| |

The Affordable Care Act, better known as ObamaCare was a 900 page bill approved

into law in 2010. There are many provisions that have been implemented since 2010, and will continue to

be introduced over the next 5 years. Nancy Pelosi said that Congress needed to first pass the ObamaCare

legislation and then, afterwards, find out what was in the legislation. Only now are we beginning to

learn the ugly facts of what was included in the ObamaCare legislation. While most provisions of

ObamaCare go into effect in in 2014, some changes are taking place in 2013. Most of us will not notice

the impact of Obamacare in 2013 since the bulk of the changes will occur in health facilities and

government offices that are gearing up for the larger changes coming in later years, i.e.,

in 2013, the huge government infrastructure and bureaucracy needed to oversee ObamaCare

is being established and, once in-place, their elimination or reduction in size will be

problematic as historically been the case with all government bureaucracies and agencies. Once in

place, they tend to be permanent.

We are already witnessing the dropping of health care coverage by some

large companies who would rather pay the penalties for non-coverage then the much higher costs

mandated by ObamaCare. Some smaller companies are laying off employees to get under the 50-employee

threshold at which they would be forced to provide health insurance or pay penalties. Still other

small companies are reducing employee weekly working hours to 30-hours or less, again in order to

get under the 30-hour a week threshold at which they would be forced to provide health insurance

or pay penalties.

Several states and unions have applied for exemptions to the ObamaCare

mandates as they learn the negative consequences of submitting to the provisions of the Affordable

Care Act.

One of the most contentious provisions of ObamaCare is the Independent

Payment Advisory Board (IPAB). IPAB is a 15-member independent panel charged with making

recommendations to reduce Medicare spending if the amount the government spends grows beyond a

target rate. Some argue that this board has the power to ration health care and is not under

congressional control.

One of the promises made by president Obama in urging the passage of the

Affordable Care Act was that there would be no new taxes imposed upon the American people. The

fallaciousness of this promise is now being clearly exposed.

“While the individual mandate tax gets most of the attention, the

ObamaCare law actually contains 20 new or higher taxes on the American people. [Emphasis

mine] These taxes are gradually phased in over the years 2010 (with its 10 percent ‘tanning tax’)

to 2018 (when the tax on comprehensive health insurance plans kicks in.)

“. . . in January 2013, five major ObamaCare taxes . . . come into

force:

1. The ObamaCare Medical Device Manufacturing Tax

“This 2.3 percent tax on medical device makers will raise the price of

. . . every pacemaker, prosthetic limb, stent, and operating table. Can you remind us,

Mr. President, how taxing medical devices will reduce the cost of health care?

[Emphasis mine] The tax is particularly destructive because it is levied on gross sales and even

targets companies who haven’t turned a profit yet.

“These are often small, scrappy companies with less than 20 employees who

pioneer the next generation of life-prolonging devices. In addition to raising the cost of health

care, this $20 billion tax over the next ten years will not help the country’s jobs outlook, as

the industry employs nearly 400,000 Americans. Several companies have already responded to the

looming tax by cutting research and development budgets and laying off workers.

2. The ObamaCare High Medical Bills Tax

“This onerous tax provision will hit Americans facing the highest

out-of-pocket medical bills. Currently, Americans are allowed to deduct medical expenses on

their 1040 form to the extent the costs exceed 7.5 percent of one’s adjusted gross income.

“The new ObamaCare provision will raise that threshold to 10 percent,

subjecting patients to a higher tax bill. This tax will hit pre-retirement seniors the hardest.

Over the next ten years, affected Americans will pony up a minimum total of $15 billion in taxes

thanks to this provision.

3. The ObamaCare Flexible Spending Account Cap

“The 24 million Americans who have Flexible Spending Accounts {FSA} will

face a new federally imposed $2,500 annual cap. These pre-tax accounts, which currently have no

federal limit, are used to purchase everything from contact lenses to children’s braces. With the

cost of braces being as high as $7,200, this tax provision will play an unwelcome role in everyday

kitchen-table health care decisions.

“The cap will also affect families with special-needs children, whose

tuition can be covered using FSA funds. Special-needs tuition can cost up to $14,000 per child

per year. This cruel tax provision will limit the options available to such families, all so

that the federal government can squeeze an additional $13 billion out of taxpayer pockets over

the next ten years.

“The targeting of FSAs by President Obama and congressional Democrats is

no accident. The progressive left has never been fond of the consumer-driven accounts, which serve

as a small roadblock in their long-term drive for a one-size-fits-all government health care bureaucracy.

“For further proof, note the ObamaCare ‘medicine cabinet tax’ which

since 2011 has barred the 13.5 million Americans with Health Savings Accounts {HAS} from

purchasing over-the-counter medicines with pre-tax funds.

4. The ObamaCare Surtax on Investment Income

“Under current law, the capital gains tax rate for all Americans

rises from 15 to 20 percent in 2013, while the top dividend rate rises from 15 to 39.6 percent.

The new ObamaCare surtax takes the top capital gains rate to 23.8 percent and top dividend rate

to 43.4 percent. The tax will take a minimum of $123 billion out of taxpayer pockets over the

next ten years.

“And, last but not least...

5. The ObamaCare Medicare Payroll Tax increase

“This tax soaks employers to the tune of $86 billion over the next ten years.

“As you can understand, there is a reason why the authors of ObamaCare

wrote the law in such a way that the most brutal tax increases {took} effect conveniently after

the 2012 election. It’s the same reason President Obama, congressional Democrats, and the

mainstream media conveniently neglect to mention these taxes and prefer that you simply ‘move on’

after the Supreme Court ruling.” (Ref. 1)

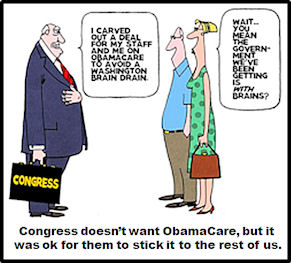

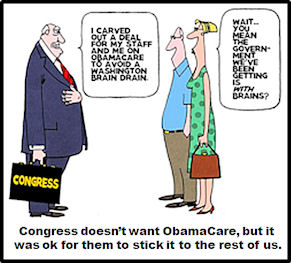

“If you ever doubted that the Affordable Care Act, derisively known as

‘Obamacare,’ was a grotesquely offensive, unworkable, nightmarish and authoritarian power grab by

the federal government to circumvent your healthcare choices and options, they should be completely

dispelled, now that congressional leaders are in talks to exempt that august body from its clutches.

Pathetic is the only way to describe it.

- - -

“Congressional leaders in both parties are engaged in high-level, confidential

talks about exempting lawmakers and Capitol Hill aides from the insurance exchanges they are mandated

to join as part of President Barack Obama's health care overhaul, sources in both parties said.

- - -

“- - - the talks involve the leadership of both chambers, the House and

Senate, and include House Speaker John Boehner, R-Ohio, and Senate Majority Leader Harry Reid,

D-Nev. Since getting to opt out of Obamacare would be such a sweet deal, this may be the only

piece of legislation that gets much bipartisan support all session.

“The talks are described as ‘extraordinarily sensitive’ - no doubt because

of the shamefulness of having foisted this monstrosity upon us, despite majorities who said they

did not believe the federal government had either the right or the ability to ‘manage’ cradle-to-grave

healthcare decisions for We the People.

“But they passed it anyway - and even though there was controversy at the

time because, supposedly, few, if any lawmakers, actually read it - - -

- - -

“Politically speaking, Democrats would - or should - suffer the worst if

Congress winds up screwing the rest of us while saving itself. That's because Democrats, who

controlled the presidency and both Houses of Congress, were responsible for Obamacare's passage.

“But Republicans would - and should - suffer as well, even though they have,

by and large, opposed Obamacare from the beginning and have made legitimate efforts to repeal it.

As members of Congress, it would be just as hypocritical for them to vote to exempt themselves,

as the tentacles of Obamacare increasingly strangle the healthcare system used by their constituents.

“Perhaps what is most troubling about this whole issue is the motivation

behind the notion: Selfishness. Obamacare's costs and provisions just might be uncomfortable for

some congressional staffers (and wasn't this law supposed to lower healthcare costs for consumers?):

.

“There is concern in some quarters that the provision requiring lawmakers

and staffers to join the exchanges, if it isn't revised, could lead to a ‘brain drain’ on Capitol

Hill, as several sources close to the talks put it. The problem stems from whether members and aides

set to enter the exchanges would have their health insurance premiums subsidized by their employer

- in this case, the federal government. If not, aides and lawmakers in both parties fear that

staffers - especially low-paid junior aides - could be hit with thousands of dollars in new health

care costs, prompting them to seek jobs elsewhere.

“Plus, lawmakers - especially those with long careers in public service

and smaller bank accounts - are also concerned about the hit to their own wallets.

- - -

“So, if Obamacare costs will hit you hard, lowly constituent, well, tough -

you just have to deal with it. But if it will mean our royal lawmakers will lose some precious staff

or might have to pay more themselves? Oh, my goodness! ‘We need an exemption!’

(Ref. 2)

“Currently, members of Congress and their staff are covered by plans they

choose through the Federal Employees Health Benefit Program, with taxpayers picking up 75 percent of

the tab. - - -

“- - - They {Congress} claim that despite their generous salaries (members earn

$174,000), they can’t afford Obamacare premiums. What the government deems ‘affordable’ for

the rest of us isn’t affordable for them. [Emphasis mine]

“For example, in New York City, a family of three with a household income

of $80,000 will be required to pay a whopping $12,784 for the second cheapest sliver plan with a

$3,000 deductible. This family won’t be eligible for a tax credit. Washington says $12,784 is

‘affordable’ for them. But not for a member of Congress with more than double the income. Under

the scheme the lawmakers are pushing, they would have to pay only $3,193 for the same plan.

“Nothing in the {un}Affordable} Care Act allows this break for Congress

and their staff. But for weeks, lawmakers from both parties – who can agree on nothing else – have

been conspiring to weasel out of paying what the public has to pay. On this one issue, Republicans

and Democrats are as thick as thieves. (Ref. 3)

Apparently, President Obama is complicit in the attempt to rewrite ObamaCare

“for the financial advantage of self-dealing members of Congress and their staffs.

“The ACA says members of Congress (annual salaries of $174,000) and their

staffs (thousands making more than $100,000) must participate in the law’s insurance exchanges

{rather than their current overly generous health care plans}.

- - -

“When Congress awakened to what it enacted, it panicked. This would cause a

flight of talent, making Congress less wonderful. So Obama directed the Office of Personnel

Management, which has no power to do this, to authorize for the political class special subsidies

unavailable for less privileged and less affluent citizens {i.e., you and me}.”

(Ref. 3)

Another facet of ObamaCare that is becoming clearer and clearer in 2013 is

the fact that millions of Americans will lose or be forced to give up their current health care

coverage. This is in spite of repeated promises from President Obama that we could keep our existing

health care plans if we so wanted. He lied! The truth is that he knew that this

promise could not be kept. “- - - Even before Congress voted to pass Obamacare, the Congressional

Budget Office warned that between 7 million and 8 million people would lose coverage at work because

of the law.”[4]

As more and more of the warts of ObamaCare come into public view, the clamor

for change and/or repeal grow. The hue and cry is now so loud that Obama and his Democratic cohorts

can no longer ignore the outcry.

“There has been much ridicule among the chattering class every time

congressional Republicans attempt – however fruitlessly – to repeal Obamacare.

“Yet here is the Obama administration itself delaying the implementation

of one provision after another because, of course, to set them all in motion would bring the health

care system crashing down around us.

“So to avoid the inevitable screaming, especially from key Obama political

constituencies, the administration has given waiver after waiver from some insurance provisions to

favored unions.

“Then just last month the White House – again with no congressional

input to actually change the law – simply announced a one year delay in the requirement that

large employers offer health care coverage to full-time employees or face a penalty. Individuals

faced with a similar dilemma and similar penalties are also demanding relief – thus far without

success.

“But this week {in August 2013} the administration announced yet another

delay – until 2015 – {of the provision} to limit out-of-pocket expenses, including deductibles

and co-pays - - -

- - -

“Now a cynic might say that this and all the other ‘grace periods’ being

re-written {without congressional approval} at the whim of the White House are carefully timed to

keep the chaos at bay until after the 2014 congressional elections. - - -

“{Let’s remember that} . . . the president promised in 2009, ‘we will place a

limit on how much you can be charged for out-of-pocket expenses, because in the United States of

America, no one should go broke because they get sick.’

“Which is now right up there with ‘if you like your health plan you can keep

your health care plan’ in the annals of presidential lies.”

(Ref. 5)

Total confusion reigns as implementation of the Affordable Care Act nears.

“Last week {May 2013}, the state of California claimed that its version of Obamacare’s health insurance

exchange would actually reduce premiums. ‘These rates are way below the worst-case gloom-and-doom

scenarios we have heard,’ boasted {the} executive director of the California exchange. But the

data that Lee released tells a different story: Obamacare, in fact, will increase

individual-market premiums in California by as much as 146 percent. [Emphasis mine]

“One of the most serious flaws with Obamacare is that its blizzard

of regulations and mandates drives up the cost of insurance for people who buy it on their

own. [Emphasis mine]

“This problem will be especially acute when the law’s main provisions

kick in on January 1, 2014, leading many to worry about health insurance ‘rate shock.’”

(Ref. 6)

And what is our president saying and doing about the Affordable Care Act?

“When he speaks, President Obama is more passionate than ever about the

affordable care act – or Obamacare.

“But his actions send a different message – delay if not retreat.

“First businesses got a one year reprieve from providing health insurance

to employees. Then, some insurers got a break: a one-year reprieve before consumer costs are

capped." (Ref. 7)

This leaves the average citizen in a predicament!

"Business won’t have to provide insurance, and costs to the

consumer won’t be capped. Meanwhile, citizens who don’t get insurance are subject to penalties

under the federal law.” [Emphasis mine]

(Ref. 7)

Why is Obama doing this? By delaying the implementation of ObamaCare,

he may be placating business interests without drawing enough anger to lose the 2014 mid-term

Senate elections. If Democrats were to lose the Senate in 2014, Congress could vote to repeal

ObamaCare or refuse to fund it. In any event, ObamaCare is proving to not be the home run that

he and Democratic Liberals had hoped it would be.

ObamaCare didn’t look too good to the American People in 2008 when it was

being proposed and in 2010 when it was railroaded through Congress and became law. Now in 2013,

as it begins to be implemented, it is looking terrible. What will ObamaCare look like during

and after the years 2014 through 2019 when it is fully implemented?

----------------------------------------------------------------------------------------

References:

- Five major ObamaCare taxes that will hit your wallet in 2013, John Kartch,

FoxNews.com, 5 July 2012.

- Members of Congress secretly negotiate their own exemptions from Obamacare mandates,

J. D. Heyes, NaturalNews.com, 5 May 2013.

- Obama’s Law: It’s what he says, George F. Will, Boston Herald, Page 19,

15 August 2013.

- Congress simply above health law, Betsy McCaughey, Boston Herald, Page 21,

7 August 2013.

- The liar in chief, OpEd, Boston Herald, Page 18, 15 August 2013.

- Rate Shock: In California, Obamacare To Increase Individual Health Insurance Premiums By 64-146%,

Avik Roy, Forbes, 30 May 2013.

- Is Obama retreating from Obamacare?, Joan Vennochi, Boston Sunday Globe,

Page K7, 18 August 2013.

|

|