| |

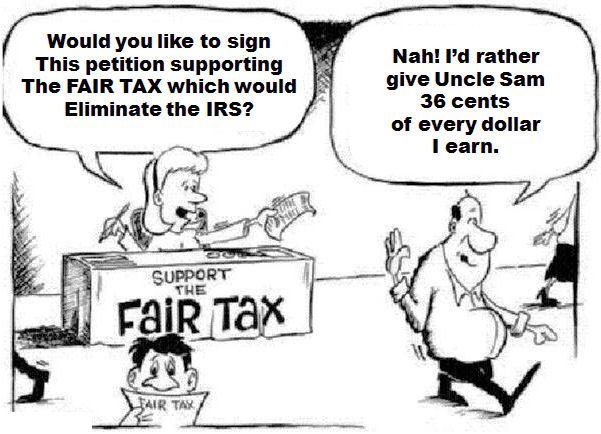

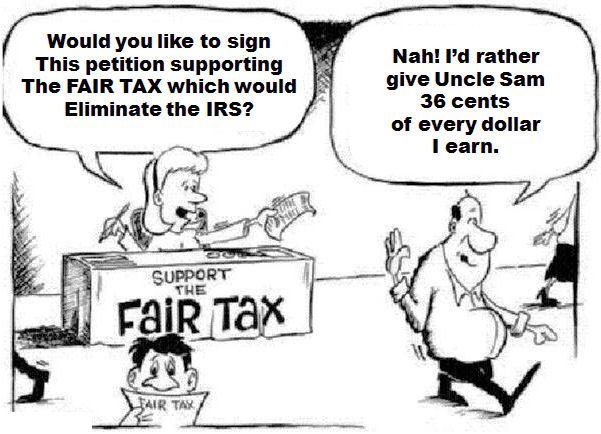

The ”Fiscal Cliff” approaches! In order to avoid this calamity,

we have the unique opportunity to make a meaningful impact on the way our government adversely impacts the lives of

every American and, at the same time, take effective action that will help to avoid the impending ”Fiscal

Cliff”. Let’s seize the day and take advantage of this opportunity. The solution that I

propose is a “the Fair Tax”, otherwise known as a “Consumption Tax”.

As I wrote previously wrote: “The time has now arrived for everyone to put aside political

bickering and focus on the economic problems facing every one of us. This means Democrats, Republicans, Rainbow

Coalition members, Green Party members, Socialists, Tea Party members, Independents, and everyone else that isn’t

a member of any of the aforementioned groups. We either work together or we go down the toilet together. No

more posturing; no more rhetoric; no more line-in-the-sand positions; no more ‘it’s my way or the highway’; and no

more ‘them vs. us’! . . .”

“In order to avoid falling off or rolling down the fiscal cliff, all parties must agree

to put aside their untenable positions.” (Ref. 1) This means we need

to stop arguing about: whether or not to raise taxes (how much?); whether or not to raise taxes on “the rich”;

whether or not to cap deductions; and whether or not to close certain tax loopholes (which ones?).

When I strongly urge is the elimination of the federal income tax and its

replacement with what is variously called a “Fair Tax” or a “Consumption Tax”. This new tax would take

the form of a federal sales tax or value added tax (VAT) or some other such arrangement. At the same time, the

federal income tax system would be totally eliminated. No more inane tax regulations, no more convoluted exemption

rules, no more loopholes, no more end-of-year filling out complicated tax returns, no need for tax lawyers, no

need for tax accountants, a major reduction in IRS personnel, a major reduction in tax-avoidance court-cases,

and much, much more!

No doubt this proposal would be opposed by unions representing IRS employees, by tax

accountants, by lawyers, and by members of Congress – don't forget that most members of Congress are, themselves,

lawyers. BUT, with such a step, we can avoid the issues of raising taxes or of raising the tax

rates on the “rich”. With this one step, we help to raise revenue to reduce the ballooning federal debt and

eliminate the income tax from our lives.

The consumption tax rate can be set so as to effectively bring in more revenue than what

the current income tax system does. Reducing the size of the IRS bureaucracy and the tax enforcement and prosecution

arms of the federal government will bring down the cost of running these agencies. Reducing tax compliance costs

for American businesses will improve their competiveness in the global marketplace, allowing them to earn more

profits with which to reinvest and to create more jobs.

Perhaps most importantly, the inflammatory issue of raising or not raising the tax rates

on “the rich” becomes moot. “The rich” spend more money than the “not-so-rich”. They will therefore

automatically pay more taxes, in the form of the consumption taxes, than the “not-so-rich”. This amounts

to a "progressive" taxing system.

“According to an article on page 33 of the April 15th 2005 Boston Herald,

it {took} Americans some 6.6 billion hours to do the paperwork for our tax returns. According to the government’s

budget office, tax work ‘towers over the entire paperwork burden for the rest of the federal government.’ The

income tax code is an incomprehensible, multi-thousand page maze of inane regulations. Even the IRS can’t

understand these regulations. As often as not, if you ask them for a ruling, they will give you an incorrect

interpretation. {You almost certainly won't get the same answer if you ask the IRS the same question two different

times.}

“The time has come to stop this madness! The solution? Let’s do away with the income tax

and replace it with a consumption tax, such as a national sales tax or value added tax (VAT). Let’s face it.

The wealthy buy more than the poor. Therefore, they’ll pay more with a consumption tax than the

poor. [Emphasis mine] The more a person makes, the more the person will spend and buy, and the more

that person will pay in terms of taxes. You and I will stop wasting our time preparing income tax returns. The

lawyers and accountants can turn their talents to more useful pursuits.”

(Ref. 2)

“A national consumption tax might work something like this: For individuals, taxes would

only be paid after reaching an income above a set threshold, perhaps $20,000 plus deductions for dependents.

{Income here is defined as ‘all income’ – earned income, dividends, capital gains, etc.} For simplicity, all

individual taxpayers would pay taxes on everything throughout the year but would then receive tax rebates at the

end of the year covering {perhaps} the first $20,000 of income. “A consumption tax would, for example, eliminate

many present distortions, such as taxing capital gains at rates different from income, and the double (or treble)

taxation of corporate dividends. . . . The source of income would no longer be important, just what’s done with

it.” (Ref. 2) In effect, the year-end tax rebate would give back

to low income families all or part of what they paid out during the year in consumption taxes. The so-called

rich would receive little or no benefit from the rebate.

As Malcolm Forbes noted (as reported in Reference 2), a consumption tax “would largely

eliminate a powerfully corrupting influence on our political life. Countless millions of dollars are given for

tax-code-related purposes – fending off destructive changes, pushing special-interest amendments.

“Fairness would be enhanced: The more you make, the more you pay. Striking disparities in taxes owed on similar

incomes would end.”

“The elimination of the income tax code, “would redirect an immeasurable amount of

American brainpower from the numbing exercise of coping with the incomprehensible tax code to more productive

purposes. There would be an enormous increase in efficiency.”

” Eliminating the income tax, “would get rid of a profoundly corrupting influence on our

political life: the countless millions of dollars now showered on politicians and bureaucrats to influence

tax-related rules and legislation.” (Ref. 2)

In Reference 3, I wrote about a suggestion made by the National Taxpayers Union (NTU)

which called for “the abolishment of the IRS and the constitutional abolishment of the federal income tax which

would then be replaced with a national sales tax, called the ‘Fair Tax’. The Fair Tax abolishes the current,

unfair U.S. Tax Code and replaces it with a national sales tax collected at the cash register at time of purchase.

It raises the same amount of money as the current system.

“The Fair Tax would do away with a tax code that now exceeds five million words in laws

and regulations. According to the Tax Foundation, the total taxpayer cost for IRS administration, enforcement,

record keeping, tax filing, advice and collection was $194 billion last year {2007}. This sum is roughly the size

of the total federal budget in 1970.” The total taxpayer cost of the IRS system is currently estimated to be $233

billion annually {2007}.

“A national sales tax system would allow each citizen to decide when and how much tax to

pay, depending upon how much he or she would consume. There would be no tax on pensions, no taxes on income from

savings, no death tax, and a rebate system would ensure no taxes on basic necessities.

(Ref. 3)

A somewhat more formal version of the “Fair Tax” proposal is contained in Reference 4.

Here is a summary of this proposal, along with its purported benefits.

“The current federal income tax system is clearly broken -- unfair, overly complex, and

almost impossible for most Americans to understand. But there is a reasonable, bipartisan alternative that is both

fair and easy to understand. A system that allows you to keep your whole paycheck and only pay taxes on what you

spend.

“The FairTax is a national sales tax that treats every person equally and allows American

businesses to thrive, while generating the same tax revenue as the current three-million-word-plus word tax code.

Under the FairTax, every person living in the United States pays a sales tax on purchases of new goods and services,

excluding necessities due to the prebate. The FairTax rate after necessities is 23% and equal to the lowest current

income tax bracket (15%) combined with employee payroll taxes (7.65%), both of which will be eliminated.”

- - -

“American workers will get to keep every dime they earn. By eliminating federal income

taxes and payroll taxes, your salary or hourly wage is exactly what you'll deposit in the bank.”

- - -

Instead of Social Security and Medicare “being funded by taxes on workers' wages, they'll

be funded by taxes on overall consumption by all residents.”

- - -

“The FairTax provides a progressive program called a ‘prebate’. This gives every legal resident household an

‘advance refund’ at the beginning of each month so that purchases made up to the poverty level are tax-free. The

prebate prevents an unfair burden on low-income families.”

- - -

“Tax evasion and the underground economy cost each taxpayer an additional $2,500 every

year! But by taxing new products and services consumed, the FairTax puts everyone in the country at the same level

at the cash register. Further, only legal residents are eligible for the prebate.”

- - -

The IRS is eliminated. “No more complicated tax forms, individual audits, or intrusive

federal bureaucracy. Retailers will collect the FairTax just as they do now with state sales taxes. All money

will be collected and remitted to the U.S. Treasury, and both the retailers and states will be paid a fee for

their collection service. (Ref. 4)

In summary, we now have the perfect opportunity and reason to get rid of the monstrosity

that is the federal income tax. “The time has come to get rid of the tax man as we know him. Let’s get rid of the

income tax and replace it with a spending tax. At the same time, let’s get rid of the thousands of pages in the

current tax code and let’s replace it with a streamlined and simplified set of rules that everyone, including the

tax bureaucrats, can understand and follow.” (Ref. 2)

CARPE DIEM! Let’s not reform the current tax code. Let’s eliminate it. Let’s start with a

clean slate. No more tax on income. Let’s replace it with a tax on spending.

-----------------------------------------------------------------------------------------------------

References:

- Avoiding Economic Armageddon, David Burton, www.sonofeliyahu; Article 150,

26 November 2012.

- It’s time to get rid of the tax man, David Burton, www.sonofeliyahu; Article 1,

8 October 2005.

- Let’s replace the income tax with the “Fair Tax” , David Burton, www.sonofeliyahu;

Article 29, 14 February 2008.

- The FairTax Plan, David Burton,

http://www.fairtax.org/site/PageServer?pagename=HowFairTaxWorks ,

Accessed 30 November 2012.

|

|