| |

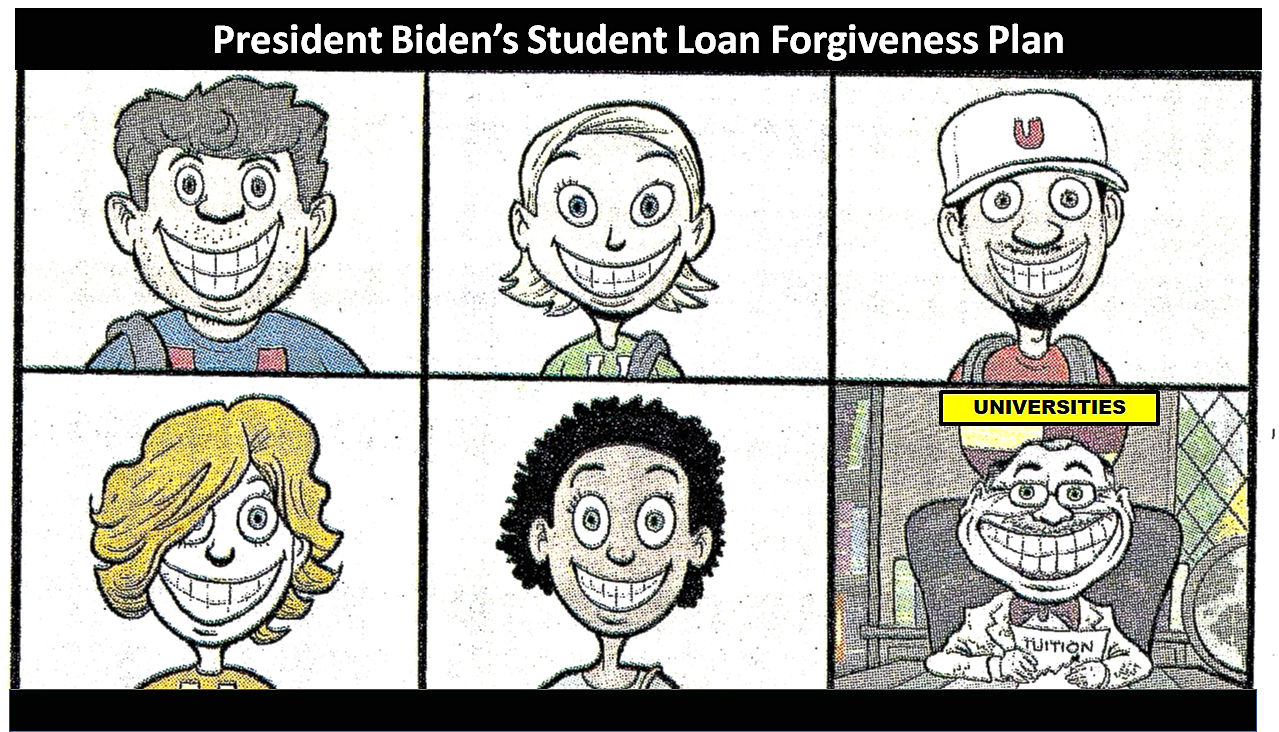

At the end of August 2022, President Joseph Biden announced his plan to have taxpayers cover

$300 billion of outstanding college debt for millions of borrowers. Under the proposal, the administration would pay

$10,000 to people earning $125,000 or couples earning $250,000. Borrowers who qualified for Pell Grants from

households earning less than $125,000 would get $20,000.

Here are some basics about the Biden proposal.

Forgiving college debt will cost taxpayers hundreds of billions of

dollars.

According to an analysis by the Penn Wharton Budget Model, a nonpartisan group at the

University of Pennsylvania’s Wharton School, absorbing student loan debt could cost as much as

$900 billion.

Student debt forgiveness dollars will largely go to wealthiest Americans.

Penn Wharton also reported that “around 70% of any debt forgiven would accrue to households

that are in the top 60% of income distribution in the U.S.” Part of the reason is that fewer than four in 10 Americans

have a college degree. Another reason is that more affluent families are more likely to send their kids to college.

And a recent report from the University of Chicago’s Becker Friedman Institute for Economics

showed that canceling student loan debt would send nearly $6 in relief to the top 20% income earners for every $1 that went to

the bottom 20%.

The college debt burden will be back in only 4 years.

According to the Committee for a Responsible Federal Budget, pouring hundreds of billions

of tax dollars into the college borrowing debt fire won’t tamp down the flamers.

They estimated that, absent other reforms in federal financial aid, outstanding federal student loan

debt would return to the current $1.6 trillion level relatively soon after cancellation. With conservative assumptions, they

found debt would return to (current levels) just 4 years after $10,000 per borrower was canceled.

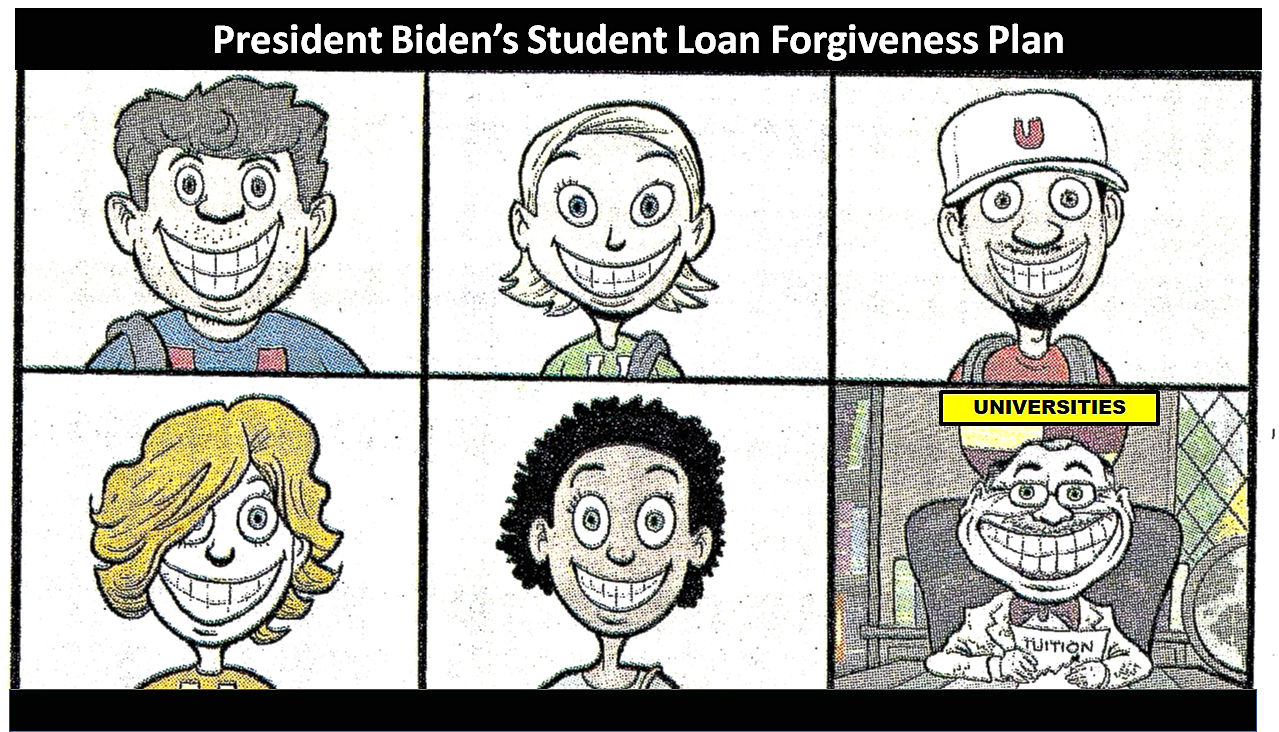

As liberal Senator Patrick Leahy from Vermont said after Biden announced his plan, colleges

and universities could be expected to raise their prices in rake in the billions in new federal dollars pouring into the

system.

Biden’s plan to unilaterally pay off billions in debt is almost certainly

illegal.

There is no “Presidential Student Debt Forgiveness” Act, and any legislation is unlikely to get

60 votes in the Senate (even a majority in the House is in question). So where did Biden get the authority for a presidential

college loan pardon?

According to most knowledgeable sources, he doesn’t have such authority. “People think that the

president of the United States has the power for debt forgiveness,” Speaker of the House Nancy Pelosi said last year. “He

does not. He can postpone, he can delay, but he does not have that power.”

Pelosi argued that student loan forgiveness can only be accomplished through “an act of

Congress.”

The Department of Education explored the question and it also found that the executive

branch lacks the power to absorb these debts from borrowers.

If Biden declared a onetime debt wipeout, it will almost certainly be blocked by courts.

That leads many observers to suggest this is a political stunt ahead of the midterms, not an education policy.

Unbelievably, there really is a plan to let borrowers who are in already in default borrow

still more federal dollars.

It’s called the “Fresh Start” initiative, and it would give 7.5 million people who took out loans

but haven’t been making their payments to have another year, after the COVID “emergency” ends, to work out some payment

arrangement without any payments or penalties due. Their credit record would be scrubbed and, as the Washington Post

reported: “Defaulted borrowers also will regain access to federal student aid. The department typically bars such borrowers

from taking out new student loans, but the administration is easing the restriction to help people complete their

education.”

“If these individuals were unable to pay back their loans the first time they borrowed, how

will giving them access to more debt help?” said Representative Virginia Foxx of North Carolina, the top Republican

on the House Education Committee. “This is a terrible gamble - one for which taxpayers will end up paying the

price.” [1]

As noted in what is written above: “According to the Committee for a Responsible Federal

Budget, pouring hundreds of billions of tax dollars into the college borrowing debt fire won’t tamp down the flamers.

‘We estimate that absent other reforms in federal financial aid, outstanding federal student loan debt would return to the

current $1.6 trillion level relatively soon after cancellation,’ the CRFB writes. ‘With conservative assumptions, we find

debt would return to (current levels) four years after $10,000 per borrower was canceled.’

“And as the liberal Democratic Senator from Vermont, Patrick Leahy, said . . ., colleges and

universities can be expected to raise their prices in order to absorb the billions in new federal dollars pouring into the

system. [emphasis mine]” (Ref. 1)

President Joe Biden’s announcement of a monstrously expensive plan to "cancel" $10,000 per student

loan, "forgive" $20,000 for those who received Pell Grants, and extend the two-year repayment moratorium once again through

the end of 2022 after multiple pandemic-era pause extensions will likely cost American taxpayers as much as a trillion

dollars over the next 10 years. Meanwhile, White House officials are scrambling to abate concerns over a

potential reflexive reaction from colleges that might drive up tuition, given that schools have little incentive

to control costs and that abundant student loans can make the bottom line appear more affordable in the consumer's

eyes. So, while the Biden administration is signaling that there's no reason to panic or question the federal

government's business logic, experts and history are saying otherwise. Should we sound the alarm on an inevitable

steep increase in college costs?

CLAIM: Susan Rice, the White House's director of the Domestic Policy

Council, was asked at a press briefing discussing Biden's announcement of the loan forgiveness program that if there

was "a worry" about colleges raising tuition rates. She replied: "You heard the president emphasize in his remarks and a key

element of our plan is to ensure that colleges that have jacked up prices and taken advantage of students, particularly those

that have made wild promises about how much people will be able to earn based on their degree program, which are not backed

up by reality, and while people are earning, or are incurring huge volumes of debt, that is something that the Department

of Education has already cracked down on and is going to continue to crack down on."

"And the Department of Education is going to be vigilant," Rice added. She noted that the Education

Department will publish an annual list of collegiate institutions that are "the worst actors in terms of the delta between

what they promise, what they charge, and what they deliver."

According to the White House's fact sheet outlining how Biden's student loan "relief" program will

work, the Department of Education watchlist will hold colleges accountable that have contributed to the crisis by tracking

who has the worst debt levels in the country, "so that students registering for the next academic year can steer clear of

programs with poor outcomes." Institutional improvement plans will also be requested from colleges.

FACTS: While the cost of college continues to soar, Biden's student loan

"cancellation" plan could cause an even greater spike in tuition rates, according to what several education and economy

experts are warning.

"Students will likely feel liberated to borrow more money on the assumption of future loan

forgiveness, and universities will take advantage of the additional borrowing by raising tuition," said the

Manhattan Institute's senior fellow, Brian Riedl, who focuses on budget, tax, and economic policy.

Referring to the so-called "Bennett Hypothesis" that was tested back in 2015 by the Federal Reserve

Bank (FBR) of New York, Riedl said that the expected trend is "pretty similar to the fact that historically 60% of

all student aid increases have been captured with tuition hikes, and this will be treated like an increase in student aid

moving forward, which suggests that 60% will be countered by tuition hikes. [emphasis mine]" Based on preliminary

findings, the FRB of New York staff report had determined that increases in subsidized loans resulted in tuition hikes of

about 60 cents on the dollar and up to 15 cents on the dollar for unsubsidized loans.

Riedl then asserted that Biden's "inflationary" initiative would encourage college students to

over-borrow, drawing a comparison to the overwhelming border crisis to illustrate how removing some of the financial

consequences of taking out loans one cannot afford is opening the floodgates to greater student financial

irresponsibility.

"Students have already been over-borrowing for decades, and if they believe that any borrowing will

be at least partially forgiven in the future, all restraints are off," Reidl stated. "This is kind of like what we see with

immigration amnesty whenever Congress passes amnesty for immigrants, it encourages more immigrants to come and cross the

border in anticipation of future amnesties. So, there's always the assumption that these one-time policies will be renewed

and, therefore, you encourage the same behavior."

Other industry experts argue that Biden's taxpayer-funded handout will worsen inflation. "Even after

spending over $300 billion and worsening inflation, canceling student loan debt will raise tuition prices for future

generations," said Americans for Tax Reform's policy communications specialist Isabelle Morales. "The primary

driver of tuition costs has been the federal government's subsidization of college. If colleges and universities expect

the government to forgive large chunks of the cost of their education, they'll be motivated to raise costs on

students."

"Further, canceling student debt will signal to future borrowers that their debt will also be canceled

at some point, creating a moral hazard," Morales continued. "College students will take on as much debt as they wish, as they

expect no consequences of taking it on. This, too, will allow colleges to continue to raise prices. [Emphasis

mine]"

Biden's "unfair" and "regressive" student debt transfer "scheme" will "lead to further

increases in college costs in the future," concurred The Heritage Foundation's director of the Center for Education

Policy. "It requires working Americans to pay off the degrees of bachelor's and professional degree holders while being yet

another handout to woke universities." Adam Kissel, a visiting fellow in higher education at The Heritage Foundation, agreed

that "canceling student debt will drive tuition up," in turn incentivizing students to take on more debt "in

the hope of cancellation later," which he explained "will encourage colleges to raise tuition even higher.

[emphasis mine]" Kissel declared, "Government subsidies cause prices to rise—that's basic economics."

According to a 2021 report by the Foundation for Economic Education (FEE), new students

will demand year-after-year that their loans be "forgiven" too.

Colleges and universities will "respond to this new reality by raising tuition commensurately," FEE

said. Tuition and fees maintained a constant 18 percent to 19 percent of family income from the 1960s until 1978. Then in 1965,

the federal government started guaranteeing student loans, and in 1973, Congress established Sallie Mae (Student Loan Marketing

Association) and charged it with providing subsidized students loans. So, by 1978, tuition and fees had started "a steady

march" to 45 percent of family income today. "When the government makes it less painful for students to borrow,

whether by guaranteeing, subsidizing, or forgiving loans, it takes away some of the pain of student borrowing, which makes it

easier for colleges and universities to raise tuition."

More than a decade ago, during the presidency of Barack Obama, the federal government was blamed

for the high cost of attending college, According to a 2011 op-ed by Mary Kate Cary, who served as a White House

speechwriter for President George H.W. Bush from 1989 to early 1992, President Obama believed he'd calm down the protests

over the high costs of a college education by easing the terms of loan repayment and forgiveness. He signed legislation that

ended subsidies for private banks. giving federally guaranteed student loans. The federal government, not banks, became the

lender of choice for most students. The former White House speechwriter posited that, as a result, college tuitions

“are artificially high directly because of federal financial aid," thereby creating a cycle of politicians buying votes by

throwing money at students and colleges increasing expenses.

"The more money the federal government pumps into financial aid, the more money the colleges

charge for tuition, [Emphasis mine]" Cary wrote. She observed that inflation-adjusted tuition and fees had tripled

over the previous 30 years while financial aid had quadrupled, which meant that student aid went up faster than tuition

itself. "Thanks to the federal government, massive sums of money were available to pay for massive tuitions," Cary

wrote. "Colleges can raise tuition with impunity because colleges know they'll get paid no matter what.

[emphasis mine]"

Meanwhile, the non-profit Committee for a Responsible Federal Budget (CRFB) estimated that

- not accounting for other reforms in federal financial aid - outstanding federal student loan debt will return to the current

$1.6 trillion level in just 4 years after the $10,000 per borrower is "cancelled." According to the CRFB, if

all debt were to be "cancelled," the debt would return to today's level in 15 years.

Rice's claim that Biden's plan will protect against universities jacking up the price tag on

tuition is FALSE, according to experts and historical patterns. Time, of course, will tell, but history tends to repeat

itself.[2]

It’s hard to top President Biden’s Afghan withdrawal for reckless policymaking, but his student-loan

forgiveness scheme is a contender for his second worst decision. Based merely on his say-so, with no credible congressional

authorization, Biden is going to forgive $10,000 in student debt for individuals with incomes below $125,000 or household

incomes below $250,000. Those who received a Pell Grant are eligible for $20,000 in relief.

Forgiveness is a sop to a narrow class of people. It is unfair to people who haven’t gone to

college, predominantly lower income. It is unfair to people who did go to college and didn’t take on loans. It is unfair to

people who repaid their loans. It is unfair to people who will take a loan the day after the forgiveness goes into

effect.

Of course, there are low-income people who are struggling with their student debt. Even if you think

they should get relief, the Biden policy doesn’t narrowly target them. Former Obama economist Jason Furman points out that

Biden’s forgiveness could provide $40,000 in relief to a married couple making just under $250,000, and it includes debt

incurred at graduate schools.

Student debt has been an obsession of Biden, along with that of his Liberal and Democratic

supporters. They deny it,

of course, but their focus reflects a deeply held, profoundly insulting assumption that those who have earned university

degrees are more valuable and worthy than all those Americans who haven’t. Then, there are the broader economic effects.

Advocates of loan forgiveness used to argue that it would be stimulative, but in an inflationary environment, they aren’t

putting that argument front and center anymore.

The program is a debacle at every level and it is not the product of a congressional

compromise or unavoidable circumstances - it’s Biden’s disaster, and his alone.[3]

As I have written before (Ref.’s 4, 5, 6, 7, 8, 9, 10), exorbitant

college costs are largely driven by the federal money that is lavished upon our institutions of higher learning. President

Biden’s plan to have taxpayers cover $300 billion – more than likely to grow considerably- of outstanding college debt for

millions of borrowers is just one more example of the Liberal bent of pouring money on any and every problem that

arises. The result will be the same as that of pouring gasoline on a fire – the fire gets worse! With Biden’s

ill-advised action, so will the cost of a college education.

With respect to the Biden administration extending the “pause” on student loan payments, those who

took out student loans will have been able to go 2-1/2 years without making a single payment nor accruing any new interest -

a raw deal for taxpayers. Since the beginning of the covid pandemic, the pause has cost taxpayers more than $130 billion in

interest payments.

As if that were not sufficient largesse, President Biden has now proposed outright “forgiveness”

of some portion of all student loan balances. Here, “forgiveness" is a euphemism for a taxpayer-funded bailout. It’s bad

policy from any angle.

It is incredibly regressive. The Urban Institute found that “most outstanding student loan

debt is held by people with relatively high incomes. … [It] is disproportionately concentrated among the well off.” While

lower-income households make a up a larger share of borrowers, upper-income households make up a larger share of outstanding

student loan debt. That’s because 48 % of student loan debt is held by households whose borrowers earned graduate degrees.

Professional degree holders (doctors and lawyers, for example) earn a median annual salary of $96,772, far more than those

who did not attend or graduate college. The more generous student loan forgiveness becomes, the more it benefits

upper income earners.

Additionally, there is the moral hazard. Student loan forgiveness would likely encourage colleges to

raise tuition even higher - particularly if graduates expect student loans to be forgiven again in the future. Indeed, if

current student loan balances are forgiven, why wouldn’t today’s students borrow the maximum amount allowed to attend the

most expensive school possible, with the expectation that their debt will also be forgiven in the future?

Let’s admit it - student loan forgiveness is unfair to those who chose not to attend college,

those who worked their way through college to avoid taking on debt, and those who paid off their debt as promised.

44% of students who began a four-year degree in 2009 did not borrow anything to attend, and one-quarter borrowed less than

$10,000. Having chosen not to take on debt, they should not now be asked to repay a loan they never took out.

And then there are the broader economic impacts. Regarding inflation, both the moratorium and broader

forgiveness are gasoline on the fire. Absolving people of a debt reduces the incentive to work and reduces participation in

the labor market. That retards economic output and drives up prices. Furthermore, repaying student loans would help reduce

the money supply, taking the oxygen away from the inflationary fire and helping to keep down prices.

When the pause on student loan repayments ends, it should not be renewed. And the Biden

administration should abandon its misguided, regressive, expensive, inflationary, and morally hazardous pursuit of student

loan forgiveness. The president may think it politically expedient, but the long-term consequences would be

disastrous.[11]

---------------------------------------------------------------------------------------------------------------------

References:

- Why Is College So Expensive?, Casey Bond, the balance, 20 December 2021.

- Ticker: Federal student loan interest rates to increase, Boston Herald: Pg 16,

16 May 2022.

- Will Colleges Raise Tuition Due to Biden's Student Debt 'Forgiveness' Plan?, Mia Cathell,

Townhall,

26 August 2022.

- Unpacking Biden’s student debt debacle, Rich Lowry, Boston Herald: Pg 14,

27 August 2022.

- Why is college so expensive, Paul Kix, Boston Sunday Globe: Pges K1 and K3,

25 March 2012.

- Does A College Education Have To Cost So Much?, npr.org/ , 14 December 2011.

- Commonsense lesson for college students, Cal Thomas, Boston Herald: Pge 11,

5 May 2012.

- The government’s college money pit, Jeff Jacoby, Boston Globe: Pge K9, 29 April 2012.

- Why Does it Cost So Much to go to College?, Son of Eliyahu: Article 122, 7 May 2012.

- Time to go after Big College’s soaring costs, Editorial, Boston Herald: Pg 14,

16 May 2022.

- Biden’s Student Loan “Forgiveness” Plan Is a Raw Deal for Taxpayers, Lindsey M. Burke, Ph.D. and

EJ Antoni, The Heritage Foundation, 16 May 2022.

|

|