| |

As is clearly obvious, college costs continue to spiral out of control, largely

as a result of the government guaranteeing a continuous supply of customers (students) and an ever increasing

supply of money for the colleges (government grants, loan guarantees, and government financing). In 2012,

I noted that “Over the past three decades, college tuition has increased at more than double the rate of inflation.

Outstanding student loan debt in the United States now exceeds $1 trillion, a national burden even greater than

that of credit cards.” (Ref. 1) While this was debt for students

and their parents, it was mana from heaven for colleges and universities.

While college education costs have been steadily spiraling upward, the government has been

pouring more and more money into higher education – and now there is a cry to pour even more taxpayer money into

this apparently bottomless pit.

“As bank-robber Willie Sutton exclaimed when asked why he robbed banks, ‘That’s where the

money is.’ So it is with college education. Colleges and universities are anything but stupid. They quickly

realized that they could make lots more money by enrolling more students, knowing that, a) the federal government

would pick up the tab, or, b) the federal government would guarantee student loans, i.e., even if the student

defaulted on paying back his or her student loan, the federal government would cover the default. In other words,

the college or university could not lose. In addition, colleges and universities could raise their prices without

fear of pricing themselves out of the marketplace. No matter what they charged, Uncle Sam would pay the bill -

one way or another.” (Ref. 2)

“Schools know that students have access to tens of billions of dollars in grants and

loans, . . . and they raise tuition because the aid lets them do it.

In the case of for-profit colleges, they can opt to either receive federal aid or to

refuse it. A Harvard and George Washington University study found that the schools receiving federal grants and

loans set their tuition roughly 75 percent higher than those institutions that go without government

support.” (Ref. 3)

“There are multiple ways to rein in the high costs of advanced education. One step in that

direction is for the government and the public to acknowledge that, a) not everyone is qualified for higher

education, and, b) not everyone needs a college education – it may be desirable to go to college but it is not

absolutely necessary. Another step in that direction is for the government to award student grants and to guarantee

tuition loans on the basis of both qualification and need, i.e., to provide financial support only to

best-and-brightest who are in real need and not solely on the basis of need.”

(Ref. 2)

If income is effectively guaranteed to colleges and universities by the state and federal

governments, they have little incentive to control their costs. A college professor, once tenured, is essentially

guaranteed lifetime employment, no matter how ineffective or inefficient he is; the costs of university buildings

and classrooms are irrelevant – the more elegant the better; salaries are not necessarily based on the marketplace

nor the teaching quality of the individual – a recognized name is often more important than teaching

ability.

“The presidents of the universities, the senior officials, the key faculty do not get

rewarded by being efficient, by teaching more students for the same amount of money or whatever, by using

buildings efficiently, six, seven days a week, et cetera. There's no incentive in that for them.

“So, there's no great compulsion to reduce costs, and yet spending more money often has

rewards. It can help improve your rankings in the magazine rankings that go on by magazines like US News or Forbes.

And it is actually beneficial to colleges, or at least it's perceived to be beneficial to colleges, to spend more

money: nicer facilities for students so you attract more students, better students, whatever, lower teaching loads

for faculty so that they're happy and content and not likely to cause a lot of problems.

“So the job of a university president is to raise a lot of money, tons of money, and

distribute it, and not too much attention is placed on lowering the cost to the consumer.”

(Ref. 4)

An exceedingly strong case can be made for the argument that the government is at the

root of the problem of the high cost of a college education. Our government has told the public that everyone is

entitled to a college education. Our politicians declare that it’s a national obligation to go to college –

irrespective of whether or not that individual is realistically qualified to go to college. At the same time, the

government has set up loan and grant programs to ensure that the colleges and university in this country have every

incentive to enroll more and more students at ever increasing costs. After all, the government is providing the

money, or, at least guaranteeing that loans to students will be repaid. The more students the colleges admit and

the more colleges and universities charge, the more money they receive and the greater is their profit. Colleges

have no incentive to reduce or contain costs and our college-age youth are repeatedly told by our politicians that

they all are entitled to a college education – no matter whether they can afford it; no matter whether they are

really qualified for it; and no matter whether they would be better off financially in the long run without the

college education.

In higher education, as in housing and health care, the push to give something to everyone

by entitlement, whether or not they need it, can afford it, or are qualified for it, has driven up the cost. The

high cost of a college education is being largely driven by government entitlement programs and a misdirected

higher education policy.

“IF INSANITY is doing the same thing again and again but expecting a different outcome,

then the federal government’s strategy for keeping higher education affordable is crazier than Norman Bates.

“For decades, American politicians have waxed passionate on the need to put college within

every family’s reach. To ensure that anyone who wants to go to college will be able to foot the bill, Washington

has showered hundreds of billions of dollars into student aid of all kinds – grants and loans, subsidized work-study

jobs, tax credits, and deductions. Today, that shower has become a monsoon. . . . government outlays intended

to hold down the price of a college degree have ballooned, in inflation-adjusted dollars, from $29.6 billion in

1985 to $139.7 billion in 2010.

- - -

“And what he we gotten for this vast investment in college affordability? Colleges are more

unaffordable than ever.

“Year in, year out, Washington bestows tuition aid on students and their families. Year in,

year out, the cost of tuition surges, galloping well ahead of inflation. And year in, year out, politicians vie to

outdo each other in promising still more public subsidies that will keep higher education within reach of all.

Does it ever occur to them that there might be cause-and-effect relationship between the skyrocketing aid

and the skyrocketing price of a college education? That all those grants and loans and tax credits aren’t containing

the fire, but fanning it? [Emphasis mine]

“Apparently not.” (Ref. 5)

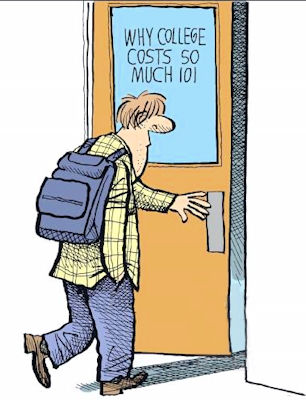

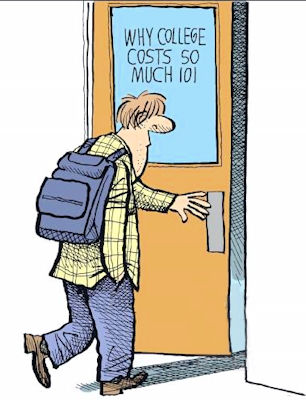

Just when will the facts become obvious to our government leaders? It’s not rocket

science, it’s just economics 101, stupid!

“Federal financial aid is a major source of revenue for colleges and universities . . .

That gives schools every incentive to keep their tuition unaffordable. Why would they reduce their sticker price

to a level more families could afford, when doing so would mean kissing millions of government dollars goodbye?

Directly or indirectly, government loans and grants have led to massive tuition inflation. That has been a boon for

colleges and universities, where budgets, payrolls and amenities have grown amazingly lavish. And it has been a

boon for politicians, Republicans and Democrats alike, who are happy to exploit anxiety over tuition to win

votes.

“. . . The more government has done to make higher education affordable, the more

unaffordable it has become. More of the same won’t yield a different outcome. By now, even Norman Bates would have

figured that out.” [Emphasis mine] (Ref. 5)

Another consequence of the government pouring money into our higher education system is

that, as frequently reported, American students are no longer the best and the brightest in the world. Why is this?

One answer is that our universities take in many less-qualified students and keep them enrolled in order to continue

receiving the government-backed monies that send these students to college. If a college accepts only the top 10%

of candidates, they can teach at the level of this top 10%. But, if they take in the top 50%, then they must teach

at the level of those at the bottom of the 50% range in order to keep the poorer students from flunking out. Losing

these lower performing students means that the college would lose the funding that these poorer students (with

government backing) provide. To keep the money rolling in, educational standards have to be lowered. Only the most

elite of colleges can survive on reputation. The rest need the monies that lower educational standards

provide.

“If elected president, Hillary Clinton has promised to spend $350 billion to make colleges

‘more affordable’. The U.S. already has an $18 trillion debt (and growing by the day), but Clinton wants to add to

it. That’s not affordable.

- - -

“. . . direct grants and other federal help to universities began to increase in

the late 60’s, leading to a rise in the cost of tuition. [Emphasis mine] . . .

“. . . {T}he astonishing rise in college tuition correlates closely with a huge

increase in public subsidies for higher education. [Emphasis mine] . . .

- - -

“Hillary Clinton’s proposal is a vote-buying effort that will add one more entitlement to

an economy that can’t afford it. . . .

- - -

“If American politicians can’t be an example of what living within one’s means looks like,

how can we expect younger people to embrace a Puritan ethic that served us well before envy, greed and entitlement

took over? (Ref. 6)

“. . . Hillary Clinton’s free-college proposal has about it that same unmistakable air of

pandering.

“{Her populist campaign slogan is:} ‘Costs won’t be a barrier. Debt won’t hold you

back.’

- - -

“But Clinton is promising something she knows she can’t deliver.

“Her plan promises free tuition at all community colleges. It promises students at

four-year public colleges and universities that they will never have to borrow money for tuition, books or fees.

It promises lower interest rates for all student borrowers, and promises students ‘never having to repay more than

they can afford.’ {In other words, it promises them another taxpayer-funded free lunch, paradise and eternal

bliss.}

“In Clinton’s higher ed utopia, public colleges and universities will {miraculously} lower

their costs. {Cash-strapped} States will {altruistically} make massive new investments in higher education. More

students will graduate within four years.

“In addition to offering everything that every student and family ever dreamed of,

Clinton’s plan is burdened by the need to get it through Congress. Her team estimates it will cost $350 billion

over 10 years. She would pay for it by ‘limiting certain tax expenditures for high-income taxpayers'. {Just some

more fuel on the fire of the class warfare strategy of the liberals and socialists of robbing the ‘rich’ and giving

to the ‘poor’.}

“. . . {T}he complex scheme as Clinton presents it is the Obamacare of higher education. It

tries to be all things to all people (except for the taxpayers paying more to finance it). . . . this plan is

an ivory tower fantasy.” (Ref. 7)

Instead of the government wasting more taxpayer money on higher education, I suugested

another approach in 2012. (Ref. 1)

What I proposed was ”to allow students and universities to enter into a contract which

would require a given percentage of the student’s future earnings to be paid to the university for a specified

number of years. The percentage to be taken from the student’s earnings and the amount of time over which the

earnings would be ‘taxed’ would be negotiated between the student and the university. The monies paid to the

colleges and universities would be taken from earnings much as taxes are now paid from one's earnings - witholding

payments from each paycheck and/or with each quarterly estimated tax payment. Conceivably, the percentage rates

could be capped by law, much as loan rates are capped under usury laws.”

Under such a plan the following befits would accrue:

- Parents would be off the hook of paying for their childrens’ college expenses.

- College graduates and parents would not be burdened with fixed repayment loans whether or not the borrowers

could afford the repayments at any given point in time.

- The college students would only have to pay a percentage of their future incomes – what they could afford,

since they would pay less if their income was low and more if their income was high and nothing if they had no

income.

- In the case of the highly successful, e.g., Bill Gates, both the college student and the university would reap

the rewards of the high income. In such cases, the college or university would receive significantly more than the

average cost of a college education.

- Colleges would share in the risks/benefits of a college education. If they turned out excellent students who

earned lots of money, the college would receive a large income stream. If the colleges bestowed degrees on poor

students who didn’t earn large amounts of money after matriculation, the colleges and universities would receive a

lower return on their “investment.” In other words, colleges would be paid on the basis of performance – an

incentive to turn out the “best and brightest” rather than the issuing of diplomas in “diploma-mill” fashion.

- The cost to the government of financing and administering a federal student aid program would be eliminated.

The political ramifications of federal student aid programs would also be eliminated. There would no longer be the

periodic crisis associated with renewing or modifying the government program. Financing and administering would be

left to the colleges, universities and private 3rd parties. Government interference would be eliminated.

- The program would be totally flexible. The student could decide on what portion of his college costs to finance

under the program, what portion to pay out of pocket (grants, scholarships, or his/her own or parents earnings and

savings), or what to pay with borrowed money (private student loan programs) and when repayments would commence and

end.

- The burden of filling out financial aid applications would be eliminated. Instead, the student and college would

simply sign a document akin to a mortgage agreement – the college would agree to provide the education and the

student would agree to have a fraction of his or her income deducted and paid to the school for a specified period

of time. The requirement to establish financial need would be done away with.

There are a number of other options that could be employed. For example, the percent of

salary paid to the college over a period of years could be variable so that the graduate would keep a larger

portion of his salary when he first enters the labor market and his family financial needs might be high and

then gradually increase the percentage as his salary level increases and his financial needs, as a percentage

of income, decrease.

It's time to think out of the box. A college education should not have to break the bank.

Simply pouring more money at the problem may be the government's way of doing business - it is not, however, the

way that the problem will ultimately be solved.

The solution to the problem of high college costs is to stop doing what has been shown to

be a failure. Stop feeding the beast! The liberal solution of simply throwing more and more money

at a problem, as usual, has failed to fix the problem. More money is only making the problem worse. It’s time to

face reality and to innovate, rather than more of the same old, same old. Let’s stop the political

pandering and start applying some intelligence to coming up with realistic solutions to the problem. College costs

can be reduced – but only if our leaders, politicians and, most importantly, the masses get serious about making it

happen. Simply complaining about high college costs won’t hack it!

---------------------------------------------------------------------------------------

References:

- An Affordable College Education Plan, David Burton, Sonofeliyahu.com; Article 132,

8 July 2012.

- Why Does it Cost So Much to go to College?, David Burton, Sonofeliyahu.com;

Article 122, 7 May 2012.

- Why is college so expensive, Paul Kix, Boston Sunday Globe, Pages K1 and K3,

25 March 2012.

- Does A College Education Have To Cost So Much?, Talk of the Nation, NPR Radio,

Accessed 26 March 12.

- The government’s college money pit , Jeff Jacoby, The Boston Globe, Page K9,

29 April 2012.

- Colleges don’t need more subsidies, Cal Thomas, Boston Herald, Page 11,

15 August 2015.

- A lesson in overreach, Op-Ed, Boston Herald, Page 14, 17 August 2015.

|

|