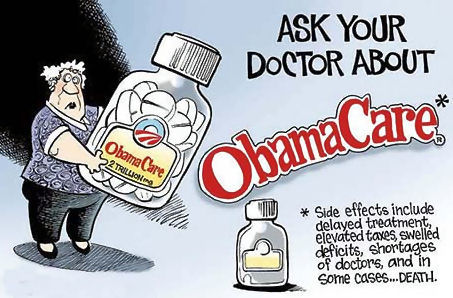

Kill ObamaCare Before it Makes Us All Sicker

© David Burton 2013

Kill ObamaCare Before it Makes Us All Sicker© David Burton 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

With ObamaCare, these same people will have free, or nearly free, medical care. And where will the money come from to pay for this “free” health care? It will come from the hard-working taxpayer, the America middle class - you and me! The non-contributing ObamaCare recipients feel “entitled” to free health care because they have been told that "healthcare is a universal right." These people want something they think they're getting for nothing. There is no such thing as "free". Someone is paying for it and that someone is you, me, and every other hard working American. If we don't foot the bill, ObamaCare will either make us pay a fine, or go to jail. The healthcare issue continues to heat up, as 1) full implementation nears, and 2) the full import of what is contained in ObamaCare becomes better known and more fully understood. One aspect of this monster healthcare program that is becoming clearer is the fact that costs will increase significantly in a variety of ways to many individuals and businesses. Among those increasing costs to individuals is the loss in real wages to many workers. Stealing From Medicare to Pay for ObamaCare One of the consequences that results from the passage of ObamaCare is the effect that it produces on Medicare and on the seniors that depend upon Medicare. “Paul Ryan said this about Medicare: And the biggest, coldest power play of all in ObamaCare came at the expense of the elderly. You see, even with all the hidden taxes to pay for the health care takeover, even with the new law and new taxes on nearly a million small businesses, the planners in Washington still didn't have enough money; they needed more. They needed hundreds of billions more. So they just took it all away from Medicare, $716 billion funneled out of Medicare by President Obama.” (Ref. 1 As described in Reference 1, “Obamacare cost about $1 trillion dollars over 10 years, according to the Congressional Budget Office {CBO}. . . . roughly half of that money {comes} through new taxes, and the other half was “raised” from cuts in Medicare.” Under the rules of rules of the CBO, Obamacare was allowed to call the money taken from Medicare an “offset” to the new spending. “So, Obamacare looked deficit neutral on paper, when in fact half of it was paid for with borrowed money.” “The $500 {More likely $716} billion in cuts to Medicare do not amount to cuts in benefits to patients, at least nominally. . . . Obamacare imposes efficiency requirements on doctors and hospitals that, over time, {they will be virtually impossible to maintain. The} government’s chief accountant for Medicare, estimates that 15 percent of all hospitals will fall into the red because of these cuts. Thus, seniors will have the same benefits on paper – but, much like those in the Medicaid program, they will find it difficult to find a doctor or hospital willing to provide the service.” In summary, to fund ObamaCare, President Obama and the Democrats “cut $500 {$716?} billion from the {Medicare} program; {they} used that money to cover the cost of ObamaCare; the cuts are likely going to result in barriers to access for seniors.” (Ref. 1) Realistically, the real cost of ObamaCare is unknown. But, based upon the cost growth history of nearly all major federal government programs, what is almost certain is that current cost estimates for the unaffordable ObamaCare program are grossly underestimated. The cost escalation process for ObamaCare has already begun. The Lie that Health Care Costs would Not Be Increased “Your medical plan is facing an unexpected expense, so you probably are, too. It's a new, $63-per-head fee to cushion the cost of covering people with pre-existing conditions under President Barack Obama's health care overhaul. “The charge, buried in a recent regulation, works out to tens of millions of dollars for the largest companies, employers say. Most of that is likely to be passed on to workers. “{An} Employee benefits lawyer . . . calls it a ‘sleeper issue’ with significant financial consequences, particularly for large employers. "’Especially at a time when we are facing economic uncertainty, {companies will} be hit with a multi-million dollar assessment without getting anything back for it,’" (Ref. 2) This cost increase comes in spite of the repeated claim by President Obama that ObamaCare would not increase health care costs to individuals – a claim that drew justified derision in 2009 and 2010 in view of the number of previously uninsured people that would be added to the health care rolls at public expense. “Employers are bracing for {these} big fees {to hit} next year . . . The fee goes to create a $25 billion fund for insurance companies to offset the cost of covering patients with high medical bills. “- - - The requirement is unfair, they say, because it subsidizes individually purchased plans that won't cover their workers. Companies including Boeing Co. (BA) and a union health plan covering retirees of General Motors (GM) Ford Motor Co. (F) and Chrysler, among other groups, have asked federal regulators to exclude or shield their insurance recipients from the fee. (Ref. 3) “Some Americans could see their insurance bills double next year as the health care overhaul law expands coverage to millions of people. “The nation's big health insurers say they expect premiums -- or the cost for insurance coverage -- to rise from 20 to 100 percent for millions of people due to changes that will occur when key provisions of the Affordable Care Act roll out in January 2014. - - - - - - “- - - the biggest price hikes are expected to hit a group that represents a relatively small slice of the insured population. That includes some of the roughly 14 million people who buy their own insurance as opposed to being covered under employer-sponsored plans, and to a lesser extent, some employees of smaller companies. “The price increases are a downside of President Barack Obama's health care law, which is expected to expand coverage to nearly 30 million uninsured people. The massive law calls for a number of changes that could cause premiums for people who don't have coverage through a big employer to rise next year -- at a time when health care costs already are expected to grow by 5 percent or more: • Changes to how insurers set premiums according to age and gender could cause some premiums to rise as much as 50 percent, according to America's Health Insurance Plans, or AHIP, an industry trade group that's funded by insurers. • A new tax on premiums could raise prices as much as 2.3 percent in 2014 and more in subsequent years, according to a study commissioned by AHIP. Policyholders with plans that end in 2014 probably have already seen an impact from this. • Requirements that insurance plans in many cases cover more health care or pay a greater share of a patient's bill than they do now also could add to premiums, depending on the extent of a person's current coverage, according AHIP. - - - “The impact of some cost hikes will be wide ranging. The new premium tax, for instance, will affect individual insurance, some employer-sponsored coverage and Medicare Advantage policies, which are privately-run versions of the government's Medicare program for the elderly and disabled.” (Ref. 4) In his 2013 State of the Union speech, president Obama continued to advocate for his health care program with a series of falsehoods and misrepresentations. With respect to his promise to reduce the cost of health care, we have the following: “The president claimed his national health insurance is driving down medical costs. It’s actually the reverse. [Emphasis mine] ABC News reported on the conclusion of the nonpartisan Health Care Institute: ‘Spending on health care rose 4.6 percent in 2011 – up $4,500 per person on average.’ The network also noted a Kaiser Family Foundation report that said: ‘Health insurance premiums for individuals and families also climbed year-over-year, up 3 percent ($186) on average for an individual and 4 percent ($672) on average for a family.’” (Ref. 5) The Promise that ObamaCare Would Not Create Any New Tax Increases or Increase the Deficit ObamaCare was touted as a health care plan that would incur no new tax increases. Such is clearly not the case. “According the U.S. Supreme Court, on 23 March of 2010, the largest tax increase in the history of the United States was signed into law - The Patient Protection and Affordable Care Act (PPACA), more commonly referred to as ObamaCare. In addition to the overall plan itself, he PPACA actually contains several new taxes, including:

So, the facts are clear that ObamaCare does indeed impose new taxes. In the midst of a prolonged economic recession, do we need these increased financial strains on the taxpayer and on American business? Under President Obama's health care overhaul all taxpayers and many others will have to pay for it. “The Affordable Care Act will extend health care coverage to some 30 million uninsured consumers along with an expansion of Medicaid services. It also promises a slew of tax credits for small business and middle-income families to help offset the costs of mandatory coverage. “Much of the cost burden will be shouldered by the health care industry and employers that provide workers with insurance. On an individual consumer level, however, it'll be the wealthiest Americans who feel the sting of ObamaCare” . . . What follows are a list of the new costs and on whom the payment burden will fall. “ Medicare surtaxes: . . . As of Jan. 1, 2013, a 3.8 percent surtax will be levied against surplus investments reported by the following groups: single filers reporting $200,000; married couples reporting $250,000; and married couples filing separately reporting $125,000. “In addition to the investment surtax, high-earning households will see their Medicare tax spike by 0.9 percent on their earned income . . . The tax will apply to individuals earning more than $200,000 and married couples filing jointly who make more than $250,000. It goes into effect Jan. 1, 2013. “Consumer penalties: . . . the law would mandate coverage for all Americans on pain of penalties. Those penalties . . . will kick off in 2014 . . . - - - “If you're not covered by your employer, you'll have to pick from a list of government-mandated health insurance packages . . . Some exceptions do apply, including low-income families who can prove financial hardship. “Flex spending account limits: In addition to capping Flexible spending accounts at $2,500 in 2013, new rules limiting what you can buy with flex accounts will remain. . . “Employee health coverage: Part of the Affordable Care Act's intent is to ensure that businesses choose low-cost plans, which it hopes to accomplish by levying an excise tax on plans that cost more than $10,200 per individual or $27,500 per family. That provision isn't in effect until Jan. 1, 2018. - - - “Pharmaceutical industry: Pharmaceutical manufacturers will see a spike in annual government fees. . . .{ranging from $2.8 billion in 2012-2013 to $4.1 billion in 2018}” “And insurers won't be off the hook either. {They will pay annual government fees ranging from $8 billion in 2014 to $14.3 billion in 2018.}” (Ref. 7) Obama care has been touted as a program that will save health care costs for Americans. That is as likely to happen as Mitt Romney being elected president of these United States. What about not increasing the debt? President Obama “promised that his plan would not add ‘one dime’ to the deficit. {but} the Government Accountability Office announced last week that it would more likely add . . . $6 trillion over 75 years.” (Ref. 8) What About the Promise that Everybody Could keep Their Existing Health Care Coverage “The Washington Times reported, ‘Obama’s Health care law will push 7 million people out of their job-based insurance coverage – nearly twice the previous estimate, according to the latest estimates from the Congressional Budget Office.’” (Ref. 5) Whatever happened to the president’s promise that ObamaCare would not force anyone to lose the coverage he already had? While president Obama promised that “if you like your health care plan, you can keep your health care plan.” But, in fact, “Estimates for how many Americans will lose their existing plans vary. The CBO says 5 million to 20 million. The consulting firm McKinsey & Co. says about 30 percent of employers will push workers onto the public system. “Even the AFL-CIO and the Teamsters union have started to freak out over the gold-plated benefits many of their members will lose.” (Ref. 8) Unintended Consequences What are some of the unintended (and perhaps intended) consequences of ObamaCare? Summarized from Reference 9, here are some of these consequences:

The negative impact of ObamaCare is becoming more and more apparent. “Walmart, the nation’s largest private employer, plans to begin denying health insurance to newly hired employees who work fewer than 30 hours a week . . . “Under the policy, slated to take effect in January, Walmart also reserves the right to eliminate health care coverage for certain workers if their average workweek dips below 30 hours -- something that happens with regularity and at the direction of company managers. - - - “Labor and health care experts portrayed Walmart’s decision to exclude workers from its medical plans as an attempt to limit costs while taking advantage of the national health care reform known as Obamacare. Among the key features of Obamacare is an expansion of Medicaid, the taxpayer-financed health insurance program for poor people. Many of the Walmart workers who might be dropped from the company’s health care plans earn so little that they would qualify for the expanded Medicaid program, these experts said. - - - “’Walmart is effectively shifting the costs of paying for its employees onto the federal government with this new plan, which is one of the problems with the way the law is structured,’ “’Walmart likely thought it didn’t need to offer this part-time coverage anymore with Obamacare, . . . This is another example of a tremendous government subsidy to Walmart via its workers.’ “In pursuing lower health care costs, Walmart is following the same course as many other large employers. . . .other companies are also crafting policies that will exclude some part-time workers from medical coverage. “- - - the growing corporate interest in separating out part-time workers {is} a reaction to another aspect of Obamacare -- the new rules that require companies with at least 50 full-time workers to offer health coverage to all employees who work 30 or more hours a week or pay penalties. “Several employers in recent months, including Darden Restaurants, owner of Olive Garden and Red Lobster, and a New York-area Applebee’s franchise owner, said they are considering cutting employee hours to push more workers below the 30-hour threshold.” (Ref. 11) ObamaCare establishes still one more federal bureaucracy and “relies on states to expand insurance coverage through Medicaid and to set up bureaucracies, called exchanges, through which new health insurance subsidies will be distributed.” (Ref. 12) Several state governors are refusing to implement this section of the new health care law. To Explain his refusal, The governor of Louisiana wrote the following letter to the Department of Health & Human Services: “’The full extent of damage the [Patient Protection & Affordable Care Act] causes to small businesses, the nation’s economy, and the American health care system will only be revealed with time. The State of Louisiana has no interest in being a party to this failure.’ - - - “At least 21 states have said they definitely or probably will not set up state exchanges.” (Ref. 11) Physician Shortages America faces a growing shortage of primary care physicians. Will ObamaCare relieve or worsen the problem? The odds are that ObamaCare will simple make the problem more severe. “’It’s hard for patients to find a primary care doctor right now. In 10 years, it will be impossible.’ Experts predict that the U.S. will be short 45, 000 primary care physicians by the year 2020 – throwing an already overstretched medical system into crisis. (Currently, the average U. S. physician is responsible for 2,300 patients – more than twice the recommended number.)” (Ref. 13) The causes of the problem? – Many general practitioners are nearing retirement and there aren’t enough new doctors to take their place. Will ObamaCare help to avert the crisis? Not likely! Obamacare threatens to limit or reduce the pay of physicians creating a financial disincentive, considering the horrendous cost to educate a doctor and establish a medical practice; ObamaCare will increase, not reduce the physician workload by adding regulatory oversight, more reporting and red tape. Lessons to be learned From ObamaCare’s Predecessor The program known on ObamaCare draws many of its provisions from the pioneering Massachusetts healthcare law, known as RomneyCare. One of the selling points for ObamaCare was the claim that health care costs to the individual would not increase significantly. This claim is being disputed as new evidence becomes available. As should be obvious, there are no free rides when it comes to increasing health care coverage – someone must pay the bill. ObamaCare is supposed to rein in the increasing cost of health care. The model for ObamaCare is RomneyCare which went into effect in Massachusetts in 2006. Let’s look at how RomneyCare has reduced the costs of health care. “In 2013, health care {in Massachusetts} will consume 41 percent – roughly $14.3 Billion – of the state budget, compared to {only} 23 percent in 2000.” (Ref. 14) In other words, RomneyCare has just not failed to reduce costs, it has instead resulted in an enormous cost increase! Can any sane person imagine that the same result will not happen under Obmacare? “… a new study shows mandated health care in Massachusetts cut $6,000 from some Bay State residents’ annual pay. . . . “… the liberal-leaning Brookings Institution … found that Massachusetts employees who bought workplace coverage because of mandated health care saw their wages plummet. . . . “RomneyCare’s estimated $6,058 added cost to workers comes from firms passing most insurance expenses onto employees. . . . “ObamaCare should show the same effects when national mandates kick in . . . “the pro-market American Institute said the study shows RomneyCare and ObamaCare both penalize workers ‘who need wage income more than health insurance.’” (Ref. 15) Here in Massachusetts, we already have a “universal health care law - RomneyCare. Romenycare is not inexpensive, but most citizens of Massachusetts who want coverage are covered by it. An unfortunate aspect of RomneyCare is that even those who do not want its coverage are essentially forced to accept its coverage to avoid paying penalties. ObamaCare would replace RomneyCare here in Massachusetts with a higher cost to the citizens of the state. Here in Massachusetts health care costs are higher than in the most of the U.S. and so are health care premiums. Under ObamaCare, Massachusetts would be penalized because of these facts, resulting in increased costs to the people of Massachusetts and to all businesses in the state. RomneyCare in Massachusetts portends what will happen to the cost of healthcare nationally, once ObamaCare fully kicks in. Impact of ObamaCare on Massachusetts Under the provisions of ObamaCare, a study by the Pioneer Institute shows that: “Beginning in 2018 insurers and businesses that self-insure will be required to pay an excise tax for higher-value health plans - - - “a majority of individuals and families on private insurance in Massachusetts will be hit by the Cadillac tax by 2018 – and more if health care costs continue to grow faster than inflation. “For the small-business owner with at least three full-time workers it will mean $86,905 in additional taxes per employee over 10 years. For a police officer, an additional $53,907. An additional $20,807 for a middle school teacher over the same decade.” Instead of a tax on “super, gold-plated Cadillac plans”, we are getting a “Ford Tax”. The impact on employers may well be to weaken benefits or to drop their insurance coverage altogether and let the employees come under government provided coverage. As an unintended consequence of the “Cadillac plan” tax, Massachusetts residents “will be forced to dig deeper to ensure coverage for the rest of the country.” Also, if their employers or insurers drop coverage, many may be forced to give up their existing health care coverage altogether for one that they may not want. The promises that “you won’t have to give up your current health care coverage” or “your health care coverage costs won’t increase” under ObamaCare appear not to apply in Massachusetts. To how many other states and citizens of the U.S. this is true is not apparent at this time. (Ref. 16 for items enclosed in quotation marks) The medical device industry in Massachusetts is taking a hit from ObamaCare, as are all individuals who use medical devices – and just who doesn’t? “The Internal Revenue Service released its final rules last week {in December 2012} on that ObamaCare medical device tax that is expected to hit Massachusetts like a freight train. And, yes, it’s every bit as bad as expected. - - - “- - - while state lawmakers are attempting to control health care costs in this state, the new federal tax [Emphasis mine] will increase the costs of everything from tongue depressors to pacemakers.” (Ref. 17) Note that this is indeed a new federal tax in spite of the promises that that there would be no new taxes or that health care costs would not be increased. “A new tax on medical device makers, including Boston Scientific, has taken effect . . . The 2.3 percent excise tax is one of several taxes that are designed to help pay for president Obama’s federal health care overhaul. [Emphasis mine] The industry warned the tax could cost about 43,000 jobs nationwide.” (Ref. 18) What the Immediate Future Holds With the defeat of Republican Mitt Romney and the failure of the Republicans to gain control of the Senate in the 2012 elections, any serious hope for rescinding ObamaCare, or, at the least, scaling back its most onerous provisions, are gone. We are all likely to get much sicker financially under ObamaCare and other negative consequences are also likely to result. Every time the issue of ObamaCare resurfaces, we find out some new facts. After all, it was Nancy Pellosi who told us that we needed to pass the health care legislation so we could find out want what it actually was. Well, the health care legislation is now law and nearly every day we continue to find out more and more about what is buried in the massive and still largely incomprehensible program – and much of what we are learning is not good. As ObamaCare becomes fully implemented, some of its effects that we can expect to see are as follows: “Companies with more than 50 employees are searching for ways to avoid the penalties for not complying with the law’s employer mandate.” (Ref. 12) Some alternatives under consideration are: reduce the number of employees to less than 50 and/or reduce the number of work-hours for some employees to change their status from full-time to part-time – not conducive to the affected employees and their families maintaining a decent standard of living. “The individual mandate will take effect in 2014, and the CBO expects at least 6 million people to pay the initial $95 fine rather than purchase expensive, government prescribed health insurance.” (Ref. 12) Overall, some other effects that the future may hold under ObamaCare are: “New federal regulations that look to combine the individual and small health insurance markets nationally could adversely affect small businesses - - - “The Affordable Care Act regulations may lower premiums for individuals, but raise them for small groups – primarily small businesses - - - “It will make small businesses second-class citizens by raising premiums - - - “Wellness cooperatives were created {in Massachusetts} last year as part of a state initiative to improve healthy living and lower overall health care costs. “Under the new {federal} regulations, such cooperatives stand to lose their lower premium incentives, thus undercutting the goal of promoting wellness - - - “’Federal regulations essentially focus on how to pay for illness, rather than how to promote wellness.’” (Ref. 19) As is all too typical of many federal initiatives, the focus here is on regulation and paperwork – a government job-creating and maintaining consequence – rather than on addressing the real core problem! The result – more compliance and reporting burdens and expenses for private business; more government employees beholden to the liberal-Democratic establishment; increased cost of government to be borne by the taxpayer and business; more deficit spending, more federal debt and still more interest costs to pay off the ever-increasing federal debt. Postscript "It isn't every day that more than half the Democrats in the Senate vote to repeal part of President Barack Obama's health care law. But that's what happened Thursday night when the Senate voted 79-20 to repeal a 2.3 percent sales tax on medical devices such as catheters, pacemakers and MRI machines, which was intended to help to finance coverage for the uninsured that starts next year. - - - "{Unfortunately} the vote was nonbinding, amounting to budget guidance. . . . "Nonetheless, 33 of the chamber's 53 Democrats joined all 45 Republicans in voting for the repeal {of the} amendment. . . . - - - "The {medical device} companies started paying the tax Jan. 1, and they say if it stays on the books that will lead to lay-offs and put a damper on investment. Outside economists expect the industry will be able to pass on most of the tax increase to customers." (Ref. 20) Maybe the message is beginning to sink in - for Democrats as well as Republicans. ObamaCare, as it currently exists, is not good good for the health of America. -------------------------------------------------------------------------------------- References:

|

| 28 March 2013 {Article 160; Govt_42} |