with nearly all of these measures is that they have politicians and bureaucrats

making decisions about what kinds of jobs should be created to what workers in these jobs should be paid. We’d

be far better off leaving those decisions to the private sector. If we want to grow the economy, there’s no

better way {as proven by history} than cutting taxes.”

(Ref. 13)

“One reason for high unemployment is business uncertainty. Companies don’t know how much

they’ll have to pay for energy if the House-passed ‘cap-and-trade’ legislation ever becomes law, or if the Obama

administration implements its plan to impose an additional $80 billion in taxes on the oil and gas industry and

jacks up royalty fees for drilling in the Gulf of Mexico.

“Cap-and-trade alone is likely to cost 2 million jobs by 2011.”

(Ref. 14)

If Democrats have their way, the estate tax or ‘death tax’ so-called by many will come

back into existence in 2011. The death tax was done away with in the 2004 Bush tax cuts. The death tax adversely

affects many small businesses in that they may “not have sufficient cash to pay the tax.” Sale of the business

or parts of it may be necessary. “The death tax threatens countless family-owned businesses. Especially ones that

own large amounts of land like farms and ranches.” It’s estimated that repeal of the death tax would create 1.5

million jobs.” (Ref. 15)

“Business is refusing to invest aggressively in the future – including hiring more

people – in an atmosphere of rising taxes and regulations, not to mention rhetorical attacks on business by

President Obama.” (Ref. 16) Reasons for the reluctance of

businesses to invest include: higher costs of Workman’s Compensation Insurance, unemployment insurance, and

health care; higher costs of compliance with government regulations such as the new requirement to submit a

form 1099 for every purchase over $600; increased costs of compliance with new health care rules; and increased

costs of ensuring the security of employee information. There are other factors.

Even as President Obama urges Congress to pass a small-business aid package with one hand,

he continues with his other hand to pursue the agenda that has stifled all elements of the private business

community for the past 2 years. He is urging still more deficit spending. “President Obama rolled out a

long-term jobs program {whose estimated cost} would exceed $60 billion.” His plan has “low odds of becoming

law this year.” Why propose the program if it has little chance of being enacted? Because “the proposal’s only

pre-election impact would be a political one.” As the House Republican leader said in response to the

President’s plan, “We don’t need more government ‘stimulus’ spending. We need to end Washington Democrats’

out-of-control spending spree, stop their tax hikes, and create {permanent private sector} jobs by eliminating

the job-killing uncertainty that is hampering our small businesses.”

(Ref. 17) Enough of the ‘same old–same

old’!

“As cash runs low in government coffers around the country, politicians are ratcheting

up the intensity of their search for revenue and new areas to regulate. Small businesses are in their crosshairs

in a mammoth, nationwide shakedown. They are the nation’s critical engine for growth, innovation and job

creation, yet they are being starved for credit and being slammed with more taxes, government directives and

litigation exposure. This spells weaker profits and fewer jobs, risking a fundamental deterioration in

America’s private sector.”

“Businesses with fewer than 250 employees provided most of the net job growth in the

2002-07 expansion yet are still in the starting blocks in the current recovery. The 2,300 page health care bill

will take months and years to decode and will weigh heavily on small-business decisions. New regulations are

mushrooming from the constant string of thick ‘stimulus’ bills, the coming law on new fiscal regulations and

the sure-to-be-bad tax bill toward year’s end.

“The threat to profit is explicit in Washington’s evolving ‘economic justice’

platform. Small businesses already face a high top marginal tax rate, horrendous tax complexity and layers of

new taxes, yet the revenue-extraction process is intensifying. The jump in tax rates planned for the end of

the year, the expansion of the Medicare tax and the threat of a value-added tax are just the transparent side

of the tax shakedown.”

Small businesses are “starved of credit. Normal business loans, the bread-and-butter

staple of a healthy partnership between banks and small businesses, are down 8% from the already reduced

levels of a year ago. Normal bank lending is further penalized in the coming 2,000 page financial services

regulation bill and the latest antigrowth decisions by the Financial Accounting Standards Board in May. The

FASB, an unelected new regulatory superpower, seems bent on outdoing Sarbanes-Oxley in transferring jobs to

the accounting field – already one of the top growers – from innovation and growth elsewhere in the economy.

“While Washington {and specifically President Obama} pays lip service to the

challenges facing small businesses, it repeatedly chooses its own expansion over results. In effect,

government has become a huge silent partner in all businesses, often taking a majority of the profits

and forcing many unprofitable business decisions without the risk that it can be fired.”

(Ref. 18) President Obama and the other ‘statist’ politicians

in Washington are simply an anchor around the neck of a drowning critical sector of the American free market

system.

With their left hand, the Obama/Pelosi/Reid triumvirate have enacted legislation and

instituted policies that have resulted in businesses having to lay off workers, forgo expansion, put off new

investment and remain in an idle mode in the uncertain economic and political climates created by the

‘statist’ agenda of these left-liberal politicians.

Now, with the mid-term elections of 2010 and the presidential elections of 2012 facing

him and the Democratic House and Senate politicians, President Obama is taking a tentative first step and is

attempting to extend his right hand to the business community in a belated effort to move the economy out of

its 2-year long doldrums. Over this 2-year span of time the American economy has remained largely stagnant

and real unemployment has been stuck around 16%. For nearly 2 years, the President has been taking from the

business community with his left hand and is only now offering to give with his right hand.

--------------------------------------------------------------------------------------------------

References:

- President urges aid to small businesses, Associated Press, Boston Herald, Page 18,

31 August 2010.

- Active Government = Unstable Economy, Steve Forbes, Forbes, Page 13,

30 November 2009.

- Capitalism: A True Love Story, Steve Forbes, Forbes, Pages 24 - 28,

19 October 2009.

- The Sickness of the West, Paul Johnson, Forbes, Page 15, 15 March 2010.

- Of Dems, tax cuts, Editorial, Boston Herald, Page 14, 4 September 2010.

- Let’s mean business, Newt Gingrich and Peter Ferrara, Boston Herald, Page 15,

4 September 2010.

- Stimulus won’t work, Brian Riedl, Boston Herald, Page 15, 4 January 2010.

- Ireland Gets It, Steve Forbes, Forbes, Page 15, 12 January 2009.

- Stop the Insanity, Newt Gingrich and Dan Varroney, Forbes, Page 24,

18 January 2010.

- Keynes Who?, Paul Krugman, Forbes, Pages 32 - 33, 9 August 2010.

- In-credit-able, Steve Forbes, Forbes, Page 15, 28 December 2009.

- Cloudy forecast for Copenhagen, Jonah Goldberg, Boston Herald, Page 17,

7 December 2009.

- Tax cuts still best stimulus, Linda Chavez, Boston Herald, Page 17,

7 December 2009.

- Obama de-energizes economic recovery, Mackubin Thomas Owens, Boston Herald, Page 15,

23 December 2009.

- Repealed death tax would liven industry, Curtis Dubay, Boston Herald, Page 15,

23 November 2009.

- The Forgotten Employer, Rich Karlgaard, Forbes, Page 19, 30 August 2010.

- Obama unveils jobs plan, rips GOP spoiling tactics, Associated Press, Boston Herald,

Page 8, 7 September 2010.

- Keynes Shakedown, David Malpass, Forbes, Page 18, 28 June 2010.

| |