| |

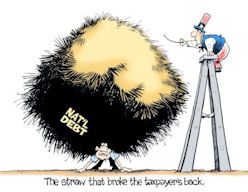

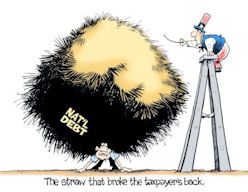

Today, the United States is facing Armageddon. This Armageddon is not the result

of war, famine or any other natural disaster. It is the result of profligate spending beyond the nation’s means

and the growing sense of entitlement in its citizenry that characterizes the failed and failing economies of

socialistic countries in today’s Europe and which has been the hallmark of the failed socialistic experiments

throughout the world during the last century and a half. American is falling into the trap of too many feeling

that they are entitled to receive the goodies of life from a benevolent Santa Claus called the “government.”

The message of, “not to ask what your country can do for you but, instead, to ask what you can do for your

country” is falling on an ever-growing number of deaf ears. Instead of raising their arms in support of the nation,

too many are stretching their arms out for handouts. The alarm has been raised before. Entitlement programs

like Social Security and Medicare are costing more than we can afford. But the people with the presumed power

to solve the problem, our elected officials, have consistently taken the coward’s path and, to date, have

refused to show the political courage to take the steps needed to address the problem – they fear being turned

out of office and losing their political power.

The mechanic that tells you, “you can pay me now or you can pay me later” is, in

truth, telling you that you can pay a little now for preventative maintenance or you can pay me later when a major

repair is required. For too many years we have elected not to “pay now.” Now, we must be prepared to pay a major

repair bill. Waiting longer will only cost much, much more. In terms of the finances of our government, the analogy

holds true – when liabilities (deficits) fail to be addressed in a timely and prudent fashion, the eventual reckoning

is very uncomfortable. When these liabilities and deficits are the result of promises and obligations to a large

segment of the population who have planned their lives around these promises, the adjustments when the corrections

are finally made are much more than uncomfortable – they can devastate lives and futures!

This country needs responsible elected officials - not Democrats or Republicans –

but politicians with the courage, the will and the intestinal fortitude to do what must be done. As a former

Comptroller General of the United States said, “deficits are … not manageable without significant changes in

the status quo programs, policies and operations.” (Ref. 1) In

addition to elected officials doing what needs to be done, the citizenry must also do its part – we must be willing

to give up what is unaffordable. We may have to retire later in life, we may have to pay more for health care, we

may have to ante up more in taxes, we may have to turn down some of the “free” handouts.

The United States can’t grow its way out of its financial quagmire because of

demographic trends (the U.S. is aging) and exploding health care costs. New medicines and procedures are being

continually introduced that cost more and extend lives. “Annual budget decisions without adequate considerations

to longer term costs only dig the hole deeper.” (Ref. 1) We

are currently doing nothing about the problem and the outlook is not promising. In the year 2011,

all federal revenues covered only mandatory spending and interest on debt. All discretionary

spending – defense and non-defense - is borrowed!

What are our elected officials doing to get us out of this pit? If the recent failure of the congressional

“Super Committee” to come up with even a temporary solution is any indication, they are doing less than nothing.

The $1.2 trillion debt reduction they were supposed to come up with (and failed) is less than 10% of our current

$15 trillion debt which now amounts to 100% of our GDP! Through all of this, there was no discussion of

adjustments to entitlements. Heaven forbid that the politicians’ constituents might have to do some belt

tightening which, in turn, might cost these politicians some votes. By their reasoning it’s better to let

the house burn down than to sustain some water damage in putting out the fire. “A broken process continues,

and the final bill {for the major repair} promises to be soon, large and painful. We have grown too big,

promised too much, waited too long.” (Ref. 1)

What is causing our debt crisis? Obviously, the cause is our federal government

spending more than it is taking in. Each year since 1969, our federal government has spent more money than

its income. To account for this deficit, the Treasury Department has had to borrow money to pay for these

appropriations and all of us as taxpayers have to pay interest on that huge, growing debt.

So where are the major contributors to the spending part of the problem?

The biggest spender in the 2011 federal budget was the Department of Health and Human Services (HHS) at

about $890 billion. This $890 billion is primarily used for “income redistribution.” After HHS comes

Social Security (SS) at around $780 billion, followed by the Department of Defense (DoD) at $720 billion

and the Treasury Department at $520 billion. Note that included in the Treasury Department’s expenditure

of $520 billion for the Fiscal Year 2011 is some $454 Billion for interest payments on the national debt.

No other item in the federal budget for 2011 exceeds $150 billion. To address our debt crisis, then,

requires that spending reductions be considered for these four major areas of the budget – HHS, SS, DoD,

and the Treasury. With nearly 90% of the treasury budget required for debt payment, there is little to be

gained by trying to reduce the Treasury Department’s costs. That leaves HHS, SS and DoD for the chopping

block. Also, remember that social spending in 2011 – HHS and SS – amounted to more than twice the costs

associated with national defense - $1.67 trillion Vs. $720 billion.

We are penalizing America’s low wage earners, America’s businesses and

all Americans in general with our growing federal debt burden and the tax system that is paying for

our indebtedness. Our current income tax system penalizes low wage earners and small businesses with a

tax burden that amounts to about 26 - 30% of the cost of every product or service purchased. As previously shown,

the major contributor to our growing debt problem is social spending, even if you don't include Social Security.

The United States won’t solve its fiscal problems until it gets the social spending item in the federal

budget under control. We either need to wean ourselves away from expecting these federal handouts or

we need to face up to the likelihood of our government going bankrupt.

Think the solution is to increase the taxes of America’s corporations? Think again!

Corporate taxation hurts everyone. It makes American products and services less competitive in the global marketplace.

It is unfair to America’s low income folks because corporations treat the tax as a cost and include this tax in

the price of the products and services they sell. The price of every product that is sold by American companies

has embedded in it corporate income taxes of 25% or more. Everyone pays the price. Increasing corporate

taxes to pay off the federal debt is counterproductive – it sends business offshore and penalizes the people that

it is supposed to help by raising the cost of goods and services with which they need to live.

The American People have been fixated on looking to the Government and to the

American political parties to address the country’s fiscal problems. That will not do. We have been blindly

thinking (hopefully wishing) that our elected political leaders will solve all our financial problems magically

and bring us out of present economic crisis – this is a vain hope. There are no miracles in economics and

there are no free lunches. It never happens. To solve our problems, we will have to fight for our survival

and we will have to contribute to the solutions. This means that we and our government must change our policies

of overspending, borrowing and paying interest forever.

A major element of America’s fiscal problem is simply too much spending.

The biggest driver of this spending is entitlements and, if not brought under control, these entitlements

(which include Social Security, Medicare, and Medicaid) will consume all tax revenues by 2049 if taxes remain

at their historical levels. Our politicians have taken the cowardly way out and have refused to address the

major issue of ongoing disastrous entitlement spending.

America can no longer put up with the political intransigence of the two parties.

We can no longer accept the lines drawn in the sand by the leaders of the two parties: “no tax increases”, “raise

the taxes on the millionaires and the billionaires”, “no cuts to Social Security”, “no cuts to Medicare”, “no cuts

to defense spending”, etc. There can be no more lines in the sand; everything must be on the table; there can be

no sacred cows. Whatever needs to be done to get the problem under control should and must be done – no matter

whose bull is gored.

The longer we wait to address the problem, the larger the bill our children and

their children must pay, either in higher taxes or lower benefits. That is the cruel hard fact. Our leaders need

to stop playing word games. They need to start seeing the economic forest for the trees, and set in place policies

that go far beyond what they claim to have been considering to eliminate the fiscal problem.

We, the American public, must stop looking for the easy and ineffective budget

solutions and instead, we must show that we are willing to accept the difficult and effective solutions.

We need to get rid of the delusion that a small tax increase on the rich, combined with cuts in not-very-important

spending categories will somehow deliver us from fiscal ruin. We need to accept the fact that what’s necessary

is an extreme makeover with a heavy dose of tough love. What we don’t need are politicians who keep telling us

that they have simple and painless fixes that the politicians in the other party are against. What we don’t

need are politicians who tell us that we can wait until after the next election to fix the problems.

A pox on the houses of both parties!

Never particularly grounded in reality, budget talks in Washington have an

Alice in Wonderland quality. Both Democrats and Republicans are trying to be identified as the party of

fiscal responsibility without broaching the two real steps needed to solve America’s budget crisis:

meaningful tax increases (part of which should result from the closing of numerous

loopholes in our Byzantine tax laws) and meaningful reductions in spending.

One place to start in solving America’s fiscal problems is in the area of

entitlements. “If the U.S. Congress ceased the practice of giving people what they have not earned, budgets

would be more than balanced. For government to guarantee a person a right to goods and services he has not

earned, it must diminish someone else's right to what he has earned, simply because governments have no

resources of their very own.” (Ref. 2)

“Growing social spending in the name of health is just one example of a much

larger process affecting the whole of our societ{y}. There's a process we might call contagion, in which

spending automatically and unavoidably breeds more spending. For example, if government provides subsidies

for wheat farmers, corn farmers will organize and protest that it's unfair not to grant them subsidies.”

Government bailouts also result in contagion. “If Congress bails out General Motors, what's the justification

for not also bailing out Chrysler and JPMorgan Chase, Bank of America, Fannie Mae, AIG, Citigroup and other

failed enterprises?” “Bailouts {also} create what's known as a moral hazard, in which people have reduced

incentive to mend their ways.” (Ref. 2)

America is showing evidence of becoming a welfare state and the tendency of a

welfare state is to grow and consume more and more of a nation's income. Witness the collapse of the Soviet

Union and what has recently been happening in Europe. There is also considerable evidence that we cannot

simply tax our way out of our fiscal mess. In order to avoid permanent stagnation or total economic collapse,

we must start the process of reducing welfare spending as part of the overall solution

to America’s current and developing fiscal problems.

Americans, step up to the plate and start by turning out of office those

politicians that we send to Washington but who aren’t getting the job done. In place of these

incompetents, vote into office candidates that offer real programs and policies that realistically address the

problem. Never mind whether they have a ‘D’ or an ‘R’ beside their name on the ballot. Listen to what they say and

then watch what they do. If they say and do what’s needed, reelect them. Otherwise, come next election time,

vote them out of office and try someone new. We need to make politics more akin to professional sports,

where you either produce or are replaced by another athlete who does produce. In professional sports there

is no room for incompetents or malingerers. The same needs to be true for elected office.

For much too long, we have tolerated a fatal combination of selfish interest

groups, pampered and lazy voters, and elected leaders who have distorted, dithered and ducked their duties.

There are other villains. Some among us have the attitude of not giving a damn about the country, future

generations or even their grandchildren. Their mantra is “don’t touch our entitlements!” Instead the

entitlements should be adjusted and means-tested and those seniors who don’t need the maximum benefits

should be willing to accept less, just as every American should be willing to pay more and take less so

that our nation can reverse the damage caused by decades of greed, stupidity, corruption and

incompetence.

There are many suggestions for solving our fiscal dilemma – some don’t stand

the test of history and experience; some have a pedigree of past success; others that may be untried.

What is needed are elected officials with the intelligence, commitment, experience and foresight to select

the options that make sense and the courage to put them in place, though there may be pain as a consequence.

Short term pain beats eventual death. What is also needed is an American electorate willing to sacrifice and

accept short term pain in order to avoid long term disaster.

Otherwise, Armageddon awaits!

--------------------------------------------------------------------------------------------------------

References

- Day of Reckoning is Approaching: It’s Pay Me Now or Pay Me Later, Lawrence P. Farrell, Jr.,

National Defense, Page 4, December 2011.

- Only one way to solve U.S. fiscal mess: Get off the dole, Walter E. Williams,

Charlotte Observer, 27 September 2011.

|

|