Comments on Government and More

© David Burton 2019

Comments on Government and More© David Burton 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

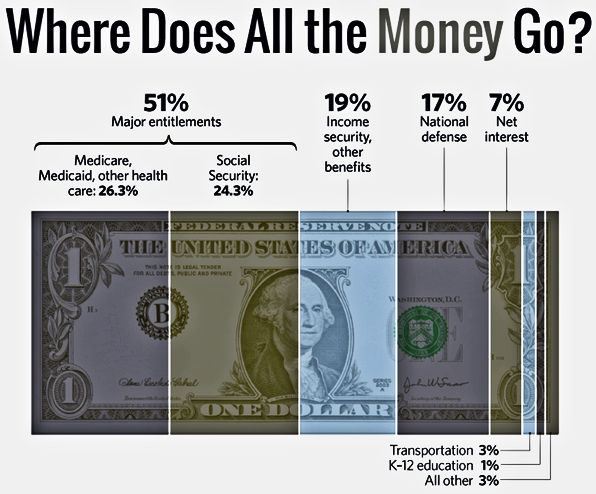

More “Current U.S. government spending is $4.746 trillion. That's the federal budget for fiscal year 2020 covering October 1, 2019, to September 30, 2020. It's 21% of gross domestic product according to the Office of Management and Budget Report for FY 2020. "Before the recession, the government kept federal spending below 20% of GDP. It grew no faster than the economy, around 2% to 3% per year. During the recession, spending grew to a record 24.3% of GDP in FY 2012. This increase was due to economic stimulus and two overseas wars. “At the same time, growth slowed. That reduced tax receipts. Congress worried about the ballooning U.S. debt. No one could agree on how to reduce it. As a result, Congress enacted a 10% budget cut, called sequestration. That finally reduced spending to 20.7% of GDP in FY 2015. “Since then, spending has crept up again despite the sequester. Congress and the president rely on deficit spending to boost economic growth. But deficit spending is out of control. [Emphasis mine] It rises each year even when the economy is doing well. “Almost two-thirds of federal spending goes toward paying the benefits required by Social Security, Medicare, and Medicaid. [Emphasis mine] These are part of mandatory spending. Those are programs established by prior Acts of Congress. “The interest payments on the national debt consume 10% of the budget. These are also required to maintain faith in the U.S. government. “The remaining 30% of spending goes toward discretionary spending. This pays for all federal government agencies. The largest is the military. “The mandatory budget will cost $2.841 trillion in FY 2020. Mandatory spending is skyrocketing because more baby boomers are reaching retirement age. By 2030, one in five Americans will be older than 65. “Note: Social Security costs the most at $1.102 trillion. Current payroll taxes provide $949 billion of the income. Interest from the Social Security Trust Fund pays for the rest. "But the costs will outpace interest and income by 2034. At that time, Social Security benefits will begin draining the general fund. It also means Congress can no longer "borrow" from the Social Security Trust Fund to pay for other federal programs. “But the costs will outpace interest and income by 2034. At that time, Social Security benefits will begin draining the general fund. It also means Congress can no longer ‘borrow’ from the Social Security Trust Fund to pay for other federal programs. [Emphasis mine] “Medicare ($679 billion) and Medicaid ($418 billion) are the next largest expenses. Medicare taxes pay for $289 billion of its cost. The rest comes from the general fund. "In FY 2020, interest payments on the national debt are estimated at $479 billion. That's enough to pay for 10 Justice Departments. It's also one of the fastest growing expenses. "By 2029, it will more than double to $823 billion, becoming the third-largest budget item after Social Security and Medicare. It's not a mandatory program, but it must be paid to avoid a U.S. debt default. These estimates will increase as interest rates continue rising.” [Emphasis mine] (Ref. 1) Compare these 2019-2020 government spending figures with our government’s spending in the earlier 2012-2014 time frame that is presented below. Then decide on whether or not things are improving. Back in 2014 the national debt for the first time exceeded $18 trillion which was ten times the entire debt incurred in our first 200 years as a nation. The federal government is just too big and bloated, which means it spends too much money and wastes too much money. Duplication of federal programs and services alone costs an estimated $45 billion. Annual spending on Social Security, Medicare, Medicaid, and other health programs is massive compared to even the most egregious other parts of the federal budget. Further back in 2012, government spending was split as follows: Major Entitlements: 45% (Medicare, Medicaid, other health care – 23%; Social Security - 22%) Income security and other benefits: 19% National defense: 19% Net interest: 6% Note: Income security and other benefits includes federal employee retirement and disability, unemployment compensation, veterans benefits, food and housing assistance, and other federal income security programs. Source: Office of Management and Budget In 2014, the breakdown of how your federal tax dollars tax dollars were used was reported to be as follows:  “Tax dollars paid for about 85 cents of every dollar spent in 2014—the rest was

borrowed. . . .

“Tax dollars paid for about 85 cents of every dollar spent in 2014—the rest was

borrowed. . . . “Your 2014 tax dollars . . . went primarily to pay for government benefits. [Emphasis mine] “Major entitlements (Medicare, Medicaid, Obamacare and Social Security) devoured more than half of the 2014 budget at 51 percent of spending. Other federal benefits took another 19 percent, meaning that 70 percent of government spending went to pay some sort of benefit to someone. These additional ‘income security’ and other benefits include federal employee retirement and disability, unemployment benefits, and welfare programs such as food and housing assistance. “Obamacare spending really only kicked in for the first time in 2014. But Obamacare spending alone is expected to grow the major entitlement budget by 44 percent over the next decade. All in all, the total spending increase due to Medicare, Medicaid, Obamacare, Social Security and interest on the debt over the next decade is 85 percent. This means that the share of the budget going to entitlement programs will grow even bigger if Congress doesn’t act.” (Ref. 2) “HARDLY A DAY goes by without some eminence from business or finance proclaiming . . . that capitalism is in crisis and must be overhauled if it is to survive and not be replaced with some variant of socialism. Inequality, climate change, obscene levels of corporate profits, stagnant wages, soaring healthcare costs, crushing levels of student debt, rampant Wall Street greed, high-tech monsters and much more are all laid at the feet of an allegedly heartless, unresponsive capitalistic system. “It ain't so. Contrary to all this highbrow hand-wringing, the problem is bad government policies and, worse, a fundamental misunderstanding of free markets. [Emphasis mine] . . . - - - “Government mistakes--not inherent flaws in free markets--are at the root of every economic crisis in modern times. The Great Depression was triggered by the draconian Smoot-Hawley Tariff Act, which imposed higher taxes on thousands of import items, triggering a global trade war that devastated economies. This felony was compounded when countries--Germany, Britain and the U.S. were the worst offenders--substantially raised taxes in the teeth of a sharp downturn. “The terrible inflation of the 1970s was the result of the Federal Reserve and other central banks repeatedly printing too much money. The crisis of 2008–09 sprang from the U.S. deliberately weakening the dollar, which set off a flight to hard assets such as housing. “High taxes are growth-killers. Taxes are a burden. Countries that keep the burden light do better than those that don't. After it recovered from WWII, Europe had growth rates comparable to or even better than those of the U.S. But in the 1970s the weight of taxation became heavier and heavier with the imposition of VATs and higher effective income tax rates. Result: microscopic paces of expansion. “Every time the U.S. has enacted big tax cuts, its economy has blossomed. [Emphasis mine] The economy's post-Obama pickup came from the 2017 tax reduction and deregulation. “Excessive regulations hurt. [Emphasis mine] . . . “ (Ref. 3) No matter how you feel about the person, the inescapable fact is that Donald Trump and his administration have reduced taxes – both personal and business – and, over the same span of time, he and his administration have greatly reduced excessive government regulations. Is this a change for the better? On another note, we continually hear about the exorbitant cost of higher education in this country. Blame for this is assessed everywhere, except in the right place. Our demagogue politicians have all sorts of solutions to the problem, except the right one. So, who is really to blame and what is a realistic solution? First, “Don't blame student debt on free enterprise. Government is the villain. [Emphasis mine] . . . Washington created programs to help people pay for college, primarily Pell Grants and student loans. Studies from the New York Fed and others confirm that the more money colleges collected via these schemes, the more students were charged.” [Emphasis mine] (Ref. 3) One possible solution to the problem that I proposed back in 2012 is as follows: Allow “students and universities to enter into a contract which would require a given percentage of the student’s future earnings to be paid to the university for a specified number of years. The percentage to be taken from the student’s earnings and the amount of time over which the earnings would be 'taxed' would be negotiated between the student and the university. The monies paid to the colleges and universities would be taken from earnings much as taxes are now paid from one's earnings - withholding payments from each paycheck and/or with each quarterly estimated tax payment. Conceivably, the percentage rates could be capped by law, much as loan rates are capped under usury laws.” (Ref. 4) This, of course, presupposes that we first eliminate the major cause of the problem by getting the government out of the business of financially supporting colleges and universities – let the free market operate in the field of higher education. For more on the subject, see Fixing the Problem of High College Costs (Ref. 5) -------------------------------------------------------------------------------------------------------------------------- References:

|

| 24 May 2019 {Article 360; Govt_79} |